The Trading Bible Reviews Nextmarkets Review 2023 - The Good and the Bad

Nextmarkets Review 2023 - The Good and the Bad

By Stefano Treviso, Updated on: Apr 07 2023.

Nextmarkets in a Nutshell

| 💡 Score | 2.4 out of 5. |

| 🏛 Regulators | MFSA. |

| 💳 Minimum Deposit ($) | 0 |

| 💰 Payment Methods | Credit Cards, Debit Cards, Bank Transfers. |

| 💵 Base Currencies | 2 - EUR, GBP. |

| 📚 Assets Offered | 🔹 Stocks 🔹 Stock CFDs 🔹 Currency CFDs 🔹 Commodities CFDs 🔹 Indices CFDs 🔹 ETFs 🔹 ETF CFDs 🔹 Crypto CFDs 🔹 Bond CFDs |

| 💪 Retail Leverage | 1:30 |

| 💪 Pro Leverage | 1:100 |

| ✍ Custom Leverage | No |

| 🎲 Deleveraged Trading | Yes |

| 🎓 Demo Account | Yes |

| 💰 Commissions | None |

Compare Nextmarkets

Vs.

Nextmarkets in 60 seconds

- Over 10,000 equities (stocks and ETFs) available

- Commission-free trading & investing

- Curated trading service with exclusive analysis provided by expert coaches designed to assist beginners in making decisions

Nextmarkets is a german broker founded in 2014 that specialises in commission free stocks and ETFs trading through their proprietary platform which offers an expert advisory service via live coaches that suggest their trading ideas.

Nextmarkets Full Review

Here’s what we’ll talk about during our review:

- Is Nextmarkets Safe?

- Nextmarkets Minimum Deposit and Withdrawal

- Nextmarkets Account Types

- Nextmarkets Trading Fees

- Nextmarkets Available Assets

- Nextmarkets Mobile Trading Platform

- Nextmarkets Curated Trading

- Nextmarkets Web Trading Platform

- Nextmarkets Research and Analysis Tools

- Nextmarkets Educational Tools

- Verdict

Is Nextmarkets Safe?

Nextmarkets is a relatively safe broker that holds only one financial services license issued by the MFSA (Malta Financial services authority).

What led us to still consider it a safe broker despite it being under-regulated when compared to more well-known competitors is that Peter Thiel (co-founder of Paypal) decided to back the project and took a $3.5 million equity stake in Nextmarkets. Also, when analysing user reviews and opinions, we weren’t able to find any negative ones that led us to believe they can’t be trusted.

Financial

Licenses

Regulation

Regulated

Top-tier Licenses

0

Other Licenses

1

Provided by

TheTradingBible.com

Despite all the previously mentioned positive points, Nextmarkets definitely needs to acquire more high-reputation financial licenses from top-tier regulators such as FCA, ASIC, BaFin in order for them to join the top-tier club.

Nextmarkets Minimum Deposit and Withdrawal

Nextmarkets supports the following base currencies:

- Euro

- United States Dollar

For deposits and withdrawals the only allow the following methods:

- Bank Transfer

- Visa

- Mastercard

It would definitely be a great addition to their offering to allow e-wallets as a deposit or withdrawal method.

