The Trading Bible Trading Guides ᑕ❶ᑐ Understanding Solana - Is it really an Ethereum Killer

What Is Solana, and How Does It Work?

By Olayinka Sodiq, Updated on: Jan 07 2025.

The world has gone digital and a large community of remote workers now earn tokens as wages. Another notable example is crypto acceptance as payment for goods and services in the business world.

Imagine working and receiving payment in ERC-20 tokens on the Ethereum network. You open a web browser and head to Curve Finance, Uniswap, or CowSwap (decentralized exchanges on Web3 technology). These are platforms to swap digital coins without centralized authorities.

You decide to trade your wages for USDT, a stablecoin pegged at US dollar's value. Now it’s time to swap your assets, but get a notification indicating a cost of $200 to change $400 worth of crypto.

How exactly would you feel?

Unhappy would be an understatement if I were you because it sounds unreasonable. I can't comprehend paying half of my salary in fees for a transaction. But that's why Anatoly Yakovenko, a talented blockchain developer, built Solana in 2017.

This technology aims to minimize transaction costs, improve scalability and the number of transactions per second without sacrificing decentralization.

Ready to learn everything about Solana cryptocurrency and how it works? Join us as we discuss the decentralized project in-depth to end misinformation.

Solana: What Is It?

Solana is a digital currency that centers on the concept of privacy and has global acceptance. It’s a token created by Anatoly Yakovenko in 2017 with an individual unit known as SOL.

This crypto is an open-source project, meaning the underlying code belongs to no individual, instead it’s available to anyone.

Solana aims to scale throughput, which defines the number of transactions per second with significantly lower costs than rival blockchains. It adopts an innovative hybrid consensus model with a proof-of-stake (PoS) version called a lightning-fast synchronization engine.

Due to Solana’s improvement on the proof-of-history (PoH) algorithm with proof-of-stake (PoS), the network can process over 700,000 transactions per second. Its peer-to-peer design promotes safe transactions without seeking consent from central authorities.

The coin uses a ledger called blockchain, which records every currency transaction and verifies data integrity.

But Wait, What Are the Features of Solana?

Solana’s high-speed layer-1 and permissionless blockchain architecture can facilitate the creation of decentralized applications (DApp) and smart contracts. It supports non-fungible token (NFT) marketplaces and vast decentralized finance (Defi) platforms.

When we talk about RELIABLE and SOLID forms of digital cash, it’s ideal to consider Solana. Features of this fourth-generation blockchain include:

Open Source Code

Easy access to the underlying code is a distinctive feature of the Solana cryptocurrency. We mean everyone can download and implement the program for commercial or personal use.

Layered Services

Think of Solana as a technology infrastructure with different layers performing a specific function. Developers build decentralized financial institutions and applications with this crypto because its network improves efficiency with layered services.

SOL

SOL is Solana’s utility and native currency. You can transfer the units as a form of payment for bills, event tickets, gift cards, consumer staples, and more.

The token also has small denominations known as Lamports. It’s named after the famous Leslie Lamport, an American computer scientist recognized for his work on computing efficiency and distributed systems.

Horizontal Scaling

This innovation means adding more servers to the network, which distributes the load across different nodes. Solana’s distributed systems include the following:

- Sealevel

- Cloudbreak

- Pipeline

- Gulfstream

Sealevel: This network allows you to run multiple crypto contracts simultaneously by distributing the workload to other nodes.

Cloudbreak: Solana’s network for sharing the processing network inputs with other nodes for cloud storage.

Pipeline: This SOL mechanism optimizes validation when processing a transaction. It also replicates payment information through different network nodes.

Gulfstream: This memory pool allocation system transfers transactions on a queue to nodes processing fewer in-line activities. It’s the logical division of primary storage preserved for quick computing.

Turbine Protocol

Distributing data across several nodes challenges many high-performance blockchains. Think of a network with about 20,000 validators and a leader trying to share 64MB of data with each member.

