Aug 21 2023

5 Best ECN Brokers List for 2023

Ranking list of the 5 best ECN brokers, comparing trustworthiness, capabilities, fees and legitimacy versus each other.

Compare Brokers

Vs.

Featured Brokers

74.34% of retail CFD accounts lose money.

74-89% of retail CFD accounts lose money.

74% of retail CFD accounts lose money.

CFD brokers specialise in providing contracts for differences trading via mobile and web trading platforms mostly to retail investors.

CFDs (contracts for difference) are a financial derivative that is traded OTC (over the counter, off-exchange trading). That means that all of your transactions are never being routed to any exchange but rather you're engaging in a contract where you agree to exchange price differences either up or down with your broker as your counter-party.

In short words, in most cases:

This is fine as long as you're trading with a high quality and reputable broker (such as the ones we choose to display on our website).

High quality brokers never focus on a single client but rather hedge the global exposure of their company into the real market, here's what that means:

If there are $40 million in long positions and $20 million in short positions (both of them in Gold), the broker has the choice to do the following:

In either case, the broker is not targeting or communicating with individual traders, they're just analysing the whole exposure in their open trades and acting based on that.

CFD trading provides great advantages such as: low margin requirements due to high leverage factors, execution regardless of liquidity and the ability to go short (bet against) at a very low cost. On the negative side CFDs carry overnight costs when trading on leverage and they are subject to conflicts of interest between traders and brokers.

| Advantages | Disadvantages |

|---|---|

| Low margin requirements | Overnight fees when holding leveraged positions more than a day |

| Potentially better execution as it doesn't depend on market liquidity | Conflicts of interest between traders and brokers |

| Shorting any asset at a very low cost |

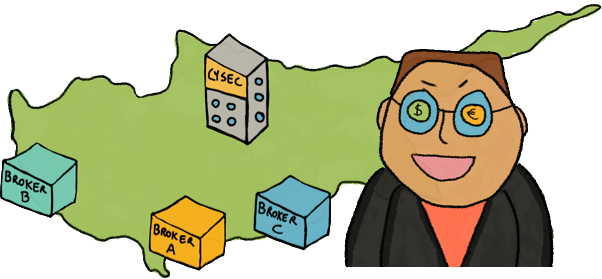

When choosing a CFD Broker one of the most important things we must look for is their regulation.

Financial regulators are governmental institutions that regulate the behaviour of brokers and serve as a middleman to deal with any possible disputes.

When your broker is regulated, they have to abide by the code of conduct set by the regulator and any mistake could cost them their license.

Some of the world's most recognised financial regulators are:

Trading with a regulated broker gives you a major edge in terms of safety and peace of mind yet you should never assume that just because a broker is regulated they are 100% good.

Many bad businesses obtain licenses from financial regulators to perform unethical business practises and defraud customers. As soon as the regulator catches up with their activities, they get shut down and proceed to acquire a new license through a third-party that most probably cannot be linked back to them.

In order to prevent choosing the wrong broker, pay attention to our next point were we mention the key differences between those who practise good and bad business.

Choosing the right broker can be a complex task if you're not an industry insider full of experience and information. To help our visitors with this problem we prepared a simple table with a few points to look for when analysing your current or future broker.

| Good Brokers | Bad Brokers |

|---|---|

| They don’t provide any type of advice (they never tell you what to buy or sell) | They provide financial advice in an illicit way (telling you what to buy or sell) |

| They don’t call you constantly to ask for money | They call you non-stop asking for money and resort to high pressure tactics |

| They are regulated by several financial regulators | They are either unregulated or regulated by a single low reputation financial regulator which allows their wrongdoings |

| They hedge the global exposure of all their client trades and never focus on one specific client | Their office location is usually false (for example: small tiny islands on the Caribbean) |

Aug 21 2023

Ranking list of the 5 best ECN brokers, comparing trustworthiness, capabilities, fees and legitimacy versus each other.

Jul 13 2024

With over two decades of experience in the online trading industry, Deriv has cemented its reputation as a leading global Forex broker, catering to the diverse needs of traders worldwide.

Jan 07 2025

Scam Forex Brokers - What You Should Know The forex market may seem alluring with promises of easy money, but it pays to be cautious because along with the potential profits lurks a sinister side: scam brokers forex.