Nextmarkets Account Types

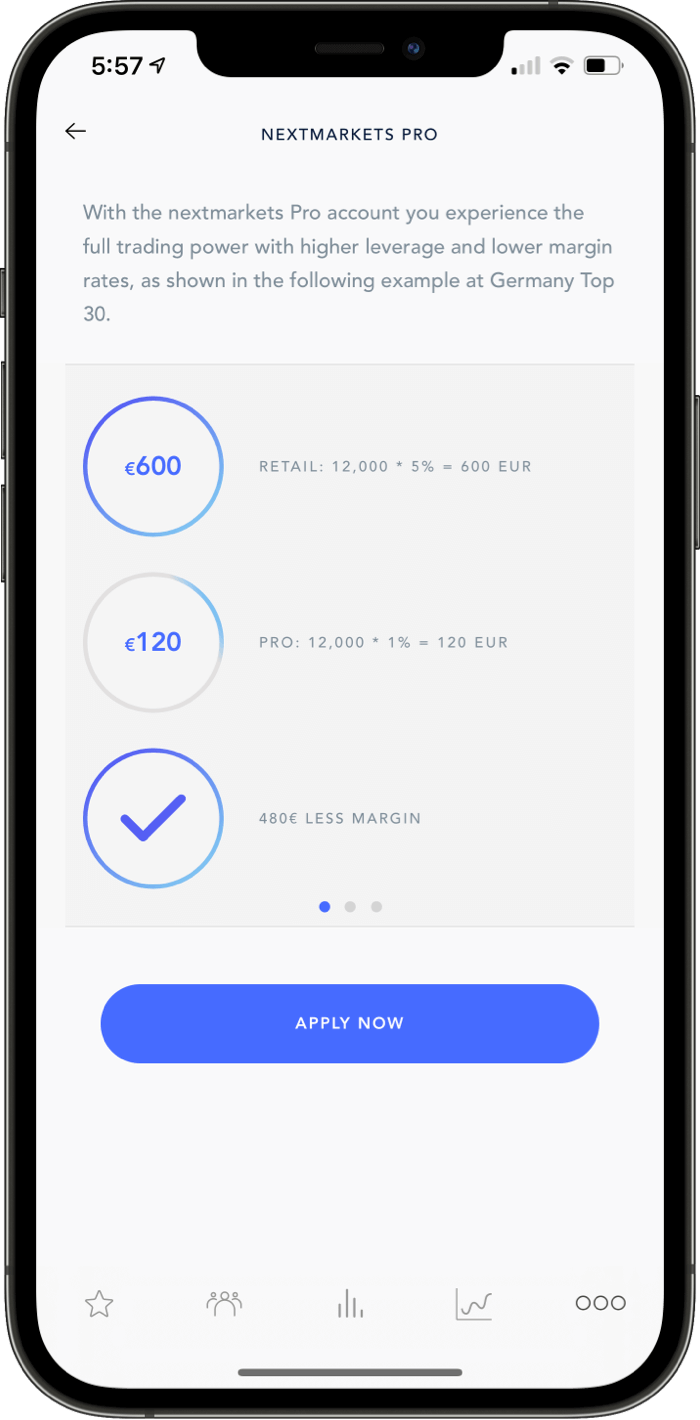

As a standard European broker, Nextmarkets offers two types of accounts:

- Standard account

- Professional account

The main advantage of a professional account is definitely the higher leverage offering which in this particular case is of 1:100, but it’s not that easy to get it as you’ll have to prove that you’re an eligible professional client by providing some specific documentation.

Nextmarkets Trading Fees

Nextmarkets charges only spreads and overnight fees. Let’s take a deeper look:

Spreads

The below table shows the spreads of Nextmarkets compared to two leading brokers for the EUR/USD currency pair and Tesla Stock.

| Asset | Nextmarkets | Trading 212 | eToro |

|---|---|---|---|

| EUR/USD Spread | Dynamic - From 0.6 Pips | Dynamic - From 1.4 Pips | Dynamic - From 1 Pip |

| SP500 Spread | Dynamic - From 50 Pips | Dynamic - From 166 Pips | Dynamic - From 75 Pips |

| Gold Spread | Dynamic - From 40 Pips | Dynamic - From 30 Pips | Dynamic - From 45 Pips |

| TSLA Spread | Dynamic - From $2 | Dynamic - From $0.6 | Dynamic - From 0.09% |

| XLK Spread | Dynamic - From $0.1 to 0.3 | Unavailable | Dynamic - From 0.09% |

| BTC Spread | Dynamic - From $125 | Unavailable | Fixed - 1% |

Nextmarkets is right in the middle of its competitors when it comes to spreads. They offer reasonable spreads on equities (shares and ETFs) and moderate ones when it comes to other assets.

