The Trading Bible Trading Guides Law of Supply - Definition & Examples in Trading

What is the Law of Supply?

By Stefano Treviso, Updated on: Apr 07 2023.

The Law of Supply shows the relationship between price and quantity from the supplier’s point of view. Assuming that any other factors remain constant, the higher the price the higher the quantity supplied and the lower the price, the lower the quantity supplied.

The Laws of Supply and Demand are amongst the most important concepts any trader needs to learn, they're at the core of price determination for every single asset you can trade and provide really valuable insights when analysing price behaviour using techniques such as price action, but before we talk about trading, lets take a look at the fundamentals behind the law of supply.

If you’re the owner of the Coca-Cola company, would you be willing to produce more if you could increase the price of your beverage from $1 to $6? Of course! Selling at a more expensive price equals more profits for you.

If somehow any market event forces you to lower prices to $0.50, your incentive to produce as much as possible is gone as there’s not that much profits anymore.

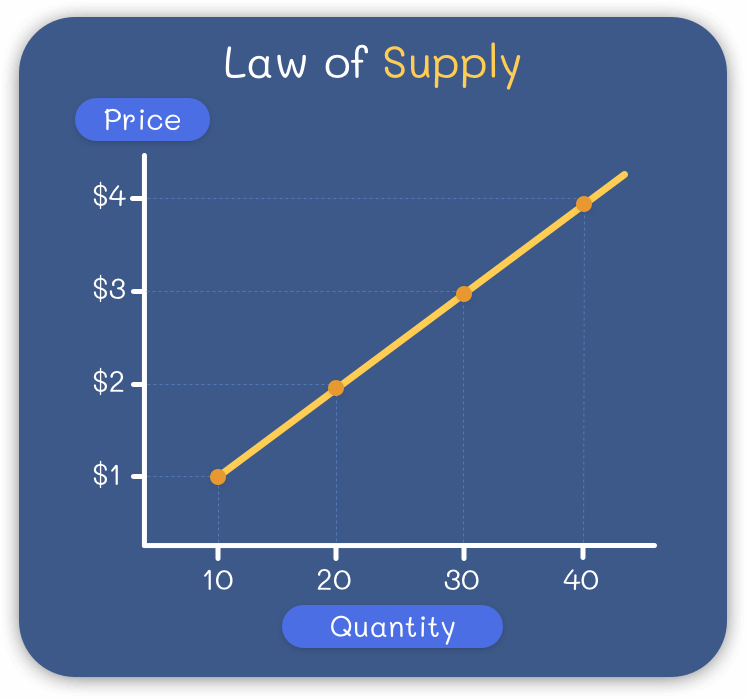

Let’s take a look at a visual example of how the Law of Supply operates:

In the chart above you’ll find on the Y-Axis (left one) the price and on the X-Axis (the bottom one) the quantity. The yellow line represents the Law of Supply assuming other factors remain constant (that means that we’re not accounting for changes in supply or any other thousand variables that could affect this). Here’s what happening in the chart:

- At the price of $1 the quantity supplied is 10

- At the price of $2 the quantity supplied is 20

- At the price of $3 the quantity supplied is 30

- At the price of $4 the quantity supplied is 40

In simple words, people are always willing to supply more if they can do it at a better price for them.

Bear in mind that the law of supply does not operate independently, it’s connected with the Law of Demand which states that the lower the price, the higher the quantity demanded and the higher the price, the lower the quantity demanded.

Even though we said that suppliers are willing to produce more at higher prices that doesn’t mean that buyers are willing to buy at those prices. If suppliers made the decision to ramp up production without taking into consideration the demand, they wouldn’t be able to sell the excess product they provided as not that many buyers are willing to pay the new price.

In reality there are millions of factors driving changes in supply and demand and that same battle is what causes price determination. Suppliers are constantly testing and adapting to the demand in order to reach an ideal price quantity relationship.

Featured Brokers for Beginners

| Broker | Top Features |

|---|---|

| |

| |

|

Examples of the Law of Supply in Trading

So far we explored the abstract concept of the law of supply, now it’s time to get into trading. You can think of market participants selling their stock or cryptocurrencies as the suppliers. Before moving on, we heavily recommend you read our guide on how stock prices are determined, it'll help you make a stronger case of the examples.

Law of Supply in the Stock Market

If you own 1000 shares of AAPL (Apple) which you bought at $50, when would you be willing to sell more: at the price of $51 or at the price of $60?

Clearly at the a price of $60. That's why you'll always find greater liquidity (availability) of an asset at a higher price in any exchange's limit order book.

Now, what happens to the buyers? They're clearly willing to buy less at those prices! So how is it possible that everyone meets at a certain point and the price of a stock moves up or down?

Well, if all the buyers immediately find out that Apple will make an extraordinary announcement that could bring lots of profits to the company here's what could happen:

- Buyers will start buying at whatever price they can get in

- This will cause them to consume the available supply of shares at higher price levels

- Suppliers (market participants selling stock) will proceed to remove their available supply

- Suppliers will change their sell orders to a higher price

Law of Supply in the Cryptocurrency Market

One of my favourite examples to explain the law of supply is Bitcoin. Try to think for a second, how can we push the price of Bitcoin up? There's only two ways for this to happen:

- The demand is so huge that eats up the available supply at each higher price level thus making prices move higher

- The suppliers simply chose to withdraw the liquidity they were providing at higher price levels, an example of this could be: if Bitcoin costs $10.000 and suppliers (sellers) withdraw all their pending orders they had to sell from the range of $10.000 to $15.000 the price of Bitcoin will magically appear at $15.000 regardless if anyone is buying or not.

- Maybe the demand decreases but that's the new price, suppliers decided to cut supply on a high demand asset to control the price.

See where we're going? Not everything is what it seems.

You could be thinking that Bitcoin goes up due to massive demand when in reality, a few powerful wallet holders are just removing their pending orders and squeezing hard that small demand. Then it all looks like everyone is going crazy buying.

Now you learned the basics of the law of supply applied to trading, go do some analysis and have fun!