The Trading Bible Trading Guides Top 5 Proven Forex Trading Strategies For All Levels

Top 5 Proven Forex Trading Strategies For All Levels

By Stjepan Kalinic, Updated on: Nov 30 2023.

The top 5 forex trading strategies are:

While all of these have their strengths and weaknesses, their usability depends on the trader’s knowledge, experience, and personality.

Although trading forex blindly might produce surprising results, inevitably, it will end up in a disaster. It is like going on an endless road trip without a map – initially, you might end up in some exciting places, but eventually, you will be lost.

Thus, using a forex trading strategy ends up being a necessity. Here are some of the most popular ones that survived the test of time. Let's get a good overview on each one of them.

Trend following

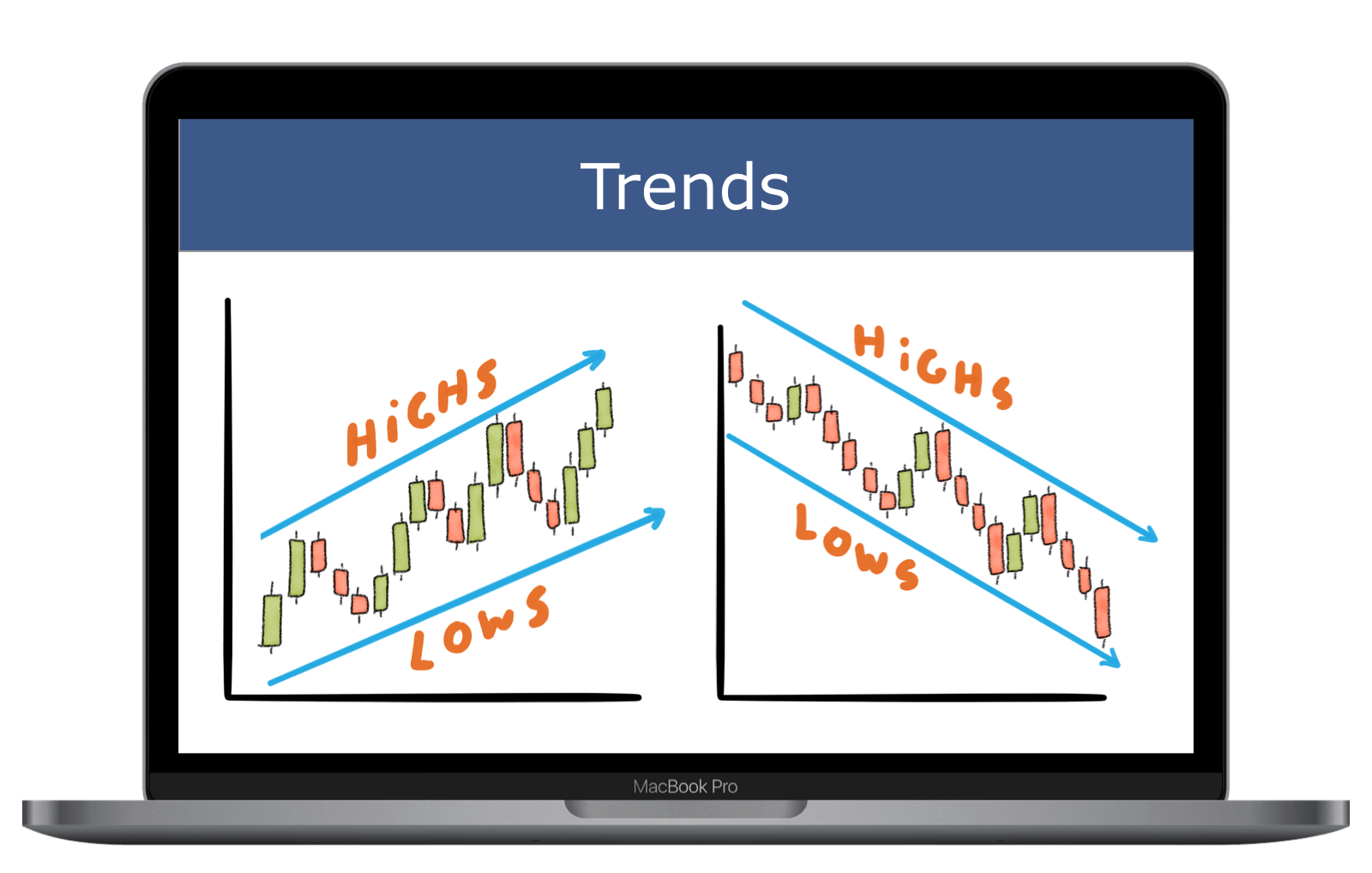

An old trader’s proverb says, “The trend is your friend.” Obviously, trading in the direction of the overall market is favorable, but the main problem is detecting the trend early enough.

The forex market tends to range before bursting out in a trend. Trend following strategies often use moving averages (MAs) as a signal.

For example, when the 50-day simple moving average, which indicates the medium trend, crosses over the 200-day moving average (long trend), this signals the bearish market. Yet, by the time the trend becomes apparent, it is mainly exhausted.

Thus, the trend following in 2023 has to be adjusted.

