The Trading Bible Blog ᑕ❶ᑐ Bitcoin Halving 101: History, Dates, Peaks, Charts

What Is BTC Halving

By Stelian Olar, Updated on: Oct 19 2025.

The Bitcoin halving is a major, pre-set event in the cryptocurrency space. It greatly changes the supply of the world's first digital asset. This event happens about every four years. Investors, Bitcoin miners, and market watchers all pay close attention to it.

It's very important to understand what is BTC halving and what it means. This knowledge helps anyone involved with Bitcoin. The halving's effects impact the Bitcoin network. They also influence price movements and how mining works. This Bitcoin halving explained guide delves into the core aspects of this pivotal occurrence.

What Happens when Bitcoin Halves

At its essence, the Bitcoin halving refers to the systematic reduction of the reward Bitcoin miners receive for successfully validating transactions and adding a new block to the Bitcoin blockchain. This reduction is by 50% and is hard-coded into the Bitcoin protocol to occur after every 210,000 blocks are mined. Given that a new block is added roughly every 10 minutes, this interval translates to approximately four years. The immediate consequence of a halving is a decrease in the rate at which new Bitcoins are introduced into circulation.

When a halving occurred, such as the one on April 20 2024, the reward for mining a new block dropped from 6.25 BTC to 3.125 BTC. This reduction in the issuance of new coins is fundamental to Bitcoin's design as a deflationary currency. By slowing down the creation of new supply, the halving aims to mimic the scarcity of precious metals like gold, thereby potentially increasing Bitcoin's value over the long term, assuming demand remains stable or grows. It is critical to understand what is Bitcoin halving mean for the ecosystem: it's a supply-side shock deliberately engineered into the system.

Is Bitcoin going to split?

Many ask is Bitcoin going to split?

The answer is No, because it's a Bitcoin network rule, not a fork.

A "split" in cryptocurrency terms usually refers to a hard fork, where the blockchain diverges into two separate chains, potentially creating a new coin.

Regarding how long does Bitcoin halving last?

The event is instant, though its economic effects are long-term.

Bitcoin Halving History

The Bitcoin halving history provides a fascinating look into the evolution of the digital asset and its market responses. Each of the halving events has been a significant milestone, shaping the narrative and the economic landscape of Bitcoin.

