The Trading Bible Reviews CMC Markets Review 2023 - Safe or Scam? Pros and Cons

CMC Markets Review 2023 - Safe or Scam? Pros and Cons

By Stefano Treviso, Updated on: Apr 07 2023.

CMC Markets in a Nutshell

| 💡 Score | 4.2 out of 5. |

| 🏛 Regulators | ASIC, FCA, IIROC, MAS, BaFin. |

| 💳 Minimum Deposit ($) | 0 |

| 💰 Payment Methods | Credit Card, Debit Card, Bank Transfer, PayPal. |

| 💵 Base Currencies | 10 - AUD, GBP, CAD, EUR, NZD, NOK, PLN, SGD, SEK, USD. |

| 📚 Assets Offered | 🔹 Stock CFDs 🔹 Currency CFDs 🔹 Commodities CFDs 🔹 Indices CFDs 🔹 ETF CFDs 🔹 Crypto CFDs 🔹 Bond CFDs 🔹 Future CFDs |

| 💪 Retail Leverage | 1:30 |

| 💪 Pro Leverage | 1:500 |

| ✍ Custom Leverage | No |

| 🎲 Deleveraged Trading | No |

| 🎓 Demo Account | Yes |

| 💰 Commissions | Yes and they vary per share exchange location. For U.S shares, there is a minimum $10 in-and-out commission. |

Compare CMC Markets

Vs.

CMC Markets in 60 seconds

- Professional proprietary platform with customisable workspaces (layouts) and advanced order controls

- Over 20,000 financial instruments

- Instant withdrawals via PayPal

CMC Markets is a global broker headquartered in the U.K that holds 6 high value financial licenses and offers CFD trading on stocks, etfs, commodities, currencies, bonds and cryptocurrencies.

Full Review

Here's what we'll talk about in our review:

Table of Contents:

- Is CMC Markets Safe?

- CMC Markets Minimum Deposit and Withdrawal

- CMC Markets Trading Fees

- CMC Markets Available Assets

- CMC Markets Web Trading Platform Review

- CMC Markets Mobile Trading Platform Review

- CMC Markets Research and Analysis Tools

- CMC Markets Educational Tools

- Verdict

Is CMC Markets Safe?

CMC Markets is as regulated as it gets and by high quality financial regulators. Below you'll find a list of their current licenses:

- ASIC (Australia)

- FCA (UK)

- IIROC (Canada)

- MAS (Singapore)

- BaFin (Berlin)

Financial

Licenses

Regulation

Regulated

Top-tier Licenses

5

Other Licenses

0

Provided by

TheTradingBible.com

On top of this, they’re a publicly traded company and one of the most well-known.

Definitely the best point about CMC Markets regulatory framework is that they don't even own a single off shore low reputation license.

CMC Markets Minimum Deposit and Withdrawal

CMC Markets has no minimum deposit and withdrawal limits. Below you'll find a list of their available deposit methods:

- Paypal (instant withdrawals)

- Credit/Debit Cards

- Bank Transfers

Base Currencies

CMC Markets allows the following base currencies:

- Australian Dollar

- Great British Pound

- Canadian Dollar

- Euro

- New Zealand Dollar

- Norweggian Krona

- Polish Zloty

- Singapore Dollar

- Swedish Krona

- United States Dollar

CMC Markets Trading Fees

CMC Markets charges spreads, commissions, overnight fees and inactivity fees.

Spreads

Here's how CMC Markets spreads compare to similar brokers:

| Asset | CMC Markets | IG | Pepperstone |

|---|---|---|---|

| EUR/USD Spread | Dynamic - From 0.7 Pips | Dynamic - From 0.6 Pips | Dynamic - From 0 to 0.77 Pips |

| SP500 Spread | From 60 Pips | Dynamic - From 40 Pips | Dynamic - From 0.4 to 1.5 Pips |

| Gold Spread | From 30 Pips | Dynamic - From 30 Pips | Dynamic - Average 13.81 Pips |

| TSLA Spread | Dynamic - Market Spread | Dynamic - Market Spread | Dynamic - Market Spread |

| XLK Spread | Dynamic - Market Spread | Dynamic - Market Spread | Dynamic - Market Spread |

| BTC Spread | Unavailable | Dynamic - From $90 | Dynamic - From $30 |

Commissions

Here's how CMC Markets commissions compare to similar brokers:

| CMC Markets | IG | Pepperstone | |

|---|---|---|---|

| Commissions | Yes and they vary per share exchange location. For U.S shares, there is a minimum $10 in-and-out commission. | Yes, they charge depending on the client’s account base currency and exchange location of the shares being traded. For example, for some clients US shares can have a minimum charge of $10 in-and-out. |

|

The first thought that comes to our minds is:

- Great for some things, too expensive for others.