The most common approach would be sending data to all other network nodes through peer-to-peer (P2P) communication. It requires different transactions as a unique connection with each validator is crucial, but it’s not time-saving. That’s why Solana uses the Turbine protocol.

The turbine is a module Solana uses to distribute blocks quickly and securely through the network. It creates a random path for each packet and transmits information with the user datagram protocol (UDP). It’s a communication module that establishes low-latency connections between apps on the internet.

Solana: How Does the Crypto Work?

Solana works with a proof-of-history algorithm and proof-of-stake consensus mechanism. Anatoly Yakovenko built the technology for scalability, which it accomplishes through the hybrid protocol.

The proof-of-history algorithm is the Solana protocol’s core component. Think of it as a cryptographic clock providing a data structure and timestamp for every transaction. It’s a computation series with a digital record of occurred events on the network at any given time.

Solana combines the proof-of-history (PoH) and proof-of-stake (PoS) protocols to process large transactions quickly. PoS is a mechanism for creating new blocks and confirming activities on the blockchain using a permissionless feature called the Tower Byzantine fault tolerance (BFT) protocol.

Quick transaction processing usually requires centralization. For example, business organizations such as Visa or PayPal use massive computer networks for rapid data processing. Bitcoin and Ethereum process information slowly due to hash rate and network activities.

Solana uses the proof-of-stake algorithm to process transactions faster than Paypal or Visa while maintaining Bitcoin’s decentralization. It also uses the protocols to agree on the same value, even when the nodes provide incorrect information or fail to respond.

The crypto adopts a 256-bit secure hash algorithm providing real-time data based on the central processing unit’s set of hashes.

Solana validators selected based on the crypto tokens they’ve pledged to the blockchain record specific information using these hashes. They often get the data generated before creating a specific hash index.

The proof-of-history algorithm creates a timestamp for transactions after validators insert this piece of data. Every node on the network must have cryptographic clocks to achieve Solana’s huge block creation time and number of transactions per second.

What’s Unique About Solana Cryptocurrency?

Transaction speed, low cost, high censorship resistance and security differentiates Solana from others.

Cryptos must meet specific criteria to qualify as genuine digital cash for the common people. Some of these benchmarks include low cost of transactions, scalability, and security, and that’s why Solana is an interesting option.

The unique qualities of Solana include the following:

- Ultra-low fees

- Scalability

- Security

- Lightning-fast transactions

- Ecosystem growth

- High censorship resistance

Let's discuss these Solana's distinctive features in-depth to improve your knowledge. Shall we?

Ultra-low Fees

Most crypto transactions attract a high cost, but that’s precisely why Solana exists today. The token developer designed its protocol to increase transaction speed with low fees.

Unlike Bitcoin, Ethereum, and other similar blockchain networks, Solana’s average fee per transaction is $0.00025. The great news is that a $2 million deal on the coin would attract a cost of approximately $20.

Scalability

Solana’s ability to handle an increasing number of transactions in short periods is one of its unique qualities. It’s scalable due to its robust network with proof-of-stake (PoS) and proof-of-history (PoH) algorithms. They’re the core innovations allowing the crypto to scale its network parameters.

Security

This cryptocurrency uses a 256-bit hash algorithm (SHA-256), which combines proprietary cryptographic functions for security. Solana’s layer-1 protocols are reliable and built for mass adoption.

Thousands of nodes operating independently of each other validate the crypto’s network. They provide real-time information and ensure users’ data remain safe and secure. Its maximum privacy allows people to have peace of mind.

Lightning-fast Transactions

Solana transactions are lightning-fast and near-instant, which means processing could take a few seconds. Thanks to its web-scale blockchain features and hybrid protocols, the crypto network supports about 50,000 transactions per second (TPS).

Solana’s architecture has a short processing time, which is 10000% faster than Bitcoin and 3800% quicker than Ethereum. On average, most Solana users send and receive SOL coins in wallets between 5-20 seconds.

