The Trading Bible Trading Guides ᑕ❶ᑐ Forex Day Trading for Beginners: Strategies, Rules and Tips

What is Forex Day Trading - a Guide for Beginners

By Stelian Olar, Updated on: Mar 26 2025.

Have you ever wondered if you could make a living day trading Forex?

I know I did.

When I first started researching Forex trading, it seemed like an exciting way to potentially earn an income without being tied to a 9-5 job but, I quickly realized there was a lot more to it than just buying and selling currencies whenever I felt like it.

Successful Forex day trading requires skill, knowledge of the right strategies, and discipline to follow proven rules.

In this article, we'll explore the world of forex day trading for beginners. You'll learn:

- What is Forex day trading?

- Key strategies used by experienced day traders to profit in the Forex market.

- We'll cover essential rules to follow for risk management and tips to improve your skills.

- And, even talk about the best Forex broker for day trading.

Compared to trading stocks or other securities, Forex vs stocks offers unique advantages for the aspiring day trader.

The foreign exchange market is:

- Open 24 hours a day, 5 days a week, allowing you greater flexibility over the stock market.

- You also benefit from increased leverage and the ability to profit whether currencies are rising or falling.

By the end of this daytrading beginner's guide, you'll have a solid foundation of knowledge to start day trading Forex. Let's jump right into key forex day trading strategies, forex day trading rules and tips so you can minimize your risks and maximize your potential rewards in the exciting world of the foreign exchange market.

How Does Day Trading Forex Work

Unlike investing for the long-term, Forex day trading involves opening and closing trading positions within the same day. A Forex day trader would rely on short term price movements to turn a profit.

A typical day trade is executed using an intraday trading strategy based on technical analysis of the markets. Successful day traders will:

- Closely monitor forex price charts for signals,

- Utilize technical indicators and chart patterns to help identify potential trading opportunities.

- When they spot a promising setup, they open a position and closely manage their risk with stop losses.

The goal is to capture small but consistent gains each day and while individual profits may be modest, they can compound over time into substantial returns. Day trading requires patience and discipline - traders may wait hours or days for the next viable day trade.

It's important to remain objective and stick to your strategy.

Note* If you’re trading stocks, be aware of restrictions like the pattern day traders PDT rule which defines a day trader as a person who executes more than 4 trades within five business days.

Is Forex Trading the Same as Day Trading?

Many new traders wonder, is forex trading the same as day trading, or are they different forms of trading?

While related, day trading and forex trading have some distinct differences.

The main difference between day trading vs forex lies in the holding times. Day traders close all positions within a single trading day, while forex trading can involve holds for any duration. Forex traders can day trade but they can also swing trade, scalp trade, or even be long-term investors.

Is Forex Day Trading Profitable?

The short answer is yes, day Forex trading can be profitable however, it's important to have realistic expectations.

While returns vary, successful Forex day traders consistently earn solid daily returns that compound into significant monthly and annual profits. According to a 2022 survey of Forex traders by ZipRecruiter:

- The average annual income of a successful day trader is $99,764 per year.

- The top 25% of respondents reported earning over $150,000 annually.

In addition, data from Interactive Brokers – best broker for Forex day trading professionals, found that profitability among frequent traders on their day trading platforms was around 32.3% while 67.7% of retail traders lose money with IBKR.

Many aspiring traders are curious - can you really make money day trading Forex?

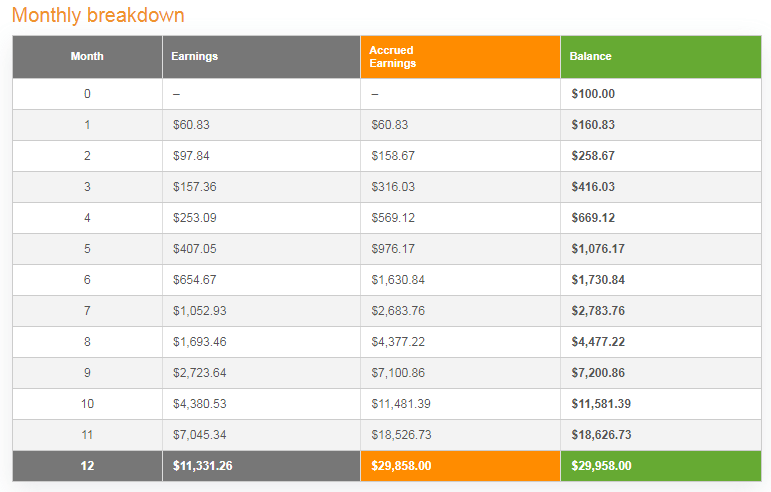

For instance, if your system nets 2% per day, you could theoretically grow a $100 account into over $29,958 in one year.

