The Trading Bible Trading Guides Learn How to Trade | Top 5 Things you should know

How to Learn Trading? - Top 5 Things you should know

By Stefano Treviso, Updated on: Apr 07 2023.

If you came to us looking how to learn trading, you’ll get that answer to the best of our abilities. The whole purpose of this article is to create a guide of a possible learning path you can follow if you’re starting from scratch.

Here's what we'll talk about:

- Trading Basics

- Charts and Technical Analysis

- Japanese Candlesticks

- Psychology of Candlesticks

- Technical Analysis Principles

- Trends

- Support and Resistance

- Economics

- Law of Supply and Demand

- Macroeconomic Indicators

- Risk Management, Statistics and Probability

- Risk Reward Ratio

- Anticipating Profit and Loss Scenarios

- Brokers

- CFDs (Contracts for difference) Market Makers

- DMA (Direct Market Access)

- Conclusion

The first step to learn trading is defining what you need to learn and in what order you could learn it. Let's get started.

1 - Trading Basics

The first thing when learning to trade is getting to know the differences between investing and trading, both disciplines have different approaches in terms of speed and execution.

Trading is all about trying to generate profits by buying or selling assets without you really caring about the asset itself or its real value. A trader is never attached emotionally to any asset or class.

If your style is to buy some Tesla shares because you believe in Elon Musk and then forget about those stocks for 5 years while they grow, that’s not trading, it’s called investing.

Now, the big question.

What are we going to trade with?

To answer this question then we must learn about asset classes.

Our recommendation is to learn this assets in the following order to ensure a better foundation:

- Stocks (Shares)

- Forex (Currencies)

- Indices

- Commodities

- Cryptocurrency

- Financial Derivatives

Stocks tend to make more sense when we’re starting to learn trading as we’re usually hearing every day about companies, the logic behind them, profits, ownership, and many other terms that are part of our daily lives.

Our personal recommendation is to NOT choose Forex as your starting point to learn trading.

Currency markets require a solid understanding of macroeconomics and a lot of variables that take time to understand, so to make your life easier, learn trading by studying shares first.

One of the craziest things in trading is you see that a lot of Gurus selling the idea of easy forex, then a lot of beginners start trading without understanding how it really works and they just make decisions looking at charts with a couple indicators, then after they don’t do well they lose a lot of time trying to get out of those bad habits.

Learning to make decisions through a solid analysis process using logic and taking time to rationally think why we do things is usually the best path to not ending broke.

Featured Brokers for Beginners

| Broker | Top Features |

|---|---|

| |

| |

|

2 - Charts and Technical Analysis

The second step when we’re learning to trade is decoding the art of interpreting charts so that we’re able to look at one and understand what is going on and what could go on, not because a computer says it, but rather because when we looked at that chart we arrived at a logical conclusion.

These are the most important points when learning technical analysis as a beginner:

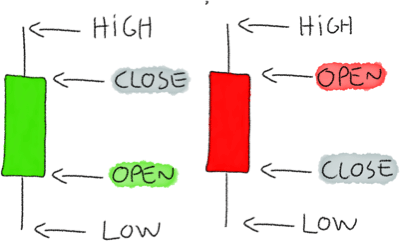

Japanese Candlesticks

Japanese candlesticks allow you to store much more data in a chart, they give you the possibility to see the open, close, high, low prices of any given period you can choose.

Psychology of Candlesticks

The main purpose behind Japanese candlesticks is to teach us about the battle between bulls and bears in each period. People tend to get fixated on looking for some patterns and rainbows in the chart, but they don’t realise that candles are all about battles.

An extremely low wick on a candle that ended up green with a small body, means that there was a huge selling pressure on that period, regardless of the candle ending up green.

Technical Analysis Principles

Why would someone even want to look at charts as a way to predict possible future prices?

Well, now that we understand the chart’s language (candlesticks and what they represent) we can talk about why we believe such a thing. These are the 3 principles of technical analysis.

- The Market discounts everything

- Prices move in trends

- History tends to repeat itself

The first principle indicates that every single thing that could affect the price is already included in the chart, so this makes charts the only thing a technical analyst needs to study the markets.

The second principle is just trying to say that prices don’t just go jumping up and down like crazy, they move in trends across time.

The third principle tells us something interesting which is: if it happened before, it can happen again. This one is very accurate in many aspects of life.

Trends

As the second technical analysis principle says, prices move in trends.

What does this mean?

That as long periods of time pass, we’ll see that the price of an asset doesn’t move erratically. If we eliminate the daily noise caused by volatility, we’ll see that the market either was going up or down for a prolonged period of time, and what we care as traders is to identify these trends and use them in our favour.