Their main advantage is being a commission-free broker with a decent spread offering that has more than 8,000+ different equities to choose from but when it comes to spreads, they’re definitely not the most expensive or the cheapest option.

Nextmarkets Available Assets

When it comes to asset offering, Nextmarkets is trying to gain some edge competing in the areas of real stocks and ETFs or CFDs on these two classes, they’ve done a great job.

| Asset | Nextmarkets | Trading 212 | eToro |

|---|---|---|---|

| Stocks | 8000 | 10000 | 2000 |

| Stock CFDs | 8000 | 1526 | 2000 |

| Currency Pairs | 0 | 0 | 0 |

| Currency Pair CFDs | 22 | 179 | 47 |

| Commodities | 0 | 0 | 0 |

| Commodities CFDs | 5 | 25 | 14 |

| Indices | 0 | 0 | 0 |

| Indices CFDs | 5 | 35 | 13 |

| ETFs | 1000 | 1800 | 0 |

| ETF CFDs | 1000 | 50 | 145 |

| Cryptocurrencies | 0 | 0 | 0 |

| Cryptocurrency CFDs | 4 | 0 | 26 |

| Bonds | 0 | 0 | 0 |

| Bond CFDs | 1 | 0 | 0 |

| Options | 0 | 0 | 0 |

| Option CFDs | 0 | 0 | 0 |

| Futures | 0 | 0 | 0 |

| Future CFDs | 0 | 0 | 0 |

On the other hand, they’re definitely outnumbered by pretty much every broker out there when it comes to other asset classes such as: currencies, indices, commodities, cryptocurrencies, etc.

Nextmarkets Mobile Trading Platform

In the area of Trading platforms, Nextmarkets clearly took a mobile-oriented approach. From both their platforms we find their mobile one to be the best. Let’s take a look at both of them:

Mobile Home

Designed with a very user friendly and simplistic approach, Nextmarkets’s mobile platform lets you select right from the start using the top area which asset class’ list you want to see.

After selecting one asset class, you’ll be able to scroll down through their full product list or if you feel you’re in a hurry, use the magnifying glass at the top right corner to search directly for a specific asset.

On the bottom of the screen you have the main menu which allows you to visit different areas from the platform being:

- Market watch (the one you’re actually looking at, the home)

- Curated trading

- Portfolio

- Investment Products

- Settings

Moving on, imagine that you would have clicked on any specific asset, here’s where you would have landed:

Asset View and Charting Tools

Nextmarkets opens a trading chart straight away whenever you click on any asset. It works both horizontally or vertically. Scrolling down is not possible as there is no specific asset information or any interesting resources.

The whole point of this view is either to perform technical analysis using their charting tools as you can see below:

Or to click on buy or sell at the top of the screen to enter the order placement view:

Order Placement

Nextmarkets mobile order placement view is definitely very good looking and user friendly. Here’s how it looks:

Users are able to select using a slider the desired leverage factor to be used in their trade (according to each asset class) and also add a specific quantity to trade, a stop-loss and a take profit order.

In the bottom of the screen you’ll have some preliminary calculations of your operation and a massive button to “send your order” right away.

Portfolio

Nextmarkets provides both CFD trading and real stocks or ETFs investing. This means that their portfolio tool has the capacity to separate each asset class and provide a detailed view of all the positions open.

A very nice touch is the top chart view which allows you to view your portfolio value once a certain amount of time has passed over several periods of time.

Nextmarkets Curated Trading

We’ve made it to the true specialty of Nextmarkets: curated trading. You might be wondering right now, what the hell does that mean?

Well, we know it sounds fancy, but let’s give it a shot, it’s actually pretty creative.

Instead of only providing the typical copy trading service where users simply disconnect mentally from trading and click a button to copy someone else’s trades, Nextmarkets decided to assemble a “curated” service full of ideas provided by specialised coaches.