Source:thecalculatorsite

Of course, actual returns depend greatly on a trader's skill, trading strategy and market conditions.

The key is consistency, much like any skill, expertise in Forex day trading develops over time.

Can You Day Trade Forex with $100?

The short answer is yes - you can start day trading Forex with just $100 or less.

While experts recommend having more start-up capital, it is possible to start day trading with $100 and still generate profits. The key is using proper risk management by utilizing effective stop losses and keeping your leverage very low.

With brokers like Pepperstone (or eToro for US residents), you can open a micro Forex trading account with no minimum deposit requirement that allows positions as small as 1,000 units of a currency. This enables you to place trades with a position size of just $0.10 per pip movement.

For example, if the EUR/USD moves just 10 pips in your favor, that's a $1 profit on a micro lot position. While profits will be small in dollar terms, by scaling your risk appropriately you can still turn consistent profits with an account of $100 or less.

Even starting with $100, the Forex day trading strategy can lead to significant profits over time if you trade prudently and manage your risk properly. In later sections, we'll offer tips to help maximize your success when you trade Forex with a small account balance.

Is Forex Day Trading Risky?

Yes, Forex day trading involves substantial risk but, the risks can be managed with proper education, caution and sound risk management practices.

In general, all forms of day trading be it Forex vs stocks day trading are riskier than long-term investing because you aim to profit from short-term price movements which can be volatile and unpredictable.

Here are two main reasons why day trading Forex vs stocks is more risky:

- You need to act fast to enter and exit positions, which leaves less room for in-depth analysis.

- Forex day trading in particular carries risks due to the leverage involved. With 50:1 leverage, a 2% market move against your position would wipe out your entire capital.

What You Need to Know Before You Start Day Trading Forex

Forex day trading for beginners requires some important factors to consider which can help set you up for long-term success.

Step #1 Understand Day Trading is Different Than Long-Term Trading

First, realize that forex day trading is not the same as long-term investing or buy-and-hold strategies. It requires closely monitoring the markets in real-time to capitalize on short-term price movements.

You need to be available during active Forex trading hours and be ready to act fast across lower time frames.

Step #2 Start With Major Currency Pairs

When first learning to day trade forex, stick to the major currency pairs like EUR/USD and GBP/USD because they have excellent liquidity and volatility for short-term trading opportunities. Avoid exotic crosses until you gain more experience.

Step #3 Develop a Detailed Trading Plan

Create a detailed trading plan that outlines your day trading Forex strategies for entering trades, managing risk per trade, managing daily risk, and exiting profitably.

Step #4 Demo Trade Extensively Before Going Live

Open a practice account from your Forex broker to do trading simulation without risking real capital. Demo trade with a forex day trading simulator for months while refining your trading skills before placing your first live trade.

Step #5 Implement Robust Risk Management

Maximize your risk management with tools like stop-losses, position sizing based on risk, and limiting total daily risk to 1-2% of capital.

Step #6 Monitor Price Action and News Closely

Closely monitor forex charts, price action, and market news events that may impact currency pairs. Forex day trading requires constantly analyzing markets to find trading opportunities. Stay vigilant.

The Best Forex Day Trading Strategies

Now that you understand the basics, let's explore some of the best forex day trading strategies used by successful traders. Having an effective trading system is crucial for generating consistent profits.

Popular intraday forex trading strategies include breakout trading, news trading, scalping, and trend following. Each strategy aims to capture short-term moves and can be adapted to fit different styles and time frames.

Breakout Trading Strategies

Breakout trading involves looking for support and resistance levels that the price is likely to break through. Trading the breakouts can lead to quick profits if properly timed. This strategy is often combined with volume analysis.

