The Trading Bible Blog Is Trading Gambling? - How to approach it the right way

Is Trading Gambling? - How to approach it the right way

By Stefano Treviso, Updated on: Apr 07 2023.

There are strong similarities between trading and gambling yet trading is not like gambling at all (assuming you believe that gambling is only about unmeasured risks) as there are many ways to control the risk and commitment in any trade. To understand how to avoid trading like a gambler the most important discipline to learn is risk management.

Why do some people consider trading gambling?

We all know that when someone says the word “gambling” automatically the first thing that comes to your mind is “Las Vegas” along with blackjack tables and nice hotels.

We tend to associate gambling with completely reckless behaviour where people don’t measure risks and just take crazy actions hoping for the best.

So in order to be on the same page let’s take a look at what gambling really means:

Gambling: the wagering of money or something of value on an event with an uncertain outcome, with the primary intent of winning money or material goods. Gambling thus requires three elements to be present: consideration, risk, and a prize.

As you can see, Trading in fact is very similar to the proper definition of gambling, because no one ever said that gambling involved doing crazy irrational stuff.

When you place a trade you’re considering the potential outcome of it (the profit or loss that can come from it) and you’re measuring the risk that you’re willing to take.

Now, not all casino games are the same, for example:

Roulette: You place bets on numbers and you’re fully committed on either losing all you placed or winning up to 38 times your investment.

Blackjack: You place bets and you’re fully committed during the blackjack hand and your profit potential is usually capped to the size of your investment plus half.

Poker: You bet only if you like your cards and progressively as you measure the risk reward involved against other opponents, this is the one that comes closer to trading than any other game.

Bottom line, remember, being a gambler is not the same as being a degenerate gambler addicted to risk that does crazy stuff.

So in the end we can say that trading and the action of gambling itself are quite similar.

Featured Brokers for Beginners

| Broker | Top Features |

|---|---|

| |

| |

|

Who are you, the trader or the crazy gambler?

Getting to know yourself as a trader should be one of your top priorities, that way you know in which areas you need to improve. Ask yourself the following questions:

- When you lose money trading do you keep opening bigger positions and doubling down to make back what you lost?

- Do you usually open big positions where the margin requirement is more than 50% of your account?

- Do you usually avoid using stop-loss orders on your trades in order to hope for a reversal in your direction if you went wrong?

- Do you usually open positions without much research and just by looking at a chart and saying: Looks like it's going up?

If the answers are yes to one or more of these questions then you’re likely going on wild gambler mode.

Don’t worry, even if you’re in Las Vegas rush mode we can still give you a few pointers that will help you go in the right direction, take a look:

Trading with Risk Management, goodbye to wild gambling.

Risk is the chance of something going wrong (in this case, one of your trades becomes a loser).

Risk Management is all about controlling and mitigating the risk involved in trading to ensure that you make the best out of your trading capital and increase your chances of becoming profitable.

Here are a few tips to help you get started on risk management:

1 - Calculate how many times you can afford to be wrong

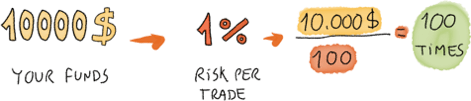

Your main objective is to be able to trade as long as possible without going broke, for that you need to calculate how many times you can go wrong in your trading to understand how strong is your capital against your strategy.

The more times you can afford to go wrong with your capital, the better off you are. It makes no sense if you have 10.000$ to risk them all in a single trade and then if you lose you’re out of the game, you want to be able to afford losing as many times as possible.

If you’re wondering why, here’s an interesting way to look at it:

If you flip a coin two times, the odds of it landing on the same side 2 times in a row are pretty big, it's very likely that can happen, but the odds of it landing on the same side 1000 times in a row are extremely low.

So when you’re trading, the more trades you can afford, the more you’re improving your chances.

That’s why good traders set a risk percentage per trade and use stop losses to limit their trades to their pre-set plan.

2 - Anticipate the asset’s movement and make sure you’re always risking to lose less than what you’re willing to profit.

If you see that a particular asset like oil moves every day 1$, you know that if you purchase 50 barrels of oil you’re risking to either lose or profit 50$ in a single day, so the question is: Does this match your risk management plan?

If it does match your risk management plan, then the question is, are you opening a trade where your reward (potential profit) can be higher than your risk (potential loss)?

If the answer is yes, then you’re on a good path, if the answer is no, then your risk management strategy is likely to end up in big losses long term.

A lot of traders quickly rush to open a trade with a huge downside risk and also as soon as they see a 1$ profit they run and close it.

Eventually they end up losing everything as the risk/reward ratio was not favourable.

Conclusion

When you understand the definition of gambling then trading clearly shares a lot of similarities with it. As long as we’re not talking about wild crazy gambling then we’re usually on the same page.

The financial markets can be unpredictable a lot of times so the only way to stay in the game is by practising risk management and ensuring 3 things:

- Know how many times can you afford to be wrong

- Risk less than what you’re willing to profit.

- Have a defined plan and stick to it.

Good luck!