The Trading Bible Questions ᑕ❶ᑐ Crypto vs Stocks - Is Cryptocurrency Safer than Stocks?

Is cryptocurrency safer than stocks?

By Stefano Treviso, Updated on: Apr 22 2025.

When compared to cryptocurrencies, stocks have much less price volatility and rely on the presence of stronger regulatory frameworks which of course makes them a safer investment.

Before you make up your mind, we have a few interesting thoughts to share about both asset classes that can make you understand the pros and cons of each, so read on!

Watchdogs

Listing stocks on an exchange is not an easy process at all, a company can’t just go and list their stock on the New York Stock Exchange (NYSE) whenever they want, they need to meet some requirements such as:

- Having at least 400 shareholders who own more than 100 shares of stock

- Have a market value of at least $40 million

- Minimum stock price of $4

- Have at least 1.1 million shares of publicly traded stock

And these are just the beginning, there are profitability requirements and many more to consider before the NYSE decides whether to accept a particular stock or not.

In the cryptocurrency space, anyone (even you or me) can simply access the ethereum network, create a token with a few hundred dollars, run an initial coin offering (ICO) and then proceed to list it on a small centralised exchange with poor entry requirements or even list it in a decentralized exchange with no requirements at all (this only applies in the tokens space, when it comes to creating a layer 1 cryptocurrency such as Bitcoin or Monero, it’s more complicated as it requires a community, an ecosystem and adoption amongst other things yet it’s still possible for any skilled group of developers to accomplish it without much regulatory hassle).

Having said this, now we understand that it’s not so easy to find a scam company on the NYSE whereas in the cryptocurrency space, anyone with an internet connection can set up a “shiny” looking crypto project and disappear with all the money.

This doesn’t mean that all cryptocurrencies are unsafe, it means that there is no regulatory framework protecting investors and that caution, experience and attention to detail are required when analysing cryptocurrency projects or coins to invest in whereas in stocks, there is a big layer of safety thanks to financial regulators such as the SEC.

Featured Brokers for Beginners

| Broker | Top Features |

|---|---|

| |

| |

|

Price volatility

Cryptocurrency has blown out of the water the concept of “price swings” by showing us percentage gains or losses in the range of hundreds of thousands of points over a couple of months, see an example below:

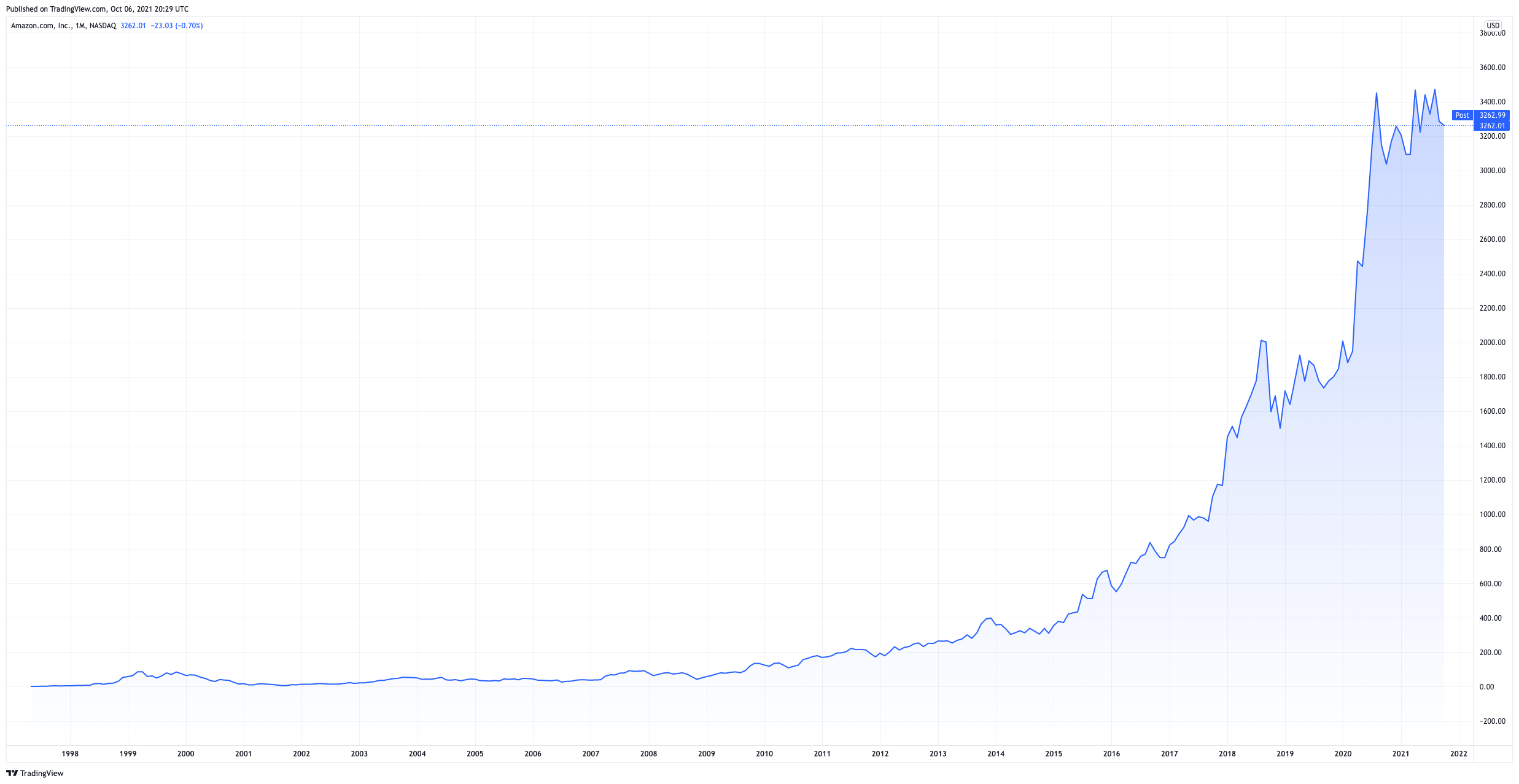

Amazon’s initial public offering happened on the year 1998 and since then their shares appreciated around 188,455.49%, here’s how that looks:

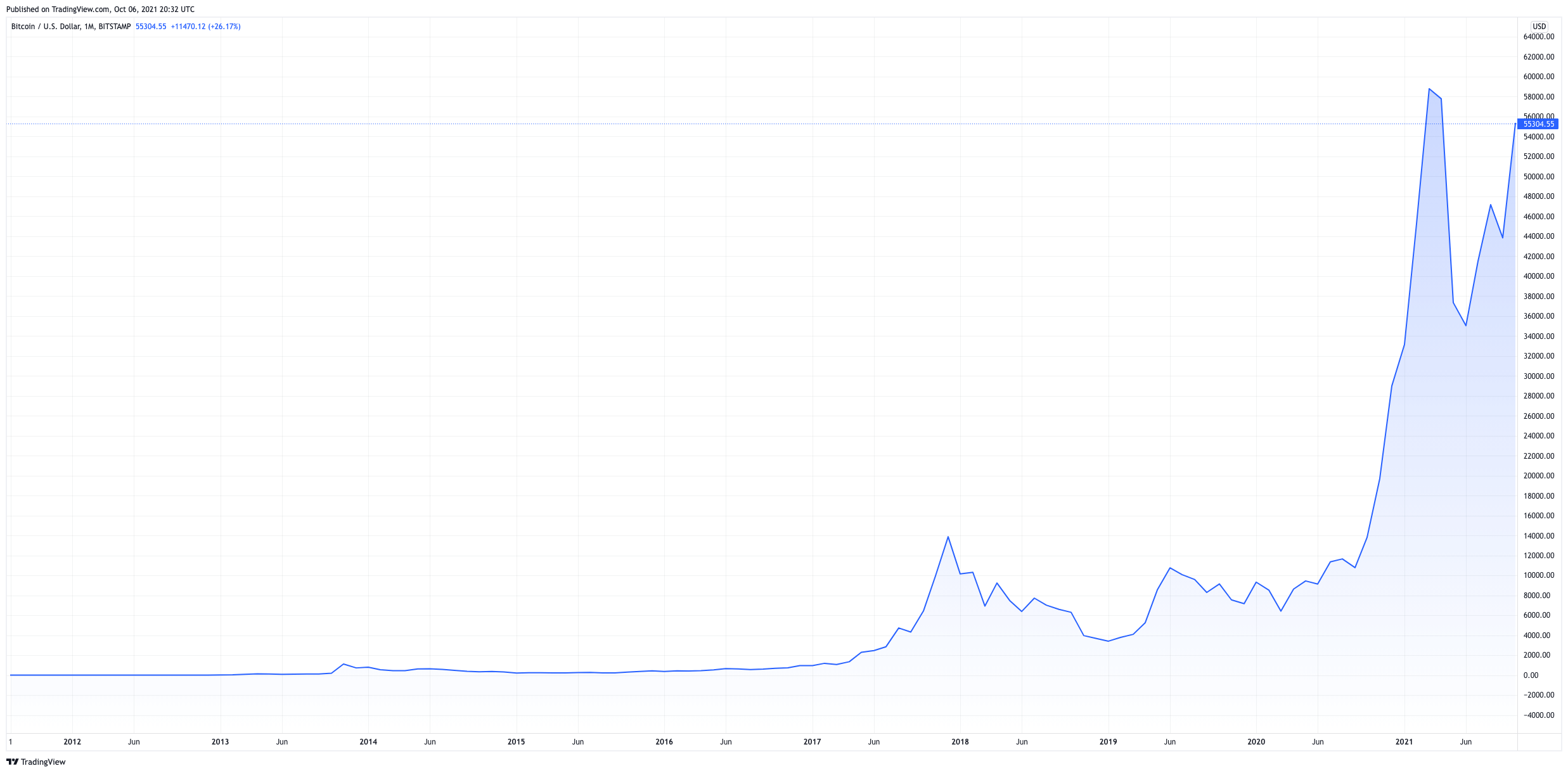

Bitcoin has been around since 2009, but to make our case we’ve decided to take into consideration the approximate price posted by the cryptocurrency exchange BitStamp in 2012 which was around $5 and since then, Bitcoin has appreciated around 1,040,000 %. Here’s how that looks:

Something interesting to note is that during all these times, Bitcoin had several crashes where sometimes it even lost more than 80% of its value whereas a stock like Amazon hasn’t lost more than 25% of its value even during adverse market conditions.

Cryptocurrencies are clearly more volatile than stocks (excluding penny stocks which are an extremely high risk) and they offer unique opportunities for face-melting profits or eye-watering losses which are completely outside the reality of the stock market.

In conclusion, stocks are safer than cryptocurrencies thanks to strong regulatory frameworks and reduced price volatility as long as penny stocks are not being taken into consideration.