The Trading Bible Brokers 5 Best ECN Brokers List for 2023

5 Best ECN Brokers List for 2023

By Stefano Treviso, Updated on: Aug 21 2023.

An ECN broker allows for greater transparency and tighter spreads by matching client’s orders via an ECN network (Electronic Communications Network) which allows multiple participants to compete for orders thus resulting in a better pricing for the trader and tighter spreads.

Here are our 5 Best ECN brokers for 2023:

| Broker | Reason |

|---|---|

| Oanda | Most powerful regulatory framework and no commissions |

| FP Markets | Best asset offering overall with more than 10,000+ instruments |

| Pepperstone | Tightest spreads and MT4 / 5 and cTrader platforms |

| IC Markets |

Competitive spreads with MT4 / 5 and cTrader platforms |

| AvaTrade | Powerful trading platform with options on currencies |

Before diving deep into the logical reasoning behind our choices, let’s get some background about ECN brokers out of the way.

What is an ECN Broker?

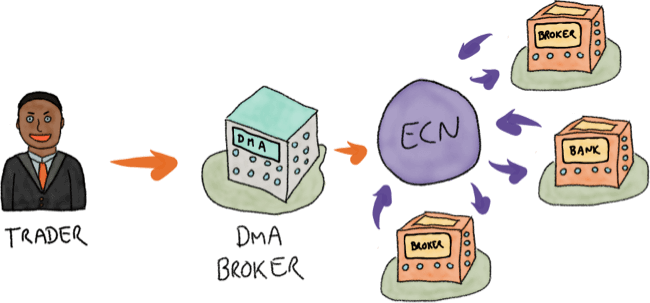

An ECN broker is the one that matches and routes its customer’s trades via the ECN network which is nothing more than a global electronic trading network that connects different liquidity providers.

This network guarantees a fair price as the competition happens electronically and also a more transparent trading environment as all participants have access to all the available prices.

How does an ECN broker work?

One of the best ways to understand how an ECN broker works is by comparing it to another type of broker, in this case an STP (Straight through processing) broker.

An STP broker receives an order and immediately routes it to another broker or liquidity provider.

An ECN broker receives an order and immediately sends it into a global network packed with hundreds of market participants competing for the best price possible.

In the case of an STP broker several things can go wrong, for example: A market maker broker that never sends customers orders to the real market can be pretending to be an STP broker when in reality they’re only routing their orders exclusively to another STP broker which they also own.

With an ECN broker, the previous problem becomes non-existent as the orders will be pooled and matched electronically at the best price possible.

Advantages vs. Disadvantages of an ECN Broker

| Advantages | Disadvantages |

|---|---|

|

|

Great! Now that we’ve got the basics out of the way, let’s start with our best 5 ECN brokers for 2023:

1. Oanda - Most powerful regulatory framework and no commissions

FP Markets is a global FX broker founded in 1996 and headquartered in the U.S. They specialise in currency trading through their own proprietary platform.

| Key data | |

|---|---|

| EUR/USD Spread | Dynamic - From 0.8 Pips |

| Commissions | None |

| Minimum Deposit | 0 |

| Financial Regulators | CFTC, NFA, ASIC, FCA, MAS, IIROC, FFAJ, BVI. |

| MT4 | Yes |

| MT5 | Yes |

| cTrader | No |

| TradingView | Yes |

| Proprietary Platform | Yes |

FP Markets’s regulatory framework consists of 5 top tier financial licenses from the most reputable regulators in the world. Another great advantage is their competitive pricing due to their integration with ECN networks.

| The Good | The Bad |

|---|---|

|

|

When it comes to the most trustworthy forex dedicated broker with an ECN offering, Oanda beats their competitors by far. Their proprietary platform designed with a user-friendly approach and their competitive pricing with no commissions are definitely leading the market.

2. FPMarkets - Best asset offering overall with more than 10,000+ instruments

FP Markets is an Australian broker founded in 2005 that specialises in CFD trading. Their offering boasts more than 10,000+ assets with ECN and DMA access.

| Key data | |

|---|---|

| EUR/USD Spread | Dynamic - From 0 to 1.2 Pips |

| Commissions |

|

| Minimum Deposit | $100 |

| Financial Regulators | ASIC, CySec, FSA. |

| MT4 | Yes |

| MT5 | Yes |

| cTrader | No |

| TradingView | No |

| Proprietary Platform | Yes |

FP Markets’s biggest selling point is definitely their extensive asset offering accompanied by well-known professional trading platforms and ECN / DMA pricing. Meaning that the broker doesn’t trade against you.

| The Good | The Bad |

|---|---|

|

|

If you’re a trader looking specifically for an ECN / DMA broker that has as much fronts as possible covered (especially in the area of stocks), FP Markets is definitely a great choice as an overall provider.

