The Trading Bible Blog How COVID-19 Affected the Financial Markets

How COVID-19 Affected the Financial Markets

By Stefano Treviso, Updated on: Sep 09 2023.

COVID-19 (Coronavirus) has disrupted the global economy in ways we never even thought possible. Hundreds of thousands of people lost jobs, others made more money than ever and the stock market made a huge drop with a massive recovery.

From the outside perspective of a normal person, this doesn’t make any sense at all, but for a trader, all the dots are connected.

The purpose of this post is to walk you through a few of the things that happened from a trading perspective and how you can take advantage if they happen again in the future.

If you’re a trader, you probably think like this, but if you’re not this is how I want you to learn how to think:

- We don’t care personally about the consequences of any event

- We don’t get emotional about anything

- We only care if it’s tradable or not, it’s not our job to have feelings, traders are not well-known for their soft compassionate hearts.

- If a pandemic erases half the world, the only thing you need to care about is how to make money from that, leave the feelings to someone else.

When the world goes through a disgraceful event such as COVID, terrorist attacks or anything else you can think of, there are lots of trading opportunities and that’s all you need to care about.

Before it even became a thing - December 2019 to January 2020

I remember back in January 2020 the article I read on the main page of Bloomberg about the Chinese Lunar New Year.

The article said that more than 3 billion people would move all over the world for this and they called it the largest human migration in history.

For those of you that don’t know me personally, let me say it like this: I am a paranoid person. Paranoia is what kept me alive all these years, a never-ending feeling of stress about the future, the need to prepare always for the worst while expecting the best.

You don’t get very far in life if you’re born in Venezuela and you don’t learn to be overcautious.

Back to the subject, when I read the headline, the first thought that came into my head is:

- This is the perfect moment for something horrible to happen, especially a biological weapon to be released. A large concentration of people equals a potentially big problem.

Think about it, if you ever played that game called “Plague” for IOS or Android where your objective is to kill the world with a virus, you always deploy first in China, it’s the perfect place to start a pandemic.

Regardless of this being something impossible to prove, for me, COVID-19 will always be remembered as a Bio Weapon, the start date combined with the largest human migration in history can't be a coincidence.

During this period, very little news were released. It wasn’t until the end of January and February when the media kicked off and the panic started.

How does COVID-19 affect businesses?

Between February and March the whole world became consumed by panic. Lockdowns started, businesses shut down their doors and the nightmare became official.

Some countries stayed on really long lockdowns, others reopened in the summer while hiding their COVID numbers to make some money from tourism in order to go into lockdown again after the summer season.

In order for businesses to make money, they need a few things:

- Demand (people wanting to buy whatever they sell)

- Supply (people that sell them or give them whatever they need to make their products)

- Freedom of movement, transacting or anything required for the above conditions to happen (if a supplier can’t dispatch you your raw materials, you can’t bake your cookies).

And leave aside for a second whether the business is good or not, competitors, etc. We’re talking about the most basic business requirements right now.

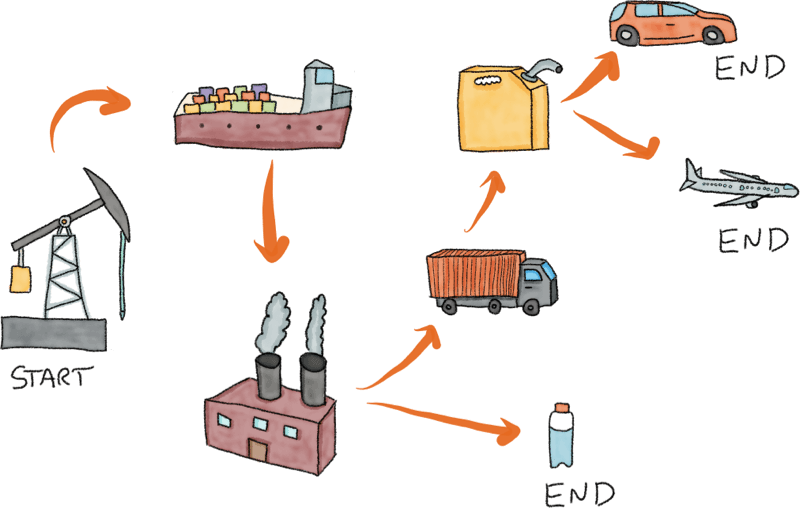

Before we begin with a clear explanation, the most important thing we need you to understand is that everything is connected, if a part of the chain fails, we all fail. Look at the image below:

Look at all the different people involved in oil:

- The oil rig company

- The sea shipping business

- The processing plant

- Trucking companies

- Gas stations

- Airlines

- And much more

What happens when one of them fails? It has an effect on all of them, and this is something you can see in our COVID trail of events.

Let’s look at how closing down all restaurants affected the whole economy:

- All restaurants are closed due to lockdown

- Chefs, waiters, baristas, all of them are fired

- The restaurant owner defaults (can’t pay) on his bank loan he took last year.

- All the restaurant employees sign up for unemployment benefits (social insurance systems become overloaded, maybe they have money, maybe the don’t)

- Employees are not consuming and spending anymore, only their basic needs.