CMC Markets makes money through the spread offered in some particular assets like currencies, commodities, futures, etc.

For example: Commissions to trade AAPL shares are at $0.02 per CFD with a $10 minimum.

So if you bought 10 AAPL shares and sold them, you just spent $20.

The extremely pricey commissions can be overlooked if you’re a high volume CFD trader looking for the best execution possible but when you trade small then CMC is too expensive to trade shares for you.

CMC Markets Available Assets

Here's how CMC Markets asset offering compares to similar brokers:

| Asset | CMC Markets | IG | Pepperstone |

|---|---|---|---|

| Stocks | 0 | 15000 | 0 |

| Stock CFDs | 10169 | 15000 | 1300 |

| Currency Pairs | 0 | 0 | 0 |

| Currency Pair CFDs | 330 | 80 | 60 |

| Commodities | 0 | 0 | 0 |

| Commodities CFDs | 124 | 37 | 31 |

| Indices | 0 | 0 | 0 |

| Indices CFDs | 95 | 76 | 25 |

| ETFs | 0 | 2000 | 0 |

| ETF CFDs | 1084 | 2000 | 100 |

| Cryptocurrencies | 0 | 0 | 0 |

| Cryptocurrency CFDs | 18 | 15 | 20 |

| Bonds | 0 | 0 | 0 |

| Bond CFDs | 55 | 19 | 0 |

| Options | 0 | 0 | 0 |

| Option CFDs | 0 | 1000 | 0 |

| Futures | 0 | 0 | 0 |

| Future CFDs | 10 | 0 | 0 |

The first thought that comes to our minds is:

- Too many and that is a good thing.

Literally, too many. You can request market data for pretty much anything you can think off and go very specific on what you want to trade.

CMC Market gives you the option to trade the spot index and several future contracts, so you can find several variants to access the underlying asset in question in the form of a CFD.

CMC Markets Web Trading Platform Review

CMC Markets trading platform is definitely one of my favourite platforms out there to trade CFDs. You can tell that the platform was built with people who traded professionally in mind. Let’s go over the most relevant details you need to know:

CMC Markets allows you to configure the platform however you want. They have a couple templates for you to use but you can skip those and open a blank canvas where you’ll be able to design and fit your required tools.

