The Trading Bible Blog Bitcoin Vs. Bitcoin Cash - What are the differences?

Bitcoin Vs. Bitcoin Cash - What are the differences?

By TheTradingBible.com, Updated on: Jan 07 2025.

Bitcoin cash is a decentralised cryptocurrency that originated from Bitcoin as the result of a disagreement between miners. The main difference between both is that Bitcoin cash has a larger block size which allows storing more data while increasing transaction speeds in the network.

Comparing Bitcoin and Bitcoin Cash

| Attribute | Bitcoin | Bitcoin Cash |

|---|---|---|

| Block size | 1.000.000 bytes (1 megabyte) | 32.000.000 bytes (32 megabytes) |

| Transactions per second | 7 | 120 |

| Block production time | 10 minutes | 10 minutes |

| Supply | 21.000.000 | 21.000.000 |

| Creation date | 3rd of January 2009 | 1st of August 2017 |

Table of Contents:

- Understanding Bitcoin and Bitcoin Cash

- What is Bitcoin?

- What’s wrong with Bitcoin?

- The solution: A hard fork - Enter Bitcoin Cash

- Bitcoin Vs Bitcoin Cash

- Price differences

- Block size differences

- Scalability

- Smart contracts capabilities

- Mining processes

- Conclusion

Understanding Bitcoin and Bitcoin Cash

If this is not the first time you hear or read about cryptocurrencies, it's almost 100% sure that you know Bitcoin, even superficially.

Bitcoin is the most famous cryptocurrency in the world, but we know that there are many other cryptocurrencies on the market, including one that was born from Bitcoin itself, Bitcoin Cash.

Yes, Bitcoin Cash was born out of a division in the Bitcoin community in response to certain problems inherent to the world's most popular cryptocurrency.

Now, many people usually ask themselves the following:

- What is the difference between these coins?

- Is one better than the other?

Well, today, we're going to try and clarify this in a simple way, these and other questions that many people usually have regarding these cryptocurrencies: their history, their fundamentals, their characteristics and their potential for the future.

After that, you'll be in a better position to decide whether to invest in them or not. Let's go!

What is Bitcoin?

Bitcoin (BTC) was the first decentralised virtual currency created in the world. It was invented in 2008 by a person or group of people under the pseudonym "Satoshi Nakamoto".

Bitcoin works like normal money, it's a digital currency with which you can buy or sell goods, services, etc.

Bitcoin was created using blockchain technology due to its security features that prevent tampering. In addition, it's a decentralized currency, that is, it's not owned, issued or controlled by any organization but rather by its whole network.

The best example to illustrate this is in the US dollar, which is issued by the US government and controlled by banks.

In this example, the centralized organization is made up of the government and banks, which leaves your dollars at the mercy of the infrastructure and monetary policies of these entities at all times.

This doesn't happen with Bitcoin; transactions on its blockchain are verified and authorized by the computers that maintain that blockchain, and behind these computers (nodes), there are many different people who don't even know each other!

This is what makes Bitcoin different from traditional money:

- Security: Uses cryptographic encryption techniques for transactions. Because of this, it can't be duplicated or either falsified.

- Decentralization: It's not controlled by any institution.

- There are no intermediaries: Transactions are made from person to person (P2P).

- Irreversible transactions: Once you make a payment, you can't cancel it.

- Privacy: It's not necessary to reveal your personal data to use it.

- Anti-inflation: The maximum number of BTC that can exist, is limited to 21 million.

Each Bitcoin is created in this network of computers that we call the blockchain, by means of a series of computer algorithms that are executed to solve certain mathematical problems. The computer that solves the problem first, wins a Bitcoin as prize. This is called mining.

All of the above means that with BTC, you are, at all times, the sole owner and responsible for your money.

Currently, many cryptocurrencies are trying to outperform Bitcoin, but none have even managed to come close to it. But even with all this, the digital currency is not without certain flaws. Let's see.

What’s wrong with Bitcoin?

From its birth, Bitcoin set out to represent an alternative to fiat money. The basic idea was that it could be used for the exchange of goods and services, while at the same time, avoiding some of the problems of traditional money, such as the unlimited printing.

BTC has contributed greatly to the creation of many cryptocurrencies with different characteristics, including some very popular today such as Ethereum (ETH) or Ripple (XRP).

Even with all of the above, throughout the life of BTC, there have been several problems that have had to be solved on the fly.

One of the main ones is scalability, or what is the same, the ability of BTC to grow as a solution, as the problems it must solve also grow.

At the beginning, the size of the BTC blocks was very small, being only 1 MB of memory — today it is 2 MB.

This results in "bottlenecks" when a certain number of transactions must be processed at the same time.

Here’s an example: When there is a large bridge where many vehicles circulate at the same time, this bridge can lead to a much smaller road whose access is controlled by a traffic light. The road has the capacity to allow only a certain number of vehicles to pass at the same time, while the traffic light will only turn green from time to time.

The consequence of this is that a large number of vehicles will accumulate behind, and these will have to wait longer and longer to pass.

