The Trading Bible Blog ᑕ❶ᑐ Best Forex Robots for Automated Forex Trading in 2025

Automated Forex Trading - What Software Do Forex Traders Use

By Stelian Olar, Updated on: Apr 29 2025.

Thanks to a revolution in AI and readily available technology, automated Forex trading is no longer the exclusive domain of institutional investors. Let's face it, the idea of having an automated forex trading robot work in the global currency markets 24/5, without the need for constant human intervention, is undeniably strong.

This automation is primarily achieved through forex robots, also commonly referred to as forex trading bots or Expert Advisors (EAs). These sophisticated software programs are designed to automate the entire trading process, from analyzing market conditions to opening and closing trades, all based on pre-defined rules and sophisticated algorithms.

This article provides a comprehensive overview of automated forex trading, delving into how these systems function, their inherent advantages and disadvantages, and how to select the appropriate tools to kick-start your automated trading journey.

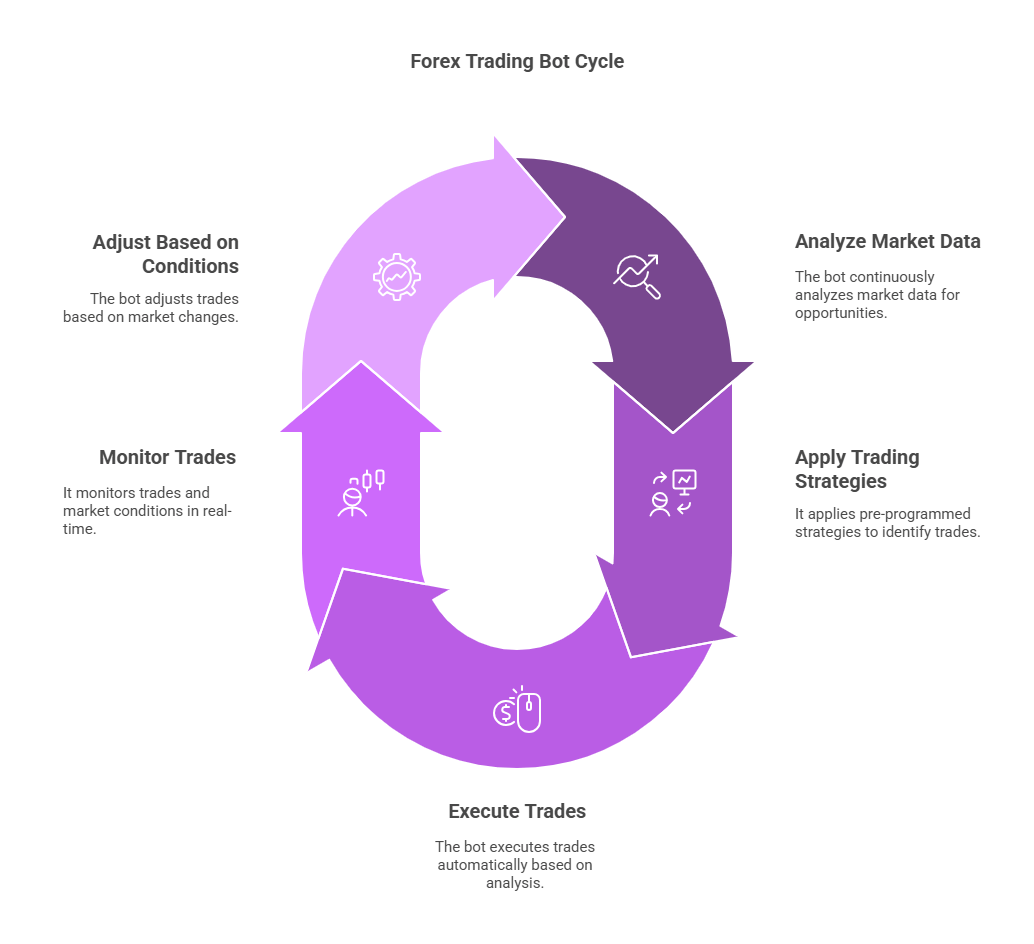

Forex Trading Bots - How Do They Work

A forex trading bot is essentially a piece of forex trading software designed to analyze financial markets and execute trades automatically.

These bots leverage algorithmic trading strategies, which rely on intricate mathematical formulas and technical analysis to pinpoint potentially profitable Forex trading opportunities.

