The Trading Bible Trading Guides Stop Loss Order - What is it and How to Use it?

Stop Loss Order - What is it and How to Use it?

By Stefano Treviso, Updated on: Apr 07 2023.

Table of Contents:

- Stop-Loss Order Explained

- How to set a Stop-Loss Order

- Advantages of the Stop-Loss Order

- Disadvantages of the Stop-Loss Order

- When should you use a Stop-Loss Order?

- Common Stop-Loss Order Mistakes

Stop-Loss Order Explained

A Stop-Loss Order is a trading order created to automatically limit a trader’s loss when prices go against his trade. A good example would be if you bought shares at a price of $10 and immediately closed your platform and went for a drive. If you previously set a stop-loss order at $8 then, your trading platform will automatically execute your stop-loss and take you out of that trade if that price is reached.

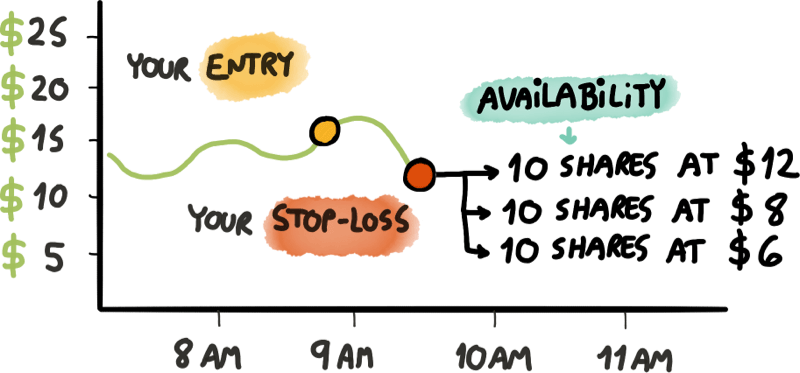

Stop-Loss orders work exactly like market orders, meaning that they will get executed at the available prices, which can be a surprise for inexperienced traders, here’s why:

Suppose that you bought 100 AAPL (Apple) shares at a price of $50. Immediately after buying you placed a stop-loss order at $45.

Clearly, your intention in this example was not losing more than $500, that’s why you set your stop-loss $5 below the purchase price.

Great, now you decided to go for a walk without your phone or any way to access your trading platform and while you’re enjoying yourself, turns out that the price of the reached your stop loss trigger.

The most logical scenario is assuming that you can lose in the worst case $500, but this is not true. You could lose even more due to price availability.

Imagine that in the NYSE (New York Stock Exchange) the available AAPL shares at each price level are the following:

- 20 Shares at $45

- 60 Shares at $44.5

- 20 Shares at $44

In the EXACT MOMENT that your stop-loss order becomes triggered, it will begin to consume the available shares at the available prices to take you out of your position.

That’s exactly how market orders work, you’re buying or selling at the available MARKET PRICES.

Going back to our first example, now you can see that your total loss is more than $500.

In order to get out of those 100 Shares of AAPL, you paid 3 different prices: $45, $44.5 and $44.

Meaning that your total loss is: $550.

Here's a visual example of the availability problem when a stop-loss order gets executed:

I’ve heard so many cases of traders complaining about their stop-loss execution because they thought that the number they set for a maximum loss is written in stone and guaranteed.

Now you know that this is not the case and any sudden market movements caused by extreme volatility can alter your plans, SPECIALLY if you trade assets that have low liquidity like penny stocks or exotic currency pairs.

Featured Brokers for Beginners

| Broker | Top Features |

|---|---|

| |

| |

|

How to set a Stop-Loss Order

There are several approaches to set a stop-loss order, the most common are:

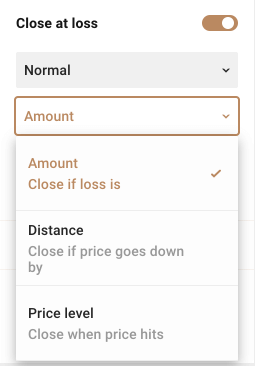

- Points (distance): if the price moves from $50 to $49.7 it moved a distance of 0.30, so if you chose 0.30 as your distance for your stop-loss it will become activated (the measure of distance can vary between trading platforms, in one platform 1 point can mean 0.01 in price change, always be careful to check).

- Specific Price: if you chose a price of $30 then if the asset reaches that price it will trigger your stop-loss.

- Amount in currency of the Loss: choose an amount that you’re willing to lose, for example $500. That means that if your trade hit’s a loss of $500 your stop-loss will be activated.