Aug 21 2023

Ranking list of the 4 best high leverage forex brokers, comparing trustworthiness, capabilities, fees and legitimacy versus each other.

Aug 21 2023

Ranking list of the 5 best Singapore Forex brokers, comparing trustworthiness, capabilities, fees and legitimacy versus each other.

Feb 09 2024

Ranking list of the 4 best Singapore stock brokers, comparing trustworthiness, capabilities, fees and legitimacy versus each other.

Feb 09 2024

Ranking list of the 5 best Singapore MetaTrader 5 (MT5) brokers, comparing trustworthiness, capabilities, fees and legitimacy versus each other.

Feb 09 2024

Ranking list of the 5 best Singapore MetaTrader 4 (MT4) brokers, comparing trustworthiness, capabilities, fees and legitimacy versus each other.

Jan 22 2024

Ranking list of the 5 best South African MetaTrader 4 (MT4) brokers, comparing trustworthiness, capabilities, fees and legitimacy versus each other.

Mar 14 2025

We Tested the ✔Top Forex Trading Apps Available in Nigeria in 2025 Based on ❶Key Features, Regulation, ❷Ease Of Use, and ❸Customer Satisfaction.

Mar 26 2025

Find the ✔Best Forex Broker in Nigeria - Check Out Our ✔List of Regulated Forex Brokers. ➤Learn How to ✔Choose the Best Forex Broker in Nigeria.

Apr 29 2025

A list of the top 10 trading platforms in South Africa for 2024, whether you are looking for the best stock brokers in south Africa, the cheapest online trading platform South Africa, based or leading forex brokers our list covers the top rated options:

Mar 14 2025

Learn about ❶When is the Best Time to Trade Forex in South Africa, and ❷How Do Overlaps in Trading Times Affect Forex Traders. ➤Read the Article!

Jan 22 2024

Ranking list of the 5 best South African MetaTrader 5 (MT5) brokers, comparing trustworthiness, capabilities, fees and legitimacy versus each other.

Jan 22 2024

Ranking list of the 5 best South Africa Stock brokers, comparing trustworthiness, capabilities, fees and legitimacy versus each other.

Jan 22 2024

Ranking list of the 5 best South Africa Forex brokers, comparing trustworthiness, capabilities, fees and legitimacy versus each other.

Aug 21 2023

Ranking list of the 5 best United Arab Emirates (UAE) MetaTrader 4 (MT4) brokers, comparing trustworthiness, capabilities, fees and legitimacy versus each other.

Aug 21 2023

Ranking list of the 5 best United Arab Emirates (UAE) Stock brokers, comparing trustworthiness, capabilities, fees and legitimacy versus each other.

Aug 21 2023

Ranking list of the 5 best United Arab Emirates MetaTrader 5 (MT5) brokers, comparing trustworthiness, capabilities, fees and legitimacy versus each other.

Aug 21 2023

Ranking list of the 5 best United Arab Emirates Forex brokers, comparing trustworthiness, capabilities, fees and legitimacy versus each other.

Aug 21 2023

Ranking list of the 5 best Australian MetaTrader 4 (MT4) brokers, comparing trustworthiness, capabilities, fees and legitimacy versus each other.

Aug 21 2023

Ranking list of the 5 best Australian MetaTrader 5 (MT5) brokers, comparing trustworthiness, capabilities, fees and legitimacy versus each other.

Sep 29 2023

Ranking list of the 5 best Australian stock brokers, comparing trustworthiness, capabilities, fees and legitimacy versus each other.

Sep 29 2023

Ranking list of the 5 best Australian Forex brokers, comparing trustworthiness, capabilities, fees and legitimacy versus each other.

Sep 29 2023

Ranking list of the best 5 UK Forex brokers, comparing trustworthiness, capabilities, fees and legitimacy versus each other.

Aug 21 2023

Ranking list of the 5 best UK MetaTrader 5 (MT5) brokers, comparing trustworthiness, capabilities, fees and legitimacy versus each other.

Aug 21 2023

Ranking list of the 5 best UK MetaTrader 4 (MT4) brokers, comparing trustworthiness, capabilities, fees and legitimacy versus each other.

Aug 21 2023

Ranking list of the 5 Best UK Stock brokers, comparing trustworthiness, capabilities, fees and legitimacy versus each other.