They possess the capability to analyze a wide array of factors, including:

- subtle price movements,

- the impact of economic news releases,

- and a multitude of technical indicators,

All are processed in real time.

The core principle of a Forex bot lies in its pre-programmed set of rules.

These rules serve as the decision-making framework, dictating precisely when to initiate a trade (buying and selling), when to exit a trade (either by reaching a pre-set profit target or triggering a protective stop loss), and the specific amount of risk capital to allocate to each individual trade.

These rules are often based on well-established and widely used trading strategies, such as moving average crossovers, MACD divergence patterns, or Fibonacci retracement levels.

The forex software maintains a constant vigil over the market, and the moment the pre-defined conditions are satisfied, the robot trade forex automatically, without any human intervention.

The best robots can work with a wide range of currency pairs.

What Technology Do Forex Robots Use?

Most forex robots are built using platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5), which use the MQL4 and MQL5 programming languages, respectively. These languages are specifically designed for developing trading robots and technical indicators.

Some more advanced bots and forex AI trading bots may utilize:

- APIs (Application Programming Interfaces) to connect directly to a broker's trading server, allowing for faster execution and more customized strategies.

- Machine learning algorithms to adapt to changing market conditions, although these are still relatively less common than rule-based systems.

Are Forex Robots Legal?

Yes, forex robots are generally legal in most jurisdictions. However, it's crucial to check the specific regulations in your country of residence. The legality typically rests on the use of the robot within a regulated brokerage environment. Using a reputable and licensed Forex broker is paramount.

For instance, brokers like Pepperstone and FP Markets operate under the oversight of major regulatory bodies, ensuring they adhere to strict financial standards and client protection measures.

Note* Be extremely cautious of unregulated forex brokers or any system that promises unrealistically high returns, as these are often strong indicators of potential scams.

Can Forex Robots Be Profitable?

Short answer: YES.

But, the profitability of forex robots is a complex question with no guaranteed answer. While some traders have achieved success using automated systems, others have experienced losses. Profitability depends on numerous factors, including the quality of the robot's algorithm, the chosen trading strategy, the market conditions, and the trader's risk management approach.

It's crucial to understand that even the best forex trading bot can guarantee profits, and past performance is not necessarily indicative of future results.

Thorough backtesting and realistic expectations are essential even for the best robot for forex trading.

Advantages and Disadvantages of Automated Forex Trading

Automated Forex Trading Software Pros

- Removes Emotion: One of the biggest advantages of automated forex trading is the elimination of emotional decision-making. Fear and greed can often lead to poor trading choices, but a Forex robot trader sticks to the pre-defined rules, ensuring discipline.

- 24/5 Trading: The Forex market operates 24 hours a day, five days a week. A forex trading robot can monitor the markets and execute trades even while you sleep, taking advantage of opportunities across different time zones.

- Backtesting: Most forex automated trading systems allow you to backtest your strategies using historical data. This helps you evaluate the potential profitability of a robot before risking real capital.

- Increased Speed and Efficiency: Robot traders can analyze multiple currency pairs and execute trades much faster than a human trader, capitalizing on short-term opportunities that might be missed otherwise.

- Diversification: Some forex bots can help you diversify your forex trading by running different strategies, reducing the risk of a single strategy underperforming.

Forex Automated Trading Cons

- Mechanical Failures: Automated forex trading software is still software, and it's susceptible to technical issues like internet connectivity problems, power outages, or software bugs. A trading app or Forex mobile app can sometimes help mitigate this, but it's not foolproof.

- Lack of Adaptability: While robots are excellent at following pre-defined rules, they may struggle to adapt to unforeseen market events or sudden shifts in market conditions. Human trading experience can be invaluable in these situations.

- Over-Optimization: It's possible to over-optimize a forex trading bot to perform exceptionally well on historical data, but this can lead to poor performance in live trading.

- Monitoring Still Required: Even with auto forex traders, regular monitoring is essential. You need to ensure the forex auto trader is functioning correctly and that the market conditions haven't changed significantly.

- Cost: While many free solutions exist, the best forex robots or best forex bot options will cost you money.