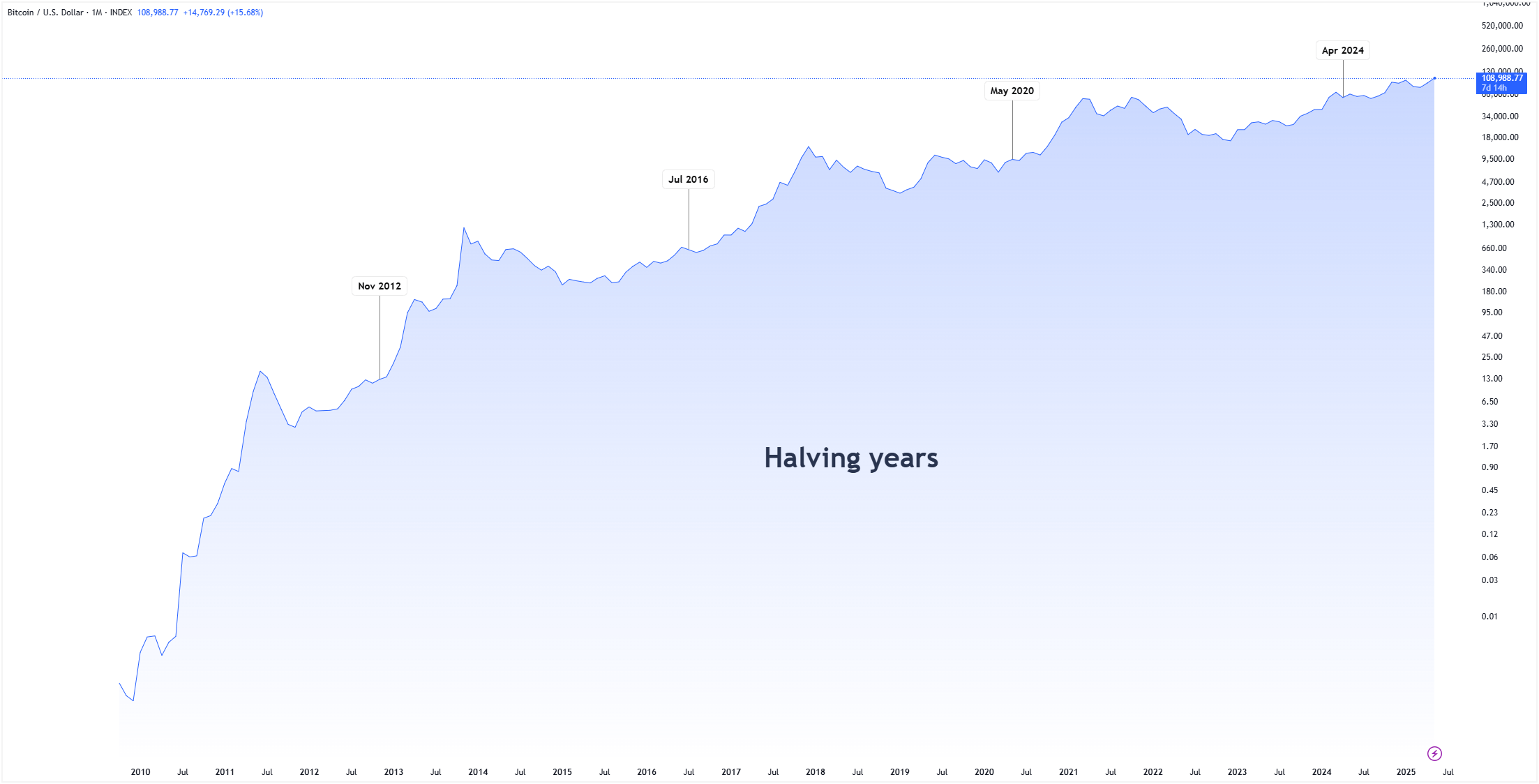

The inaugural halving took place on November 28, 2012. At this point, the block reward was slashed from 50 BTC to 25 Bitcoins. The market was still nascent, but this event set the precedent for Bitcoin's supply schedule.

The second halving occurred on July 9, 2016, reducing the block reward further from 25 BTC to 12.5 BTC. The third halving, and the one prior to the most recent, was on May 11, 2020 which event saw the block reward fall from 12.5 BTC to 6.25 BTC.

The last Bitcoin halving date was April 20 2024 (sometimes cited as April 19th depending on time zone and exact block discovery), which brought the block reward down to 3.125 BTC. Each of these BTC halving dates answers the historical question of "What Day Is the Bitcoin Halving?" for those specific cycles, each tied to reaching its 210,000 blocks milestone.