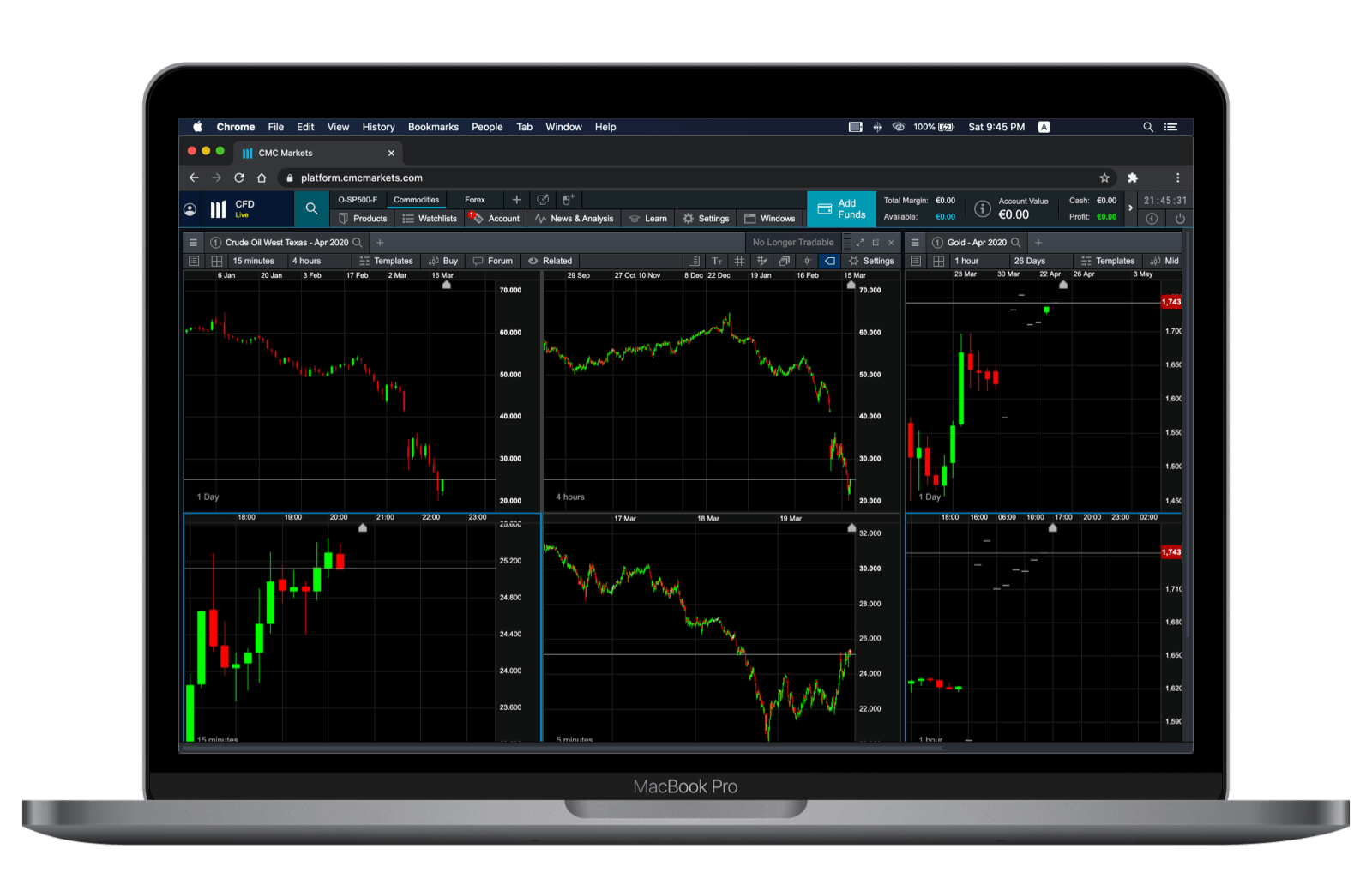

The image above is an example of a view I built to trade with:

- Dual chart layout

- Pending orders, Open positions and Trading History

- Reuters News

That’s right, you get Reuters news in any real account with CMC Markets and it’s free. If you don’t know, Reuters has this simple format where news will be delivered quickly in just a few lines and opening the news will also open a small block of text with the most relevant info. It’s all built for speed and finding things out quickly.

The platform is packed with so many features that we can’t go into details for all of them, but let’s talk about the top things we like and why:

In this big menu on top of the platform, you can create views, search for products, create custom watchlists, access research tools and much more. A good example of using these tools would be:

- Creating a view exclusively to trade forex with 4 charts and Economic Calendar included

- Creating custom watchlists with currency pairs

- Creating another view for trading Indices where you monitor the Spot index price and 2 different futures based on the index and the VIX as your hedge.

- Creating a watchlist to analyse different groups of stocks with high relevance to the index and monitor if they’re out of sync with current index behaviour

See where I’m going with this? The platform lets you trade professionally, analyse, create views that suit your needs and operate efficiently.

Another thing that I’m madly in love with is:

In every chart, you can directly search for another asset, in the image above if you were to click on the platform where it says Coffee Arabica, you would open up the search list and be able to quickly change.

Also, the whole platform supports colour sync, meaning that you can configure 3 windows to be synced with a colour code and when you change the asset in one of them, it will also change on the other windows.

Here’s an example of a Forex trading template I created:

I managed to squeeze in 2 charts, economic calendar, Reuter news, CMC insights and my execution block.

Another interesting tool is the multi-chart setting they provide. Even though the whole platform is multi-chart capable by just opening up different charts on the same view, they provide a full block that includes a quadruple view of the asset In 4 different time frames, here’s how it looks:

(Multi-Chart block is the one on the left)

The advantage of using this block in comparison to manually opening each chart is that this block has a single search selector for it, meaning that you change the asset and all the windows will maintain your selected timeframes and apply to the new asset.