3. Pepperstone - Tightest spreads and MT4 / 5 and cTrader platform

Pepperstone is an Australian broker founded in 2010 that holds 6 financial licenses from which 4 belong to high reputation financial regulators. Their biggest selling point is crafting a competitive account offering with spreads from 0 pips with ECN pricing.

| Key data | |

|---|---|

| EUR/USD Spread | Dynamic - From 0 to 0.77 Pips |

| Commissions |

|

| Minimum Deposit | $200 |

| Financial Regulators | BaFin, FCA, ASIC, DFSA, CySec, SCB, CMA. |

| MT4 | Yes |

| MT5 | Yes |

| cTrader | Yes |

| TradingView | Yes |

| Proprietary Platform | No |

Pepperstone only provides Metatrader 4, 5 and cTrader as their trading platforms. Their biggest advantage is their Razor account which has commissions from $3.5 per lot and spreads from 0 pips due to their ECN pricing.

| The Good | The Bad |

|---|---|

|

|

For high volume traders looking for professional and well-known platforms along with competitive spread pricing, Pepperstone is definitely a great choice.

4. IC Markets - Competitive spreads with MT4 / 5 and cTrader platforms

IC Markets is an Australian broker specialised in Forex trading by providing Metatrader 4, 5 and cTrader accompanied by custom account offerings with spreads starting from 0 pips and low commissions.

| Key data | |

|---|---|

| EUR/USD Spread | Dynamic - From 0 to 0.6 Pips |

| Commissions | No commissions in standard accounts but rather a 1 Pip spread markup on interbank prices received. For Raw spreads accounts, $7 per lot round turn. |

| Minimum Deposit | $200 |

| Financial Regulators | ASIC, CySec, FSA. |

| MT4 | Yes |

| MT5 | Yes |

| cTrader | Yes |

| TradingView | No |

| Proprietary Platform | No |

IC Market’s biggest advantage is definitely their Raw spreads account which offers access to ECN pricing with a commission of $7 per lot round turn.

| The Good | The Bad |

|---|---|

|

|

IC Markets can be a great choice for experienced traders looking to offset their commission costs by trading on larger volumes using their Raw spreads account.

5. AvaTrade - Powerful trading platform with options on currencies

AvaTrade is a multinational broker with more than 7 financial licenses that specialises in currency trading along with options through their proprietary trading platforms.

| Key data | |

|---|---|

| EUR/USD Spread | Dynamic - From 0.9 Pips |

| Commissions | None |

| Minimum Deposit | $100 |

| Financial Regulators | ASIC, FFAJ, CBI, IIROC, CySec, FSCA, ADGM, ISA. |

| MT4 | Yes |

| MT5 | Yes |

| cTrader | No |

| TradingView | No |

| Proprietary Platform | Yes |

At a glance, AvaTrade’s offer doesn't’ look that competitive yet the area where you’ll really find the value is in their dedicated platform for currency options.

| The Good | The Bad |

|---|---|

|

|

If you’re a professional trader and you know what you’re doing, you’ll definitely find some incredible value in AvaTrade’s custom currency options offering where you’ll be able to speculate on a whole new level and engage in very interesting hedging strategies for your portfolio.

Frequently Asked Questions

Which is better, an ECN or an STP broker?

An ECN broker is far better than an STP broker as the first one matches and routes orders electronically towards a global network of fair competition, better pricing and tighter spreads, whereas an STP broker chooses specific brokers or liquidity providers to send their orders to.

How do ECN brokers make money?

ECN brokers mostly make money through commissions charged to open and close trades. For example, most ECN forex brokers have a standard commission per lot traded (100,000 currency units). This means that if the broker charges a $2 commission per lot with a $2 minimum, every time you open and close a trade below 100,000 currency units, you’ll be paying $4.

Do ECN accounts have spreads?

Yes, ECN accounts have spread. What makes them different is that they’re usually far tighter than standard spreads as the pool of liquidity that an ECN broker is connected to is far larger and competitive than any other.

Is eToro an ECN Broker?

No, eToro is both a market maker broker and a direct market access broker depending on the assets you trade.