Support and Resistance

These are the key price levels where an asset has shown a tendency to either go back down (resistance) or go back up (support). They usually are psychological key levels where there is a big concentration of supply or demand.

If you think the subject of technical analysis indicators is missing, well, that’s because we left it out intentionally.

Technical analysis indicators tend to teach the wrong ideas to beginners looking to learn trading as they provide a false sense of confidence when making decisions, as beginners rely on them instead of having logical arguments on why they make a decision, so it’s better to avoid them when you're getting started.

3 - Economics

Once we manage to understand all the fundamentals, the next step in order to learn trading is learning economic principles which will lead to understanding how prices get determined and which factors have great influence on them.

A lot of traders try to trade Forex by just looking at some charts with indicators and they forget the real meaning behind the currency market, it’s all about measuring the economy of one country against another and there is no better way of doing that than using macroeconomic indicators for example.

The most important subjects:

Law of supply and demand

The laws of supply and demand allow you to understand that humans by the mere act of buying and selling something are the one moving the price of something up or down.

Macroeconomic Indicators

They can be the result of measuring a part of a country’s economy (such as the gross domestic product) or they can be a decision that affects the lending rate from the central bank (such as the interest rate decision). Macroeconomic indicators are the most powerful tool for a forex trader as they tend to have a huge influence in currency prices.

For example, a change in the interest rate decision for any country can result in massive fluctuations in its currency price.

4 - Risk Management, Statistics and Probability

Risk management allows us to get into trading without going broke right in the beginning. The result of an effective risk management strategy is learning how to manage your available capital regardless of the size.

One of the main tasks in risk management is calculating the risk reward ratio of your trading plan to ensure it fits a predetermined plan that keeps you in the game and hopefully profitable.

The most important subjects to study:

Risk Reward Ratio

Each time you open a trade:

- Is the amount you’re willing to lose equal, lesser, or greater than the amount you’re looking to profit?

If the answer is greater, your trading plan won’t be profitable in the long run, and here is why:

If every time you lose, you lose $50, and every time you win, you win $10, you’ll notice that statistically you’re meant to go broke.

Learning how to calculate the proper risk reward ratio will ensure that you are able to maintain yourself trading and also that you’re able to become profitable.

Anticipating Profit and Loss Scenarios

When you’re thinking about trading a particular asset, the first thing that should come to your mind is studying how the asset behaves so you can choose correctly your position size and be able to estimate your potential profits or losses in any given timeframe.

If an asset’s average price movement is $50 a day, you know that if your trading capital is $500, you can’t afford to buy 50 units of that asset because if the asset performs its normal price change, then you’re risking to profit or lose $2500 in a single day.

The big issue is when people do this under leverage (the real reason they can afford to open big trades with small accounts) and they incur in quick losses with small price movements, for not having calculated correctly the potential profit and loss scenarios based on the asset’s average price movement.

5 - Brokers

Last but not least is learning how brokers work and their different types so that you’re able to distinguish between a good broker or one with questionable ethics.

The most common types of brokers you’ll find are:

CFDs (Contracts for difference) Market Makers

They create the market by quoting sell and buy prices. They usually match traders that are long (buying) and short (selling) against each other and send the remaining trades they’re unable to cover into the real market.

In many cases a CFD market maker can decide not to hedge into the real market and just take the opposite side of their client’s trades.

DMA (Direct Market Access)

They act exclusively as middlemen in any transaction, which means they just execute the orders you request directly into the market.

There are many broker types, but these are the most common ones.

A really valuable tip we can give you is:

“As long as a broker doesn’t tell you what to do, doesn’t call you to get you to deposit more money and doesn’t try to advise you, you’re probably dealing with a good one”.

Be extremely careful with this last point, many people are victims of this issue due to not being informed.

6- Conclusion

Learning to trade requires much more than what you just read on this guide, but at least we’re confident that it will serve you as a solid starting point for you to slowly build your knowledge by knowing which subjects you can research and in what order.

Some very important points that you might find a little funny but eventually you’ll go through as we all have:

- You’ll lose money in the beginning

- When you profit, you’ll cut your profits fast

- You’ll realise that under your risk reward ratio you won’t be able to sustain trading.

- You’ll try to trust people who claim to have winning methods.

- You’ll realise all of them are lying.

- You’ll have read a thousand books and free articles.

- You’ll finally go into breakeven mode.

- You’ll make your first official planned profits.

After all of this, you’ll come to a point where you’ll realise that the real key to success in trading lies in having solid knowledge, analysis skills, great use of logic and being able to afford losing money without causing you stress, only when you master all of this you’ll be able to see the light in trading.

Good luck!