To finalise with the web trading platform’s benefits lets take a look at their technical analysis tools:

CMC Markets technical analysis and charting tools are as good as it gets. In every chart you can open a lower panel for accessing drawing tools, indicators and pretty much everything you need.

I am a very big fan of how this lower bar was designed with a little illustration of each indicator and the ability to set your favourites to access them quickly.

Every indicator is customisable at your discretion by clicking on the indicators name once it’s activated on the top left corner of the chart.

CMC Markets Web platform is a monster tool full of amazing capabilities for professional traders that know exactly what they want to do, how to do it and what they need to accomplish it, we couldn't find anything wrong with it.

CMC Markets Mobile Trading Platform Review

CMC Markets mobile trading platform is one hell of a beautiful mobile app packed with all sorts of features, a simple interface and very useful information at a glance.

Lets make something clear, any professional trader out there knows that mobile platforms are just there for informational purposes or emergency actions, no serious trader in his right mind would base all his operation on mobile, that’s what newbies do, and it’s wrong.

Regardless of mobile platforms being there just as a complement to the main web trading platform, these guys did it the right way, here are a few points about it:

Above you can see the platform’s home tab. Notice the bottom tool bar, from there you can access quickly the most important areas on your mobile trading platform.

If there is one word to describe CMC Markets as a whole is: customisable.

The home page is fully configurable to your style, the order of the blocks, which ones you want or not. For example, you can set up quickly all your favourite watchlists in your home along with an open positions view.

Above you can see what happens when we click on: “products” in the bottom tool bar. In there we can search for any asset on the platform and also display several choices on the top of how we want to sort the different assets available.

Above you can see the order input window. In my personal opinion this is the best order execution window out there for mobile platforms.

- The platform will change colours according to the type of order - either sell or buy.

- The order type you’re entering is clearly specified on the 3 blue dotted square (it’s blue because it’s a buy order).

- If you touch the square you’re able to change the order to the available order type, for example: market, limit, stop-buy, etc.

- The stop-loss is clearly specified and also we get to know what type of stop-loss it is, if it’s a regular one, guaranteed, trailing-stop-loss, etc.

- On the bottom we get an automatic calculation of the required margin to open the position.

Everything you need is on the right place, easily accesible and identifiable (which is a huge concern for me, some platforms don't show clearly what you're doing).

Above you can see the technical analysis tools on the mobile platform, they’re an exact replica of the desktop ones and work quite smoothly.

There are several other features we could mention such as: CMC Markets TV, news by Reuters, CMC Insights and many more, but you get the idea, the platforms are fully packed of features on both mobile and desktop and they were built the right way.

Overall, the mobile platform serves as an excellent companion to quickly monitor the markets, perform key actions and even do some research on spare time when you can’t use your fully sized platform on the web, again, we couldn't find anything wrong with it.

CMC Markets Research and Analysis Tools

CMC Markets provides the following research and analysis tools:

- Economic Calendar

- Weekly outlook

- Analysis from their own analysts team

- Trader sentiment (within their platform)

CMC Markets Educational Tools

CMC Markets provides the following educational tools:

- Trading Guides

- Articles

- Live TV

- Webinars

- Events

Verdict

CMC Markets overall rating is 4.2 out of 5.CMC Markets main advantages are providing a professional trading platform on both web and mobile devices, instant withdrawals via paypal and thousands of assets to choose from. On the negative side their in-and-out share trading commissions are quite high ($10 minimum).

CMC Markets execution was amazing, withdrawals and deposits using PayPal took less than a minute and their trading software was a perfect mixture of professional features packed in a very aesthetically pleasing format.

During the time we spent using CMC Markets platforms we found nothing to complain about except one thing:

- Share trading commissions are too high for low volume traders

In every single other feature they’re at the top of the rank, specially in product quality, safety and ethics.

Here’s our opinion on whom CMC Markets is best for:

- If you’re a professional or experienced trader with a good amount of funds interested in CFDs on all assets, this platform is right for you

- If you’re an experienced trader with low trading capital and you're not into share CFDs, this platform is right for you

- If you’re new to trading and want to practise what its like to use a more professional platform, they have a lifelong free demo, so it's right for you after you've mastered a more simple one

- If you’re new to trading and have no clue about assets, correlations and order types then we do not recommend you to use this platform, leave it for later when you’re playing on the major leagues

- If you’re low on funds and regardless of your experience level you want to trade shares, then it's not the right platform for you