The Trading Bible Trading Guides Market Order - What is it and How to Use it?

Market Order - What is it and How to Use it?

By Stefano Treviso, Updated on: Apr 07 2023.

Table of Contents:

- Market Order Explained

- How to Place a Market Order

- Advantages of the Market Order

- Disadvantages of the Market Order

- When should you use a Market Order?

- Common Market Order Mistakes

Market Order Explained

A Market Order is a type of trading order designed to achieve instant execution upon availability by buying or selling an asset at the best price available at the time of execution.

Market orders never guarantee a particular price, you never know what you could end up getting as everything really depends on availability.

Important note: Market orders get executed instantly, if you click the buy or sell button, there’s no going back.

Look at the example above: a trader placed an order to buy 100 shares and the price of the asset was $15.

In that precise moment of time, there are 2 sources of liquidity (availability):

- Pending Orders that are waiting to be executed at the desired prices

- Market Orders of other traders that are instantly being matched and executed

The moment that the trader clicked buy at $15, the following scenarios could happen:

- He gets his desired price maybe because there was a Pending order on the exchange that provided his desired quantity and price

- He gets his desired price maybe because other traders instantly clicked on SELL at his desired price and quantity and the exchange matched them.

- He gets 2 different prices (or maybe even more), maybe a part of his order met the desired price but then the next available prices for the remaining amount of his order was more expensive.

- He gets a completely different price for all the shares he bought as in the exact moment he clicked prices jumped and he got his market order instantly filled at a completely unexpected price (either better or worst).

With market orders you never know what could exactly happen.

I know what you’re thinking: this sounds scary!

Yes, it does, but it’s not that bad as it sounds, we just presented all possible scenarios. In reality this depends on 2 different variables: liquidity and volatility.

In an extremely volatile market where prices can swing before we can blink our eyes then yes, we have no clue what price that market order can get us.

In a low liquidity asset then if no one is executing market orders and there are just a few pending orders on the exchange’s book then yes, we also could end up getting a horrible price. Maybe there were only 5 pending orders with a $2 difference in price each and our market order ate them all.

Featured Brokers for Beginners

| Broker | Top Features |

|---|---|

| |

| |

|

How to Place a Market Order

Market orders are the simplest of all order types, placing them is as easy as opening your trading platform, choosing an asset, selecting the quantity of the asset and clicking either on buy or sell.

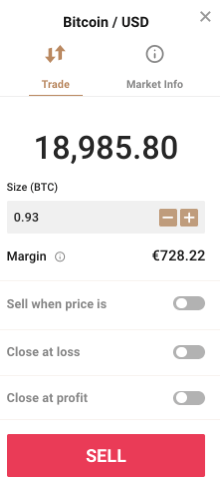

An example of placing a Market BUY order:

An example of placing a Market SELL order:

Remember, market orders are called like that because you get the MARKET price and you can never be sure which price it will be, specially on high risk conditions such as low liquidity and extreme volatility.

Advantages of the Market Order

These are the main advantages of a market order:

- Instant Execution

- Almost Guaranteed Execution (assuming that nothing insane is happening, if everyone wakes up and removes all pending orders from exchanges and also no one else is executing market orders on the opposite side then you wouldn’t have anyone to buy or sell from. That’s how market crashes happen).

Disadvantages of the Market Order

The main disadvantage of a market order is:

- You never know for sure which price you’re going to get

That’s why this type of order regardless of it being simple requires understanding of the conditions where it’s being used to ensure you don’t go broke or watch your account disappear.

Remember, be careful with low liquidity and high volatility.

When should you use a Market Order?

Market orders are commonly used when:

- You don’t care about the exact price you get.

- You want to get in a trade at whatever price you get.

- You want to get out of a trade at whatever price you get/

Remember, market orders are all about prioritising execution above price.

A good example of this would be:

- An asset is trading at $50.

- If you find out that X asset is about to climb 1000% and you’re witnessing some aggressive moves.

- You really don’t care if you get in the trade at $50 or $51, you just want to get in.

Same example applies if you know that a stock you own will go down or the company will declare bankruptcy tomorrow and disappear, you don’t care the exact price you get, you just care about getting a price.

Common Market Order Mistakes

These are the most common market order mistakes (the first one is my personal favourite):

- Using a market order in an EXTREMELY ILLIQUID asset that has just a few pending orders in the exchange and no one executing market orders. Your market order will get executed instantly if the available quantity you requested is on the pending orders and you’ll get the worst prices of your life possibly (happened to me many years ago trading cryptos).

- Using a market order in an extremely VOLATILE asset to enter a trade and end up getting a completely different price that doesn’t serves your trading plan.

Hope this guide was helpful,

Enjoy!