One of the methods we’d recommend is to find positions where you can be a short-term contrarian but a long-term trend follower. This includes a multi-timeframe analysis where you’d compare relatable charts. A good example would be 5-minute and 1-hour charts, or 15-minute and 4-hours. This way, you’d be as close as being wrong in the short-term while riding off the long-term power of the trend, giving you a favorable risk-to-reward ratio.

Scalping

A strategy that is not for “the faint of heart”, scalping is a very dynamic game. Traders who prefer it thrive in a quick-paced environment, often getting in and out of a dozen trades in a single session.

Scalping usually revolves around price patterns or indicators. It uses short-term charts: 5 -minute, 1-minute, or even tick charts.

Another tool in the forex scalper’s arsenal are key levels. Marking the weekly open, daily open, Asian session highs or lows, and pivot points will help to decide either stop-loss or take profit levels.

Yet, the most important thing for scalping is hardware, software and internet connection reliability. Speed and execution are of utmost importance, thus it is necessary to possess a fast computer and a broker that offers tight spreads and minimum slippage.

Swing Trading

Swing trading, sometimes referred to as momentum trading, is a type of trading that tries to capture a wider range of market moves. Thus, swing traders will trade in the direction of the trend but also against it – sometimes holding opposing trades simultaneously.

Swing traders also readily hold their trades overnight so they have to be ready for the higher cost of trading, lower leverage, and thus likely the higher initial balance to produce meaningful returns.

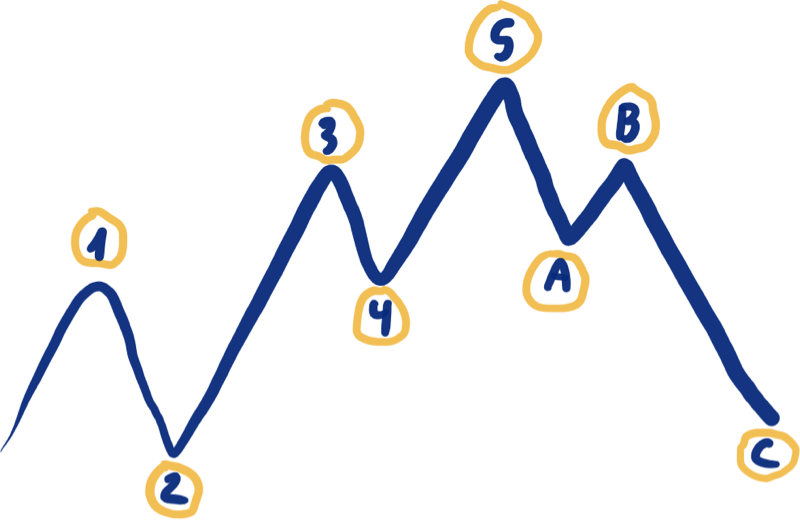

There are different tools for swing trading, but it is hard to find a better concept other than Elliott Wave Theory (EWT).