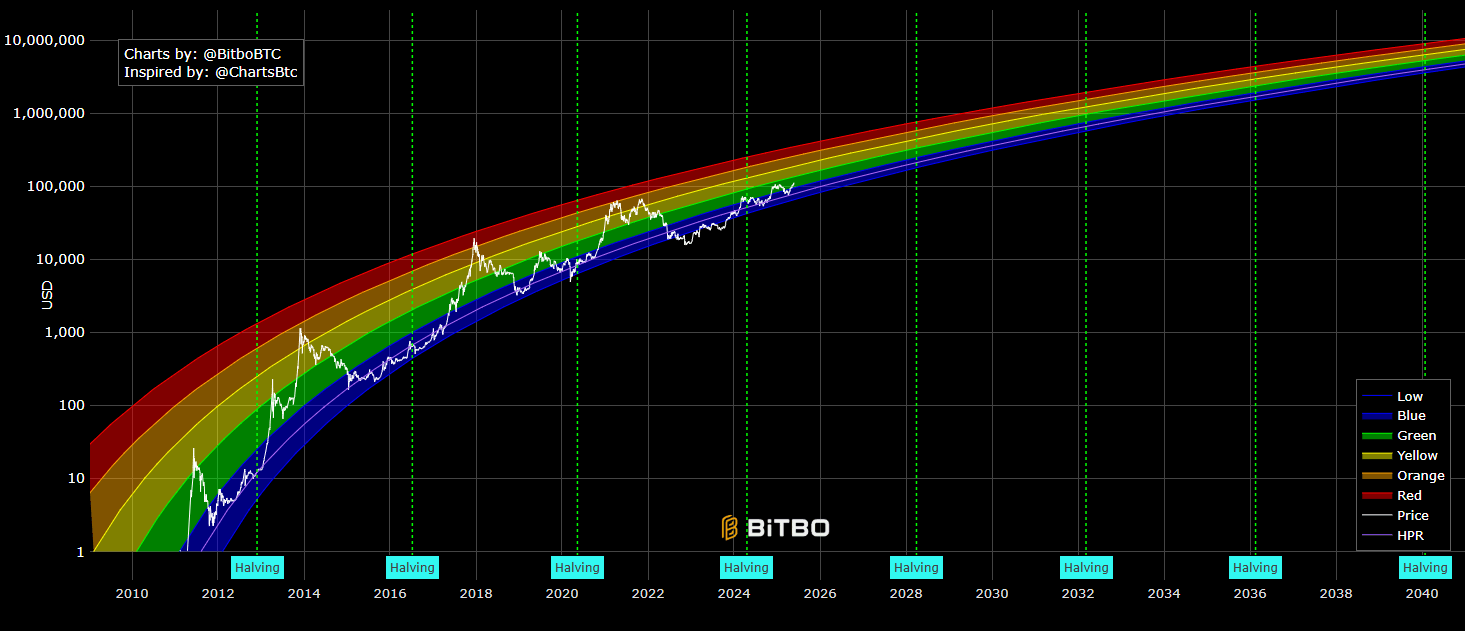

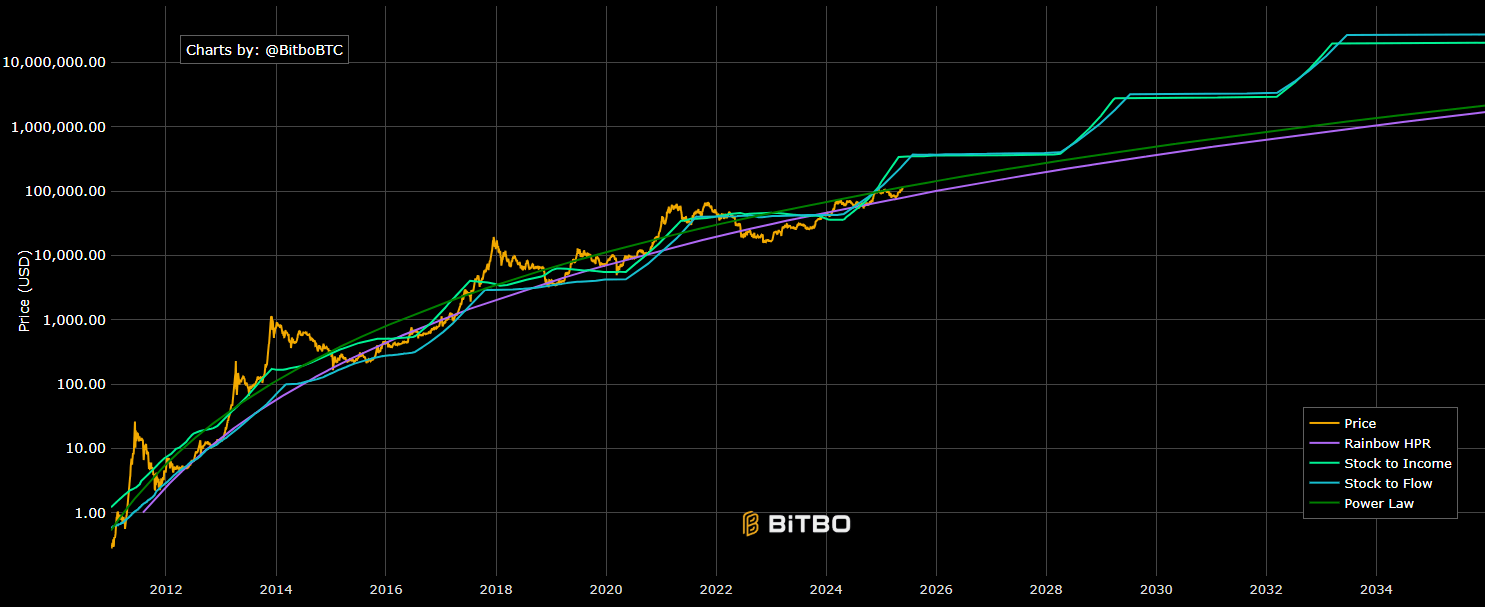

Analyzing a Bitcoin halving history chart or a dedicated Bitcoin halving chart often reveals interesting patterns in Bitcoin price around these events. Historically, Bitcoin halving cycles often lead to upward price movements, despite volatility. Bitcoins last halving now contributes to this historical data, informing expectations for the next BTC halving date, anticipated around early 2028.

The question of when does Bitcoin halve is answered by this roughly four-year schedule, tied to block generation.

Bitcoin Halving Price Prediction

Making a Bitcoin halving price prediction is a complex endeavor, inherently speculative yet deeply rooted in the economic principles of supply and demand. The core argument for a positive Bitcoin halving effect on price hinges on the reduction in the new supply of bitcoins. If demand for Bitcoin remains constant or, more crucially, increases while the rate of new supply entering the market is halved, basic economics suggests an upward pressure on the BTC price.

Historically, bitcoin price after halving events has shown a tendency to appreciate, often leading to new all-time highs in the subsequent months or year. However, it's crucial to approach such predictions with caution. The market is influenced by a multitude of factors beyond the halving, including macroeconomic trends, regulatory developments, technological advancements, and overall investor sentiment. What does bitcoin halving mean for price is not a simple equation; it's a significant variable in a larger market dynamic. The halving Bitcoin price theories often focus on this supply squeeze, but external factors can amplify or dampen its effect.

Will Halving Increase Bitcoin Price?

The central question is will halving increase Bitcoin price. The main reason for a potential price increase is less new supply. Each halving makes newly mined Bitcoin harder to get. If demand stays strong because people see Bitcoin as "digital gold," the lower supply can cause a shock that may push price movements upwards.

Conversely, market efficiency could mean the halving is already "priced in." If so, a price surge might happen pre-halving. Still, past price increases and the idea of growing scarcity often make investors feel optimistic.

While the Bitcoin halving is specific to its Proof-of-Work, market sentiment can spill over. However, events like a Bitcoin halving Shiba Inu are not directly comparable, as Shiba Inu and other altcoins have different tokenomics and don't undergo halving. Their primary impact is indirect, driven by Bitcoin-led market sentiment.