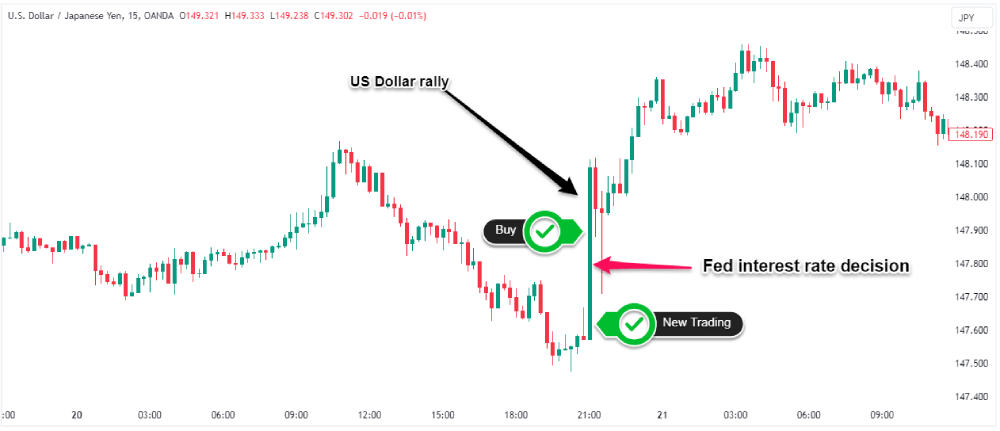

News Trading Strategies

News traders enter positions just before major economic data releases or other announcements that can impact currency prices. By reacting quickly, news trading aims to capture volatility spikes surrounding the events.

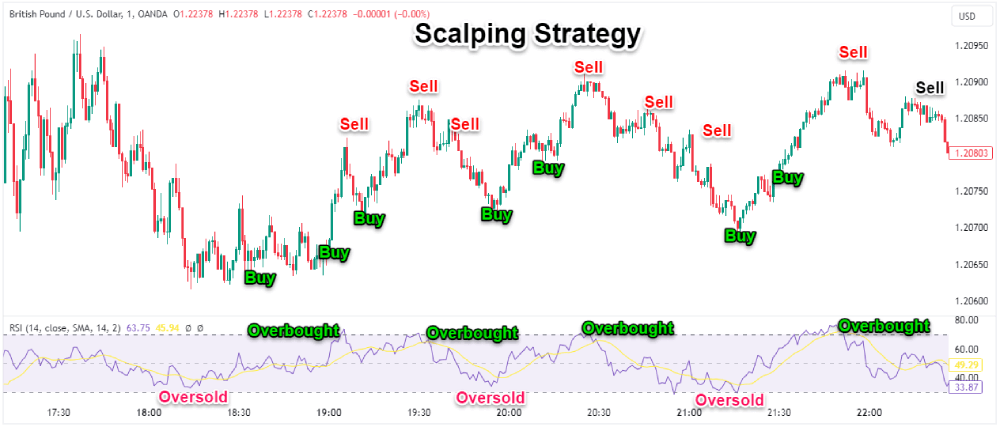

Scalping Strategies

Scalping is a fast-paced style where traders open and close multiple positions within minutes or seconds to collect small, frequent profits. Success requires precision timing and liquidity to enter and exit trades swiftly.

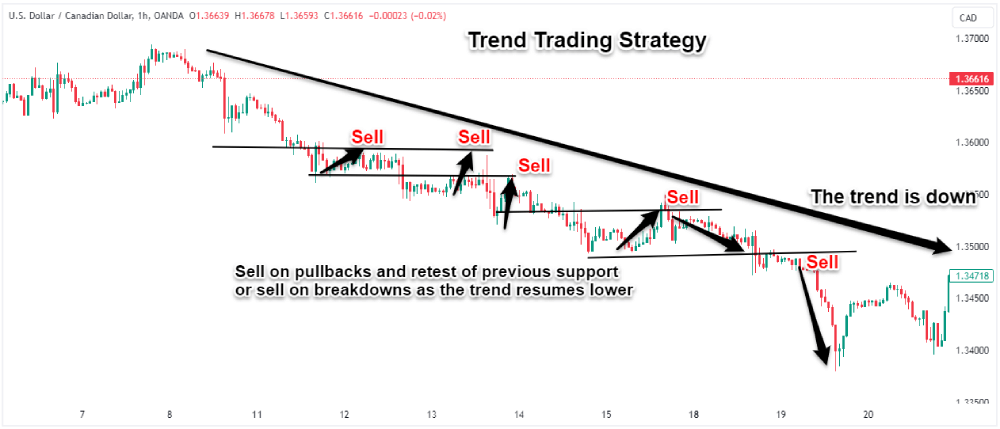

Trend Following Strategies

Trend trading aims to profit from strong market trends. Traders analyze price action and technical indicators to determine the overall trend direction and trade with the momentum. This higher timeframe strategy offers flexibility.