This problem became very obvious between 2016 and 2017 when there was a big increase in the price of BTC and there were more and more people buying and selling BTC.

The small size of the blocks led to a significant increase in waiting times to process transactions, and this also increased excessively the value of the fees that users had to pay in order for their transactions to be processed faster.

This resulted in a group from the BTC community making the proposal to increase the block size to reduce waiting times.

This initially brought a lot of disagreements within the BTC community, however, a group within this community insisted and they managed to gather enough consensus to fix the issue, at least in part ...

The solution: A hard fork - Enter Bitcoin Cash

There are several Bitcoin forks, but none are as widely used or as well known as Bitcoin Cash.

A fork or split occurs when the original blockchain code — in this case BTC — receives an update, but only some nodes accept the update.

The original blockchain remains the same, but the nodes that accepted the update, separated from the original blockchain, forming a new chain that becomes independent.

So, those who are part of the new chain, continue keeping their coins, only that now they exist in the new blockchain.

This is how Bitcoin Cash was born!

Bitcoin Cash (BCH) is a cryptocurrency that, like Bitcoin, has its own blockchain. Because it was created from a BTC fork, it retains most of its features, but with some important improvements.

We can say that BTC and BCH are like mother and daughter, respectively. This means that, as it happens in real life, the daughter retains many of the characteristics of the mother by inheritance, but at the same time, the daughter will have her own physical and personality characteristics that will differentiate her from her mother. The same happens with these two digital currencies.

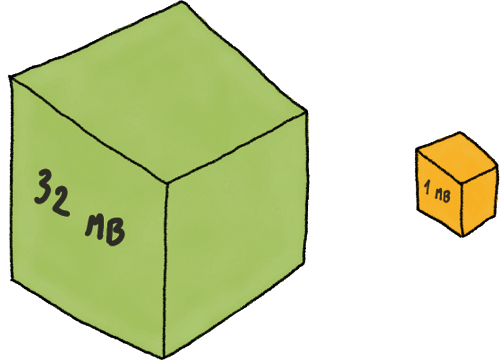

The most relevant change has to do with the size of each block, which went from 1 MB in BTC, to 8 MB in BCH, currently being 32 MB!

Only this feature provides a series of advantages in use compared to Bitcoin, mainly when sending and receiving money.

Everything is done faster and paying less too! For this reason, BCH is gaining more and more popularity among the crypto community.

Let's now go on to see in more detail the differences between Bitcoin and Bitcoin Cash.

Bitcoin Vs Bitcoin Cash

Price differences

At the beginning of its creation, Bitcoin Cash was quite successful in the market, so much so that after three weeks from its creation, its value was already around $1,000.

For quite some time, BCH remained the most valuable digital currency after Bitcoin, yet its mother has almost always led it in this regard — 5 to 10 times more. In fact, at the time of this writing, BTC is hovering around $50,000, while BCH is close to $600.

Many experts say that the main reason for this is because Bitcoin was the first #cryptocurrency in history, so it had more time to get a large number of followers. Most of the people who know anything about cryptocurrencies, know Bitcoin.

Take a look at Bitcoin’s historical price:

