Feb 17 2026

ᑕ❶ᑐ VWAP Meaning - What Is VWAP in Trading

Learn about ❶What Is VWAP (✔Volume-Weighted Average Price) Indicator in Trading and about the ❷Best VWAP Settings for Day Trading. ☎ Contact Us!

Compare Brokers

Vs.

Featured Brokers

74.34% of retail CFD accounts lose money.

74-89% of retail CFD accounts lose money.

74% of retail CFD accounts lose money.

Feb 17 2026

Learn about ❶What Is VWAP (✔Volume-Weighted Average Price) Indicator in Trading and about the ❷Best VWAP Settings for Day Trading. ☎ Contact Us!

Jun 10 2025

An Initial Coin Offering is a method used by cryptocurrency companies to raise funds for further development of their project by offering their new cryptocurrency at an appealing price to potential investors.

Apr 22 2025

A CFD (contract for difference) is an agreement between two parties to exchange the price difference between the opening and closing prices of the contract.

Mar 26 2025

Learn about Japanese Candlesticks: ❶What is a Japanese Candlestick, ❷How Do They Work, ❸How To Read Japanese Candlestick Patterns, and ❹Download a Cheat Sheet.

Mar 26 2025

Learn about the ❶Evening Star Candlestick Pattern: ❷Its Formation, ❸How To Identify It on Forex Charts, ❹How To Trade Evening Star Candlestick Pattern.

Mar 26 2025

Learn about ❶What is Forex Day Trading, ❷How It Works, ❸Is It Profitable, and ❹Find the Best Forex Day Trading Strategy for Your Profit in this Article.

Mar 26 2025

Learn about ❶What Is a Shooting Star Candlestick Pattern, ❷Formation of Shooting Star Candlestick, ❸Bullish and Bearish Patterns, and ❹How to Trade It.

Mar 26 2025

Learn about ❶What is a Hammer Candlestick, ❷Different Types of the Hammer Candlestick Pattern, and ❸How To Use Hammer Candles in Your Technical Analysis.

Mar 23 2025

Elevate Your Forex Game: Master Trend Line Trading!

Feb 28 2025

Find Out ❶How to Invest in Cryptocurrency, ❷Is Cryptocurrency a Good Investment, and ❸Is It Safe to Invest in Crypto by reading this article. ☎ Contact Us!

Jan 07 2025

A Smart Contract is a digital agreement that lives on the blockchain (everyone can see it and it’s on more than one computer).

Jan 07 2025

Updated Trader's Guide: Forex vs Crypto Markets Explained

Jan 07 2025

Solana is a digital currency that centers on the concept of privacy and has global acceptance. It’s a token created by Anatoly Yakovenko in 2017 with an individual unit known as SOL.

Jan 07 2025

Staking is one of the best use cases of cryptocurrencies because it provides rewards when investors lock up their coins for a period of time.

Jan 07 2025

Risk tolerance and trading styles will likely determine whether forex or stock trading is the best option for you: short-term traders generally gravitate to forex markets while long-term traders move into stocks.

Jan 07 2025

Deciding to trade forex or crypto currencies depends largely on a few important factors, including risk versus reward tolerance, a willingness to speculate and knowledge of how to trade both.

Jan 07 2025

Bitcoin is changing the world. Let’s dive into this amazing technology and decrypt all of its secrets.

Jan 07 2025

Ethereum is not just a cryptocurrency. It’s a decentralised world super computer capable of much more than you imagine.

Jan 07 2025

Cryptocurrency is digital currency that works without trust, borders and permissions from any authority. Let's learn how it all works.

Jan 06 2025

Depending on your entry points, the best time to leave your cryptocurrency investments or trades will be when there is a widespread sense of euphoria.

Jan 06 2025

Blockchain is a series of information blocks that are connected, cryptographically secured and dependant on each other in order for the chain to continue.

Jul 13 2024

Forex pairs correlations trading involves trading with forex pairs using the correlations factor between different currency pairs

Jul 12 2024

Learn the differences between going Long or short in forex and how you can use these tools to your advantage as a trader.

Jul 12 2024

Learn about the ✔Morning Star Candlestick - a ✔Bullish Candlestick Pattern in a Price Chart, and ✔How To Trade Morning Star Candlestick Pattern.

Jul 12 2024

Discover the ✔Triple Top and Triple Bottom Chart Patterns - Their ❶Formation, the ❷Psychology Behind Them, and ❸How To Trade the Triple Top Pattern.

Jul 12 2024

Learn about a ✔Bearish Pennant Pattern in Trading: ❶Its Components and Formation, ❷Success Rate, and ❸Useful Tips on How to Trade a Bear Pennant.

Jul 12 2024

Learn about a ✔Bullish Pennant Pattern in Technical Analysis: ❶Its Components, ❷Accuracy, ❸Success Rate, and ❹How to Trade a Bullish Pennant Pattern.