- Percentage of the total Investment at a Loss: if your total trade is worth $10.000 and you chose a stop-loss of 2% that means that when your trade hits a loss of $200 your stop-loss order will be triggered (this one is just a fancy way of putting things, in the end is also the same as an amount stop-loss calculated in a fancy way).

Instead of having a universal convention on how to set a stop-loss order in every trading platform, nowadays they’re all trying to be special and naming it differently, but in the end, it’s just a stop-loss order, all you need to do is remember that it works like a market order regardless of how they want to call it.

Here’s an example of how a window to set a stop-loss looks in one of our preferred trading platforms:

And if you were to click on the option that says amount, it will open the small panel with 3 choices of how you want to calculate that stop-loss.

In the end, regardless of the type of calculation you use, a stop-loss is a stop-loss. It will always work like a market order.

The possibility to calculate it using different measures is used for particular situations such as when you care if the asset hits a particular symbolic price level.

It's all up to your taste.

Advantages of the Stop-Loss Order

The main advantages of a stop-loss order are:

- The ability to LOCK an approximate loss level from a trade in order to meet your risk management plan.

- Locking that particular loss in an automated way without you being sticked to your trading platform.

- Setting a Stop-Loss order usually costs nothing (bear in mind you’ll still pay commission if your broker charges commission for opening and closing trades or spread).

Disadvantages of the Stop-Loss Order

The main disadvantages of a stop-loss order are:

- If you’re not there to change it (which you shouldn’t if you set it correctly the first time) then you’re fully committed to what you set on that stop-loss order by the time it triggers automatically.

- You could end up getting a different loss than the one you expected due to a volatile market and lack of availability to fill your market order at your desired price.

Objectively speaking, if you were to create an amazing and well crafted risk management plan along with timing perfect entries and exits to your trades, then stop-losses present very little to no disadvantage to your trading.

Most of the problems when using stop-losses arise from using it with the wrong trading styles and lack of knowledge combined with incorrect settings which we’ll mention at the end of this article.

In the image above you can see one of the most funny stop-loss scenarios. When you set a stop-loss and the asset’s price literally goes down and touches your stop-loss, you lose your trade and then it continues in the exact direction you wanted right from the start.

Again, we can’t stress this enough, it’s all about incorrect placement. A stop-loss by itself can’t have disadvantages, it’s all about how we set it.

When should you use a Stop-Loss Order?

Whenever you want to limit your losses and you’re sure that it makes sense to limit that loss based on your trading settings.

The real key to using a stop-loss lies on having a good trade to start with. If you analysed your asset correctly and defined some realistic targets for your stop-loss then it makes sense to use it.

The problem comes when people don’t analyse trades and just go in using their gut or feelings and find themselves in very unpleasant situations, for example:

If you’re scalping (trading on extremely short timeframes) on 10-30 seconds which is something we can consider crazy and full of adrenaline, then setting a stop-loss incorrectly can cause that a short spike of the price in the wrong direction triggers your stop-loss and the worst part is that probably the price will go back were you wanted right after triggering your stop-loss.

Common Stop-Loss Order Mistakes

These are the most common mistakes when using a stop-loss:

- Setting your stop-loss REALLY close to your entry price. Any quick and sudden movement will knock you out of that trade.

- Assuming that your stop-loss will guarantee a maximum loss. Remember, it depends on availability, nothing is guaranteed.

- Setting your stop-loss at an extremely far away price that will get hit once you’re already broke. You need to have a risk management plan and realistic targets.

- Changing your stop-loss and moving it slowly to keep making your loss bigger and not lose the trade. If you LOST then YOU LOST! Avoid that behaviour as it’s already going into the gambling side of things, not trading.

- Confusing the Stop-Loss order with the Stop-Limit Order or the Trailing-Stop Order. These are very different and we will cover them in a separate article, for now, bear in mind that they're NOT the same as a regular Stop-Loss.

- Setting your stop-loss where most of the traders would set their stop-loss. This makes you an easy meal for institutional traders.

To finalise this guide, let’s talk about that last point.

The markets have an evil nature by default, in order to make money, you have to take it from someone else’s hand (someone has got to lose, right?).

So if you understand how stock prices are determined, put yourself in the shoes of a massive WHALE trader with the ability to even move the markets through his trading platform.

He needs liquidity to execute his tactics, so if he wants to move prices he’ll aim at wiping an area were rookie stop-losses are concentrated in order to clean that level and make money easily by driving the price wherever he wants.

Remember, when it comes to trading, the more evil you think, the better.

Good luck.