Ecosystem Growth

This crypto blockchain ecosystem is gaining traction and quickly expanding. Its overall daily new NFTs increased by 8 million, representing a 19.4% increase in the network’s quarter-over-quarter (QoQ) in 2022. The significant growth occurred after Solana enjoyed a 46.5% spike in the second quarter.

High Censorship Resistance

Censorship prevents nodes from joining the network to validate transactions, which hinders activities. It prevents users from introducing new blocks to the distributed ledger technology, but Solana doesn’t entertain it.

This crypto has an innovative design that resists blockchain censorship via its rotating validator nodes.

What Can You Do With Solana?

This crypto can power various applications with a wide array of features. Ways to use the Solana include the following:

Currency: Like Ethereum and Bitcoin, you can send or receive Solana in units to and from anywhere in the world. As long as you buy products and pay for services, this crypto is ideal as payment through a cryptocurrency wallet.

Digital Apps: A digital application is a computer program developed to facilitate tasks on computing devices. The technology behind Solana supports a range of mobile and desktop app development, such as social media, investing, and games.

Non-fungible Tokens (NFTs) are unique cryptographic tokens stored on a public ledger that records transactions known as a blockchain.

NFTs are often associated with digital collectibles, online ticketing, proof of ownership, and certificates. Solana can power crypto assets, allowing artists to earn rewards by selling them to consumers.

Smart Contracts are apps on a blockchain that automatically execute contractual terms when their predetermined conditions are met and verified. Solana is programmable; its network support can process transactions faster and more economically than Ethereum.

Decentralized Finance (Defi): Defi is an emerging technology that offers financial instruments without relying on banks with government or centralized control.

Using blockchain smart contracts, you can avoid intermediaries such as exchanges and brokerages with the technology. The network supports permissionless transactions, allowing you to pay for services with Solana.

Is Solana Worth the Investment?

Solana is a coin for the people as it attracts low fixed costs and delivers fast performance with network stability. Investing in this cryptocurrency has recently gained more and more popularity, and financial institutions now have high hopes that the token could become a Visa of the digital currency world.