3 Best Robots for Auto Forex Trading

Choosing the right automated trading tool can be a daunting task, given the sheer number of options available. To simplify your search, we've highlighted three noteworthy Forex robots, each with unique strengths and catering to different trading styles:

Forex Fury: Best for Unique Features and Versatility

This forex bot is known for its versatility and compatibility with both MT4 and MT5 platforms. It focuses on range-based trading during low-volatility periods and offers extensive customization options, allowing users to adjust risk levels and trading parameters.

Forex Fury claims a high success rate, supported by MyFXBook accounts (though independent verification is always recommended).

1000pip Climber System: Best for Algorithm and Copy Trading

This system functions as an automated signal provider, using a state-of-the-art algorithm to identify high-probability trading opportunities. It provides clear entry, stop-loss, and take-profit signals, designed for copy trading and mechanical execution to eliminate guesswork.

It generates alerts with visual trade details and supports MetaTrader 4 push notifications for mobile access.

Perceptrader AI: Best for Active Forex Traders

This platform leverages machine learning and expert advisors, combining short-term opportunistic strategies with a long-term approach. It offers customization for risk tolerance and settings, and features planned integrations with AI tools like Chat GPT and Google Bard.

Important Reminder: Thoroughly research and backtest any Forex robot before using real money. Look for independent reviews, verified performance data (Eg. MyFxBook), and consider starting with a demo account. The "best" robot is subjective and depends on individual preferences and risk tolerance. No even the best forex trading bot can guarantee profits.

EA Forex - Beware of Software Scams

The increasing popularity of ea forex has, unfortunately, created a fertile ground for unscrupulous individuals and outright scams. Be wary of:

- Unrealistic Profit Promises: No forex robot can guarantee profits. Any Forex bot promising ridiculously high returns is likely a scam.

- Lack of Transparency: Avoid providers who are secretive about their trading strategies or don't offer verified performance data.

- High-Pressure Sales Tactics: Legitimate providers won't pressure you into buying their product.

- Unregulated Forex Brokers: Only use trading robots with regulated and reputable Forex brokers.

Legitimate regulatory bodies offer resources to help verify the credibility of forex software providers. Both the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) maintain searchable databases and publish regular consumer alerts about suspicious Forex robot scams.

The CFTC's consumer protection section provides warnings about current scams, while the NFA's BASIC database allows you to verify if a company is properly registered.

How to Choose a Broker for Automated Trading

Selecting the right broker is an absolutely critical step for achieving success with auto forex trading. Consider the following key factors when making your decision:

Regulation and Licensing

Ensure that the broker is regulated and licensed by a reputable and recognized financial authority, such as the FCA (Financial Conduct Authority) in the UK, CySEC (Cyprus Securities and Exchange Commission), or ASIC (Australian Securities and Investments Commission).

For example, both Pepperstone and FP Markets are regulated by multiple top-tier authorities, including the FCA and ASIC, providing a strong level of security for traders.

Platform Compatibility

Verify that the broker's trading platform offers full support for automated trading and is fully compatible with the specific forex trading software you intend to utilize (e.g., MetaTrader 4 (MT4), MetaTrader 5 (MT5)). Many brokers now offer a dedicated trading app that also supports the use of EAs.

Competitive Spreads and Commissions

Low spreads and commissions are absolutely essential for maximizing your potential profits, particularly for high-frequency trading strategies where small price differences can significantly impact overall returns.

Responsive and Knowledgeable Customer Support

Choose a broker that provides responsive, knowledgeable, and readily available customer support to assist you with any technical issues or questions that may arise.

VPS (Virtual Private Server) Service

Some brokers offer a Virtual Private Server (VPS) service, which can be highly beneficial for ensuring the continuous and uninterrupted operation of your trading robot, even if your personal computer is offline.

By diligently considering these crucial factors and conducting thorough research, you can significantly increase your chances of success in the world of automated forex trading. Remember that even the best forex trading robot is not a magical solution that guarantees profits, and effective risk management remains absolutely paramount at all times.

The best forex EA is ultimately the one that aligns perfectly with your individual risk tolerance, trading style, and overall financial goals. Selecting the right tools and understanding the inherent risks are key to navigating this complex but potentially rewarding field.

If you're interested in putting automated forex trading strategies to the test, consider exploring reputable brokers like Pepperstone, FP Markets or Deriv. They offer the platforms, tools, and regulatory oversight needed to get started safely and effectively. Remember to start with a demo account to test your chosen robot or copy trading strategy before risking real capital.