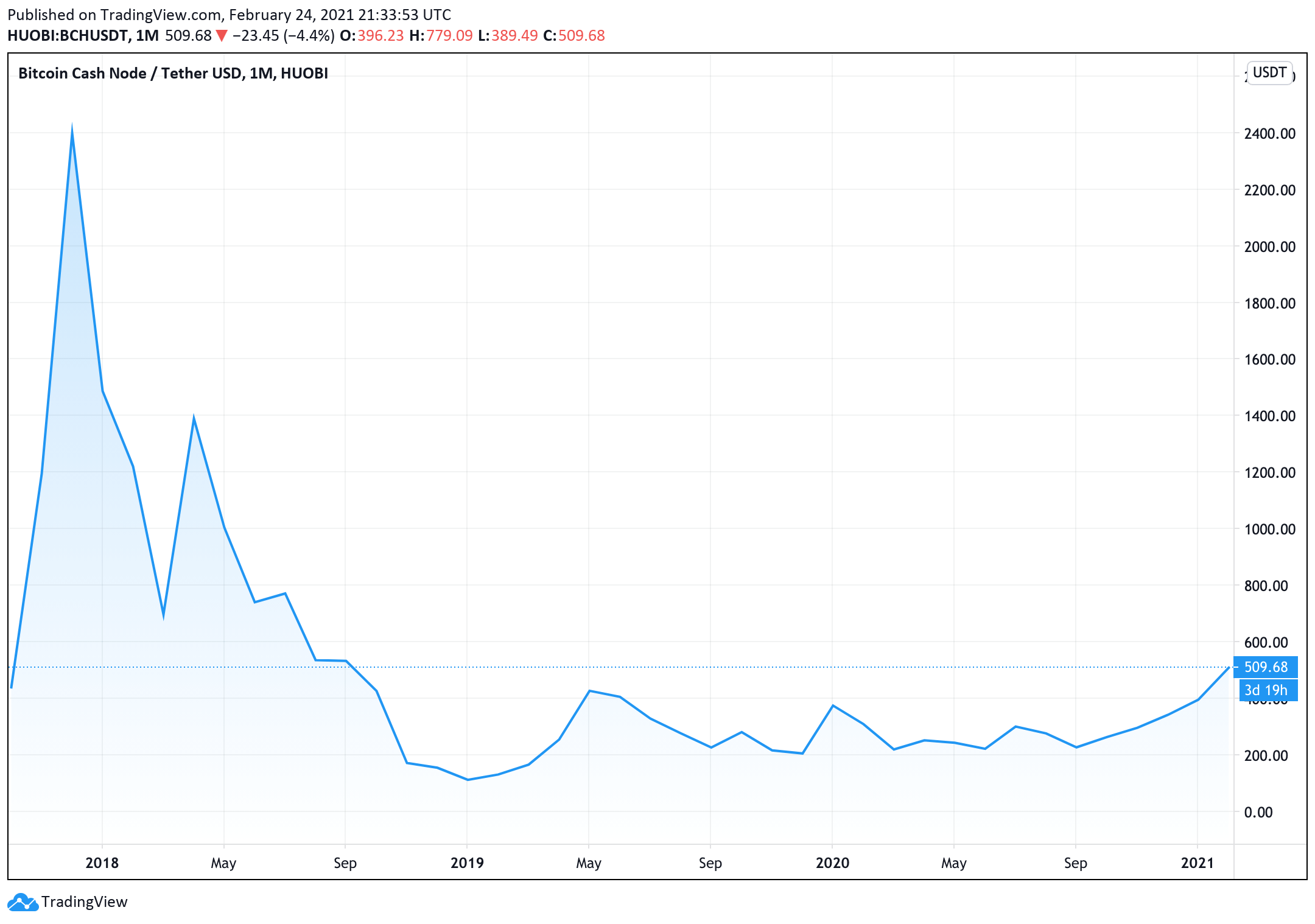

And now take a look at Bitcoin Cash’s historical price:

Block size differences

As we mentioned earlier, Bitcoin currently has a block size of 1 MB.

This makes transactions slower and more expensive, as the Bitcoin blockchain can't verify all of them quickly enough due to its small block size.

This was the main reason for the creation of BCH, for which a block size of 8 MB was added, in addition to having the possibility of increasing the block size if necessary.

So, at the end of 2017, the BCH block size was increased to 16 MB, and in 2018 to 32 MB.

Scalability

Each block of the Bitcoin blockchain can verify up to 7 transactions per second, however, this is insufficient today, due to the increasing use that Bitcoin is having.

Before making the hard fork that we know today as Bitcoin Cash, several solutions were tried without obtaining positive results, however, today, what has worked best is the simplest: increase the block size when necessary.

Because of this, Bitcoin Cash will never have a problem with scalability, but several experts say that increasing the block size that much, can also bring other security issues in the future.

Smart contracts capabilities

Although at the beginning, neither BTC nor BCH were designed to use smart contracts, today they have some — although with limited functionality — especially BCH. In fact, Bitcoin Cash allows all kinds of smart contracts.

The simplest definition of a smart contract is that it's a software that acts as a contract — like those on paper — and at the same time, as a regulator of compliance with it, all together automatically.

Here’s an example:

Let's suppose that Carl wants to buy John's house on credit. To do this, Carl wants to pay a certain amount of monthly installments. So they both decide to use some smart contract platform (like Ethereum), and schedule the contract on the terms they want.

Carl will pay a certain amount of money before a certain date each month, and if he doesn't, the lock on the house door will be locked automatically.

Now, by his part, John will transfer the title — already registered in the Ethereum blockchain — to Carl when he has finished paying the last installments.

In this way, the smart contract will act without the need for intermediaries, carrying out all the instructions to the letter, and no one can intervene.

Mining processes

Although the algorithm and security protocol are the same in both coins, as well as the required computing capacity and the reward obtained (12.5 coins), there is an important difference in terms of mining:

The difficulty of mining BTC changes for each new block since 2016, while in the case of BCH, this happens every 6 blocks.

In the case of BCH, this has the advantage that the computers used for mining can receive new charges more easily, in addition to allowing the equipment to be used for a longer time.

Conclusion

Currently, there are divided opinions regarding the use of these two cryptocurrencies: there are those who prefer BCH because it's much faster and cheaper to carry out transactions.

While Bitcoin supporters say that it'll continue dominating the market for a long time and increasing in value.

In particular, we believe there is room for both currencies. Bitcoin will certainly continue to be used, but mainly as a store of value — in fact, it already almost surpasses gold in this sense.

On the other hand, Bitcoin Cash will continue to be a much more comfortable and practical way to carry out transactions on the network. Although its value could skyrocket at any moment, just as it happened with BTC.

Whatever the case, the important thing is that now, you are in a better position to make a decision about what is best for you.

Happy trading!