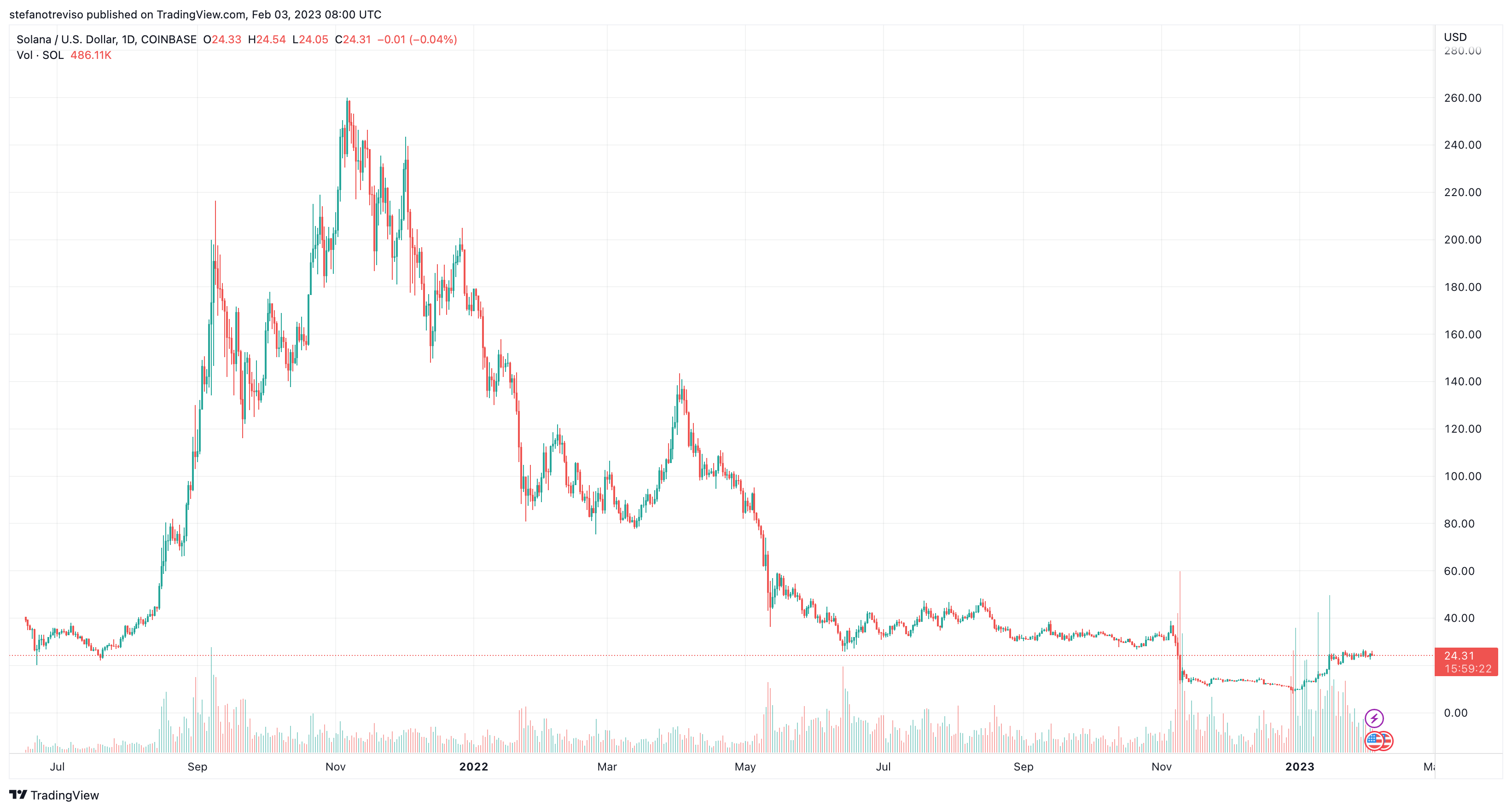

This cryptocurrency was initially released in April 2019 and traded at less than $1 per token. Since then, Solana’s price has risen remarkably, reaching above $250 in 2022 before declining alongside other digital currencies.

As of 3rd of February 2023, the coin traded at $24.31 per unit and ranked among the largest coins by value on CoinMarketCap.com.

Early adopters recognized the opportunity and probably made some money, but the recent months have been challenging. It’s best to get comprehensive information about the token instead of focusing on recent losses and gains. It often leads to fear of missing out.

The speculation and optimism of other traders are Solana’s driving force. Market sentiments and flow of resources on exchanges are other traditional factors. If they lose momentum, nothing propels the coin because fundamental assets don’t back it. It’s a critical factor for many investors, including Warren Buffet.

Are SOL Tokens in Circulation?

In January 2023, Solana token’s total supply was 538.1 million, with 371 million already in the market. It doesn’t have a capped maximum supply and is currently available at $24.61 per unit as of January 24th 2023.

Marketplaces to Buy Solana?

The easiest and quickest way to purchase Solana is via crypto exchanges. Some of the platforms include:

- Binance

- Kraken

- Coinbase

Create and verify your profile on any of these platforms with the necessary information. Fund your account and decide how many tokens to buy before trading. You can save crypto on exchanges or send it into a personal wallet. It comes at a fee, but users have control over private data, which helps them establish asset ownership.

Does Solana have downsides?

Despite the immense benefits of transacting with Solana, it’s not without downsides. Its technology competes with high-end blockchain projects but lacks adequate independent validators.

This cryptocurrency technology has about 1900 consensus nodes, which makes the innovation more centralized than their counterparts. Although anyone accessing Solana’s network can become a validator, it requires computing resources.