There is no one-size-fits-all approach so make sure to find a Forex day trading system that fits your personality and schedule.

How To Choose Your Own Day Trading Strategy

With so many possible approaches, selecting the best Forex day trading strategy comes down to your personality and risk tolerance.

Here are some key considerations to see if day trading is suited for you:

- Are you more comfortable with high-probability, low-return strategies or vice versa? This can guide strategy selection.

- Consider your schedule and availability during market hours. Day trading requires constant monitoring, while trend following is more flexible.

- Determine your profit targets, whether through many small wins or larger intermittent gains. Different strategies achieve different return profiles.

- Identify strategies that fit your analytical strengths, whether technical price action, macroeconomic events, or fundamentals. Play to your skills.

- Research strategies thoroughly to understand the principles, mechanics, risks and ideal trader personality behind each. Find the right match.

What Is the Best Forex Day Trading Strategy for Beginners

When starting out in forex day trading, simple technical strategies are best suited for beginners. Two strategies in particular are ideal for new traders:

- Range trading.

- And moving average crossovers.

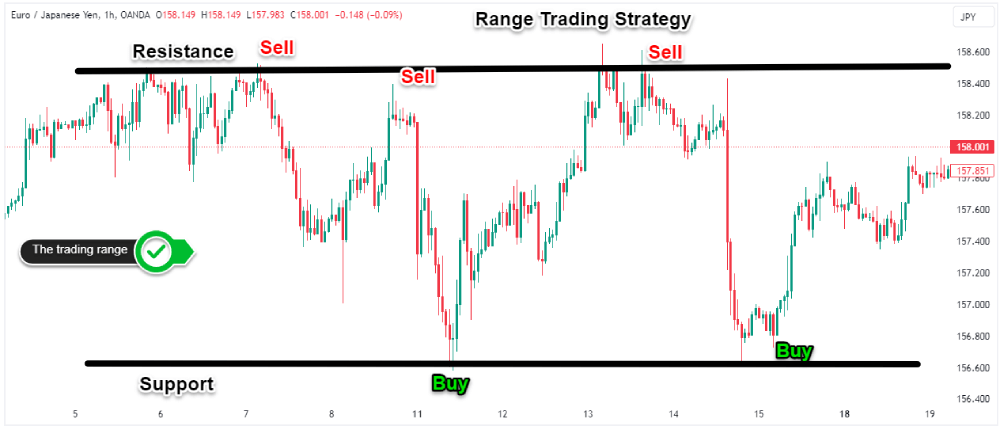

Range trading

Range trading involves identifying support and resistance levels that a currency pair oscillates between. Traders buy near support and sell near resistance to capture movements within the range.

Moving Average Crossover System

Moving average crossovers offer another straightforward beginner strategy. Two moving averages of different periods are monitored for crossover signals.

For example, buying when the faster 5-period MA crosses above the slower 20-period MA. This system provides clear entry and exit levels.

Pros and Cons of Forex Day Trading

Deciding if day trading forex is right for you? Here we'll examine some of the key pros and cons to consider:

Pros:

- Opportunity to profit from short-term price movements that other traders may miss

- Potential to earn income without needing to be tied to a 9 to 5 job

- Ability to profit whether markets are rising or falling

- Leverage allows controlling large position sizes with limited capital

- Low barriers to entry and the ability to start small even with a micro account

Cons:

- Requires constant focus and vigilance during market hours

- High risk if proper risk management practices aren't followed

- Requires expertise in technical analysis to identify trading opportunities

- Expect a steep learning curve and paper losses when first getting started

- Requires monitoring positions closely throughout the day, leaving less free time

Find the Best Broker for Forex Day Trading

Here are some tips for choosing the best broker for day trading forex:

- Look for low spreads and commissions to keep costs down on each trade

- Check for advanced trading platforms with charting tools, technical indicators, and automation

- Ensure the brokerage offers your preferred forex pairs and adequate leverage

- Ensure the Forex broker is properly regulated

- Look for seamless deposits/withdrawals and responsive trader support

For day trading Forex, Pepperstone checks all the above boxes while for stock trading, TD Ameritrade seems the right fit.