Jul 12 2024

Learn about Bullish Flag Patterns in Trading - ❶What the Bull Flag Tells Us, ❷How to Trade This Flag Pattern, and about ❸Bullish Flag Exit Indicators.

Jul 12 2024

Learn about the Doji Candlestick Pattern and Its Types: ❶Dragonfly Doji Candlestick, ❷Reversal Doji Candlestick, ❸Gravestone Doji Candlestick, and Others.

Jul 12 2024

Learn about ❶What Are Candlesticks in Forex Trading, ❷How To Trade Forex Using Candlestick Charts, and ❸What is the Best Candlestick Pattern for Traders.

Jul 12 2024

Learn about ❶Stock Candlestick Patterns, ❷Their Types and Components, ❸How to Read a Candle Chart, and ❹What Should You Look for in a Candlestick Chart.

Jul 12 2024

Learn about ❶Bullish Candlestick Patterns to ✔Identify Trading Opportunities and about the ❷Risks Associated with Trading Bullish Candlestick Patterns.

Jul 12 2024

Learn Day Trading Basics: ❶Common Day Trading Patterns, ❷How to Read Chart Patterns Like a Pro, and ❸What Is the Best Chart Interval for Day Trading.

Jul 12 2024

Learn about ❶Bearish Candlestick Patterns to ✔Identify Trading Opportunities and about the ❷Risks Associated with Trading Bearish Candlestick Patterns.

Feb 07 2024

Head and shoulders is a chart pattern that signals a potential reversal on the forex market. It is one of the most popular patterns because of its simplicity, reliability, and transparent execution rules.

Feb 07 2024

The Triangle pattern in forex trading is a time-sensitive chart pattern that shows a tightening range due to market indecisiveness.

Jan 16 2024

A currency pair is the value of one currency against another. For example, the EUR/USD is the most liquid currency pair in the world.

Dec 15 2023

Fibonacci strategy in forex trading is an attempt to profit by trading from the key price levels by using the Fibonacci sequence.

Dec 15 2023

Scalping in forex is a day trading strategy used by traders on a very small time frame, with the trade usually held for a period of minutes or even seconds

Nov 30 2023

The top 5 forex trading strategies are: trend following, scalping, swing trading, price action trading and position trading.

Nov 30 2023

A flag pattern is a candlestick formation that forms after a sharp move, followed by a rectangular consolidation that looks like a flag on the pole.

Nov 28 2023

Leverage in forex is the ratio between the money on your account balance and the maximum position your broker is allowing you to take.

Nov 28 2023

A Forex LOT is a measure to efficiently express standardised quantities of currency transactions. A Standard lot equals 100.000 units of currency.

Nov 01 2023

Forex Lot Size Calculator

Nov 01 2023

Crypto And Currency Converter

Oct 19 2023

Leverage And Margin Calculator

Sep 29 2023

Buying stocks is a process that requires setting a budget, defining a strategy, picking stocks, opening a brokerage account and executing buy orders. Read our full guide to learn everything you need to know.

Sep 06 2023

Master the UK Forex market's ups and downs with practical strategies and tips for handling volatility. Your trading edge starts here.

Sep 01 2023

Pip Calculator

Aug 30 2023

Beginners Guide to MetaMask in 2023. Also learn forex trading, and stocks vs crypto.

Aug 09 2023

Profit Calculator

Aug 01 2023

Forex Compounding Calculator

Aug 01 2023

Forex Rebates Calculator

Jul 24 2023

Fibonacci Levels Calculator

Jul 12 2023

Crypto Exchange Fees Calculator

Jul 01 2023

Risk Of Ruin Calculator

Jun 20 2023

Drawdown Calculator

Jun 20 2023

Pivot Point Calculator

Apr 07 2023

It is possible to be profitable while trading in forex.

Apr 07 2023

The VIX Index, also known as the "Fear Index," is a measure of expected volatility in the U.S. stock market and is often used as a gauge of investor sentiment and market risk.

Apr 07 2023

In the past couple of years, the word "NFT" has popped up in both mainstream news outlets and crypto spaces.

Apr 07 2023

The Wyckoff method is a technical analysis approach that analyzes the markets based on supply and demand.

Apr 07 2023

What are the differences between hollow and solid candlesticks? How to read them? Find out more by reading our accurate guide with examples of each one.

Apr 07 2023

Axie Infinity is a non-fungible token (NFT) based play-to-earn (P2E) blockchain game that constitutes cartoon characters named Axies.

Apr 07 2023

The Metaverse refers to an online virtual world, which you experience through an avatar - a digital body or a character.

Apr 07 2023

Hedging in forex is a trade protection mechanism used by traders trading with foreign exchange currency pairs. Essentially, the trader adopts a strategy to protect the initial position he/she has opened from an opposing move in the market.