Made popular by Ralph Nelson Elliot, EWT observes the market’s movement in 5 main waves plus 3 corrective waves.

Furthermore, 5 main waves consist of 3 impulse waves and 2 corrective waves with simple rules:

- Wave 2 cannot retrace more than 100% of wave 1

- Wave 3 cannot be the shortest of the impulse waves (1,3,5)

- Wave 4 cannot go beyond wave 3 at any time

Elliot Wave principles are handy for swing traders because they can map the approximate market movement and trade in both directions – either for hedging or for profits. For further information, you can check out the book Elliott Wave Principle Applied to the Foreign Exchange Markets by Robert Balan which has been released into public domain.

Price action

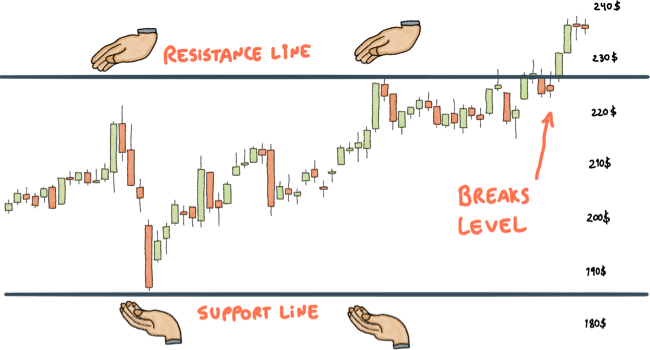

Price action refers to following and anticipating the price’s movement over time. Price action is a purist’s strategy as the price offers all the information we use. Everything else (indicators) is derived from the price.

Price action traders often prefer naked charts and then draw all the necessary information by hand. Candlestick patterns are often in the toolbox of price action traders as they have been well-researched in books like “Encyclopedia of Candlestick Charts” by Thomas Bulkowski.

The major weakness of price action is that it is highly subjective. Two traders can often come to a different conclusion by observing the same chart, yet the beauty of price action lies in its ability to become a self-fulfilling prophecy due to all traders falling victim to what they believe to be key support and resistance levels.

Position trading

A long-term strategy that focuses on fundamental analysis. However, position traders do sometimes use technical analysis – mainly for finding better entry or exit spots.

There are 2 main drawbacks of position trading. First, it requires patience and meaningful capital. As position traders hold trades for a long time, this can incur rollover costs as well as opportunity costs. Furthermore, position traders can go through prolonged drawdowns before their analysis finally catches up with the market. As the old Wall Street proverb says: “Markets can remain irrational longer than you can stay solvent.” Thus, you have to use trade sizing that is large enough to produce meaningful returns, but not large enough to crash your account.

Conclusion

While the ways to trade markets are almost infinite, the ones we covered above are some of the most-researched strategies that stood the test of time. Although all of them can be profitable, each has its own strengths and weaknesses.

In the end, choosing the best one for you will depend on your broker, account size – but most importantly on your personality.

Featured Low Spreads Forex Brokers

| Broker | EUR/USD Spread |

|---|---|

| Dynamic - From 0 to 1.2 Pips | |

| Dynamic - From 0 to 0.77 Pips | |

| Dynamic - From 1 Pip |

Frequently Asked Questions

Is there a 100% winning strategy in forex?

No. There is no such thing as a 100% winning strategy. In the forex market, anything can happen at any time. Risk can never be completely avoided, but you can manage it by taking the necessary precautions.

What is the best forex trading strategy?

Swing trading is often regarded as the best strategy in terms of time vs. result because the trader doesn’t have to spend a lot of time on the charts. However, trading strategies are highly subjective, and your favorite will be one that suits your personality.