Now, you’ll be looking at your platform thinking that “Microsoft Messenger” just resuscitated but at least this time, instead of useless messages you’ll be getting notifications and red bubbles from professional coaches that just analysed an asset and are about to potentially execute a trade. Here’s how it looks when you’re about to follow a coach:

It’s nice that it lets you choose the quantity to follow with and the dollar amount. Still we believe that we lack a lot of information on coaches and how they’re actually performing in the long-run.

For example, we noticed some coaches that have a small indicator that reads “P&L +0.74%”, is that today? Is that in his life? So could he have lost 100% last week? No one knows.

On top of everything we just learned about Nextmarkets’ interesting capabilities, they also provide different types of structured products, let’s take a look:

The below image is for an analysis on Warren Buffet’s best performing assets. It doesn’t have an author so we assume it’s internal analysts from Nextmarkets. The cool thing is that it allows you to copy straight away the basket if you’re interested in its performance.

Our final thought is that Nextmarket's curated trading & investing service has a lot of potential yet it’s still very young and requires far more development to come to a fully competitive alternative to big copy trading services.

Nextmarkets Web Trading Platform

We definitely think that Nextmarkets nailed it on mobile platform design but when it comes to web trading, we’re definitely looking for improvements. Let’s go through their platform:

Home and Charts

When you enter your platform you’ll land straight away on a trading chart with no asset selected, in here you’ll be able to navigate the only 3 available options on the top menu:

- Trading (to look at charts, search for products or place trades)

- Curated trading (to access their coaches analysis)

- Investment Products (to access their baskets of structured products based on internal analysis)

Moving on, to search for a product you can click on the search box at the top left corner and immediately a nicely organised asset list by category will appear:

Another thing to point out is that while they do provide a notifications centre on their web platform, it only serves the purpose of notifying the user of any new analysis posted by their coaches. There is no ability to customise it.

Nextmarkets Curated Trading (Web Version)

Just to not leave you with the doubt, here’s how the web version of their curated trading service looks:

Definitely, the curated trading service looks far more interesting in the web version as it’s basically a trading chart on steroids with live comments from the coaches, trading activity and also, the avatars of all the other coaches on top of the platform with brand new insights.

Nextmarkets Investment Products

Nextmarkets investment products are carefully crafted product baskets based on sectors, investors or any other classification format they can think of. Here’s how it looks:

There’s not a wide variety of options when it comes to investment products, the only ones we could see from their menu where:

- Green CFD

- Real Estate CFD

- Life Science CFD

- US Titans CFD

- Best of Buffet CFD

- Dufour Basket CFD

The other final product they offer is their Coachfolio service, where you’ll automatically follow all the signals or trades executed by a specific coach.

Nextmarkets Research and Analysis Tools

Nextmarkets does not provide any particular type of research or analysis tools beyond their:

- Analyses by coaches

- Investment products

As they’re definitely a beginner oriented broker, they haven’t invested in the creation of high-end analysis tools or integrations such as the ones required by professional traders to scan stocks for example.

Nextmarkets Educational Tools

Nextmarkets does not provide any type of educational tools or video tutorials. Clearly they seem to have taken an approach of designing their product as simple as possible and allowing customers to figure out their journey as they interact with it.

Verdict

Nextmarkets overall rating is 2.4 out of 5.Nextmarkets is definitely a beginner-oriented broker with a clever approach to copy trading via their curated trading and investing service. On the other hand, their asset offering outside of stocks or ETFs lacks variety and their trading platform doesn’t suit the needs of experienced traders.

Nextmarkets is definitely built with long-term traders or investors in mind that have little experience and are looking for some insights on what to trade on and that’s where they provide the perfect trigger, analysis by expert coaches on steroids all day long.

If you’re a professional trader looking for a customisable platform, stock screeners, advanced trading orders and extreme asset variety, Nextmarkets can fall short of your expectations.

If you’re looking for a beginner friendly platform that allows you to invest or trade with or without leverage on a wide variety of stocks and ETFs commission-free, Nextmarkets is definitely an excellent choice to try.