Apr 07 2023

Decentralised finance (DeFi) is a progressing financial system that is “decentralised” and non-mediated.

Apr 07 2023

A stock dividend is the distribution made by a company to its shareholders in the form of additional stock of the company.

Apr 07 2023

The first step to learn trading is defining what you need to learn and in what order you could learn it. Basics, Charts, Economics, Risk management, brokers.

Apr 07 2023

The inverted hammer candlestick is a single candle pattern that technical analysts use to forecast a potential bullish reversal.

Apr 07 2023

Forex risk management is a process of identifying, assessing, and controlling the threats that arise from foreign exchange speculation.

Apr 07 2023

The forex market is open 24 hours a day from 5 p.m. EST on Sunday to 5 p.m. EST on Friday to allow for traders in different time zones around the world to buy and sell currency pairs.

Apr 07 2023

The top 5 forex indicators are Moving Averages, Relative Strength Index, Fibonacci retracements, Bollinger Bands, and Average True Range.

Apr 07 2023

The Non-Farm Payroll (NFP) is an important economic indicator showing the monthly changes in U.S. jobs excluding farm-related employment

Apr 07 2023

Slippage in forex is when a trader receives a different price than the one he used to submit his order when trading currency pairs.

Apr 07 2023

Spread in forex is the difference between the bid (sell) price and the ask (buy) price of a currency pair, and it is essentially how a broker makes money without charging a commission on a transaction.

Apr 07 2023

Dollar-Cost Averaging is an investment strategy that consists of executing small regular purchases of an asset over prolonged periods of time regardless of its current market prices.

Apr 07 2023

Monero is the oldest and best private cryptocurrency in existence. This article will teach you how it helps regular people to remain private and free.

Apr 07 2023

A Pip is the smallest price measurement change in forex trading. In most currency pairs one Pip equals a movement in the fourth decimal place (0.0001).

Apr 07 2023

The law of supply and demand explains how buyers and sellers interact by analysing their desire to buy or sell based on different price and quantity levels.

Apr 07 2023

Bid is the price at which buyers are willing to buy an asset. Ask is the price at which sellers are willing to sell an asset. Spread is the difference.

Apr 07 2023

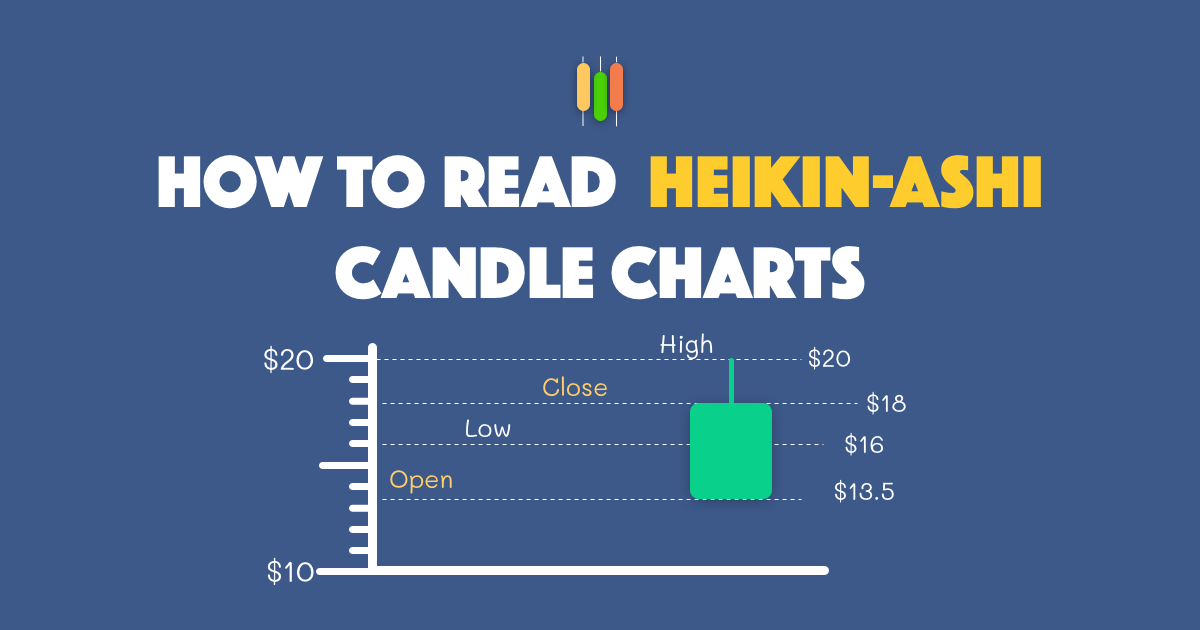

Heikin-Ashi candles are an averaged version of traditional Japanese candlesticks. They're used to spot trends in an easier way by reducing volatility noise.

Apr 07 2023

The Law of Demand shows the relationship between price and quantity from the buyer’s point of view. The lower the price the higher the quantity demanded.

Apr 07 2023

The Law of Supply shows the relationship between price and quantity from the supplier's point of view. The higher the price the higher the quantity supplied

Apr 07 2023

Betting against a stock is possible through short selling where you borrow a stock, sell it at market price, buy it back cheaper and profit the difference.

Apr 07 2023

Trading with leverage means to use borrowed funds from your broker in order to amplify your buying power while paying a cost to do so.

Apr 07 2023

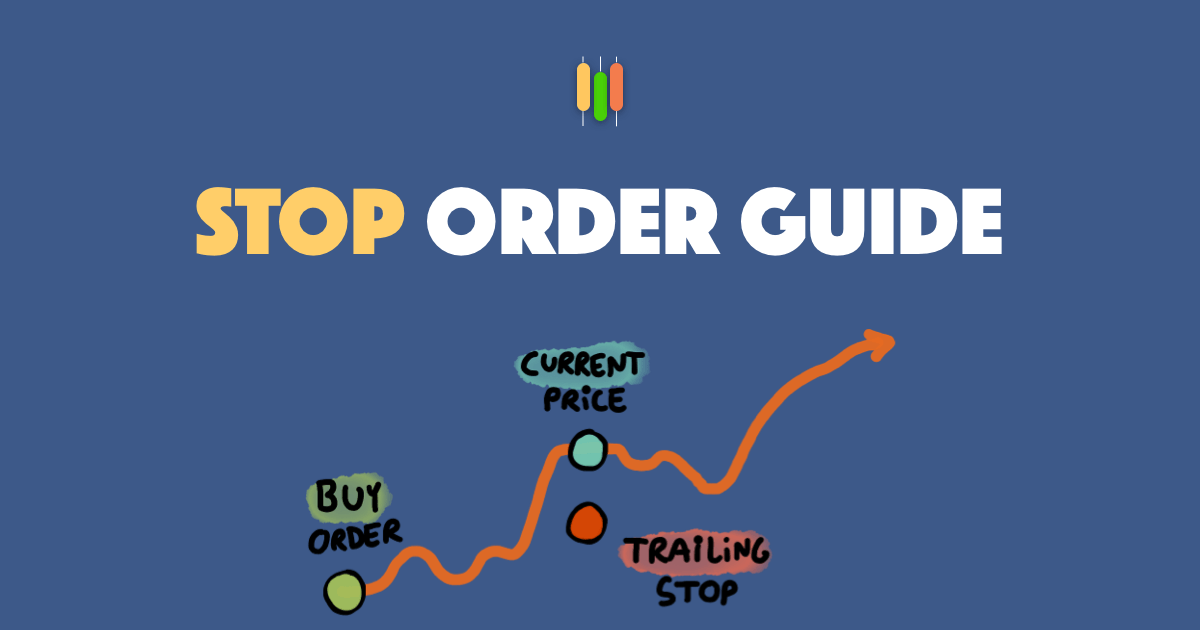

A trailing stop order is a dynamic stop order that maintains a pre-set maximum distance from the current price as long as it moves in the trader’s favour.

Apr 07 2023

A stop order is a market order to buy or sell that gets executed once an asset reaches a specific stop price defined by the trader.

Apr 07 2023

A Market Order is an instruction to instantly buy or sell an asset at the best price available at the moment. Market Orders never guarantee a specific price.

Apr 07 2023

A Limit Order is a trading order created to automatically buy or sell an asset only at a specific price or better. Limit orders don’t guarantee execution.

Apr 07 2023

Stop-Loss Orders are meant to automatically limit a trader’s loss when prices go against his trade. Stop-Loss Orders work just like market orders.

Apr 07 2023

In this Guide you'll learn what Bollinger Bands are, their formula, how to calculate them manually using a spreadsheet and a few different Trading Strategies.

Apr 07 2023

An Exponential Moving Average is a type of moving average that gives more weight (importance) to recent prices in its calculation making it more responsive.

Apr 07 2023

The Simple Moving Average indicator calculates the average price of an asset over a specific number of periods by showing an asset’s overall direction.

Apr 07 2023

Stock prices are determined by the pressure buyers and sellers exercise on each other. Let's take a look to what happens inside an exchange's order book.

Apr 07 2023

Forex trading guide for beginners, everything you need to know about Forex in a simple way: base and quote, pips, leverage, margin and economic calendars.

Apr 07 2023

Price action trading consists of studying past price behaviour and using it as your main source of information to make trading decisions.

Apr 07 2023

A complete beginners guide to technical analysis including: Japanese candlesticks basics, support and resistance, trends and the logic behind it.