- This means that if the restaurant owner or any of his employees were planning to book travel for a holiday, buy a new computer, new car, now they wouldn't

- If no one books a holiday ticket, travel agencies go bust. If no one buys new computer, computer makers go bust and so on

- Now the computer maker or the travel agency doesn’t make enough money, they have to fire so many employees (because they hired expecting high business volume, now they don’t have it)

- Now the computer maker, travel agency and all of them default on their loans

- A bank goes bust if enough people default on loans and the government doesn’t bail them

You get the picture right? It's dominoes. A never-ending chain reaction.

Now, why do we care? Asides how it affects us personally it also affects each one of the companies being traded on the stock market.

If these companies are not making money, investors dump their stocks, prices of shares go down.

See where we’re going?

Trading opportunity - The S&P500 and COVID-19

Instead of focusing ourselves on individual businesses, let’s talk big.

The S&P500 is the largest index in the U.S stock market accounting for almost 80% of the stock market’s value.

It’s an average measure of the largest 500 publicly traded companies in the U.S.

When you want to take a look at the U.S economy’s health, taking a look at the S&P500 is a good start, so here we go:

You might be wondering, how come if on February we were barely starting lockdowns the S&P500 was crashing already?

Because traders make money by anticipating things, not by jumping on them after they happened.

And why did they anticipate this? Well, because they knew the chain reaction that the virus could trigger, they understood how businesses operate and how this could harm them.

Now you know, during crisis times you have the opportunity to bet in favour or against certain assets such as stocks or indices, all you need to do is understand if what’s happening to them right now is positive or not.

Trading opportunity - The VIX and COVID-19

The second trading opportunity I’d like to show you is the VIX (Chicago Board Options Exchange's CBOE Volatility Index).

The VIX is an asset designed to measure the stock’s market expected volatility and it does so by basing itself on the S&P500 options. This post is not a detailed guide on the VIX, S&P500 or options, so we’re not gonna go into too much details about the financial instruments themselves or how to calculate them, what you really care about is:

- When s*** hits the fan or it's about to hit the fan, the VIX’s price shoots up.

- After the mayhem and chaos passes, the VIX stabilises.

Think of the VIX as the volatility measure, the financial chaos tracker.

Here’s a chart of the VIX (notice how in March 2020 we got close to the same levels of October 2008 when the financial crisis happened).

If we look at the VIX during the year 2020, you can see exactly when the climb started:

To make things even more interesting, go back and look at the S&P500 for the year 2020. Notice how when the S&P500 began its fall, the VIX began to climb. That’s why traders use the VIX as insurance in case the S&P500 blows up.

Now you know that there’s this financial instrument called the VIX which you can play with during uncertainty and crisis times.

What happened after?

Even though the stock market took a massive hit, somehow it recovered and reached all time highs.

If you understand how stock prices are determined, you can be sure of something:

- It doesn’t matter how much something is really worth, it matters how much we think it’s worth.

If we all wake up tomorrow and decide to buy AAPL shares with all our life savings, the prices will shoot up.

The market crash we experienced combined with trading apps that allowed a lot of newbies with lots of cash and no knowledge of trading, resulted in a distorted reality.

Everyone saw stocks cheap and just went nuts and started a never-ending buying streak, regardless if it made sense to buy or not.

Digital businesses thrived, pharmaceuticals, companies like Amazon, Apple, all of that is understandable, but still, that rush is not to last if the world goes into a dark era where everyone is out of jobs and no one can afford anything.

At this point is very unclear what will happen next, here’s my guess:

- If vaccines work and everyone is safe, the world’s economy will boom and it's party time.

- If vaccines don’t work correctly and we keep drowning in lockdowns, many banks will start collapsing with a ton of defaulted loans and no government will be able to save them, dark times will be ahead even if the vaccine comes, a lot will be lost.

Until we’re not fully able to restart the world’s engine and operate at full capacity, we are in very uncertain times.

Don’t bother if you see the S&P500 rising to the sky, wait for everyone to be vaccinated and the war to be over in order to celebrate.

The stock market can produce a distorted vision of reality due to the fact that it doesn't matter how much something is really worth but rather how much people think its worth.

Conclusion

There are hundreds of opportunities during crisis times:

- Betting against companies that are affected or will be affected by the virus

- Betting against Indices

- Going long on volatility based instruments like the VIX

- Going against the VIX once crisis time’s have passed

- Going long on companies that find solutions to the crisis (Vaccine makers, face masks producers)

- Going long on companies that thrive during the crisis (Netflix, Amazon, etc).

For this all you need to do is have a business mind, every day some business opportunity is born in the most stupid way possible you can imagine, here’s an example:

- Governments announce that you require a special health card made of plastic and purple colour in order to travel

- The first thing that should come to your mind is: Who’s making that card? Are they a publicly traded company?

- If they’re not, then, what about who’s shipping the card, what if they announce that only DHL will be shipping that card worldwide?

- Then we know that DHL is a tradable company and they’re going to make a lot of money from this.

I hope this example made everything clear. There are a lot of opportunities out there, all we need to do is listen and analyse.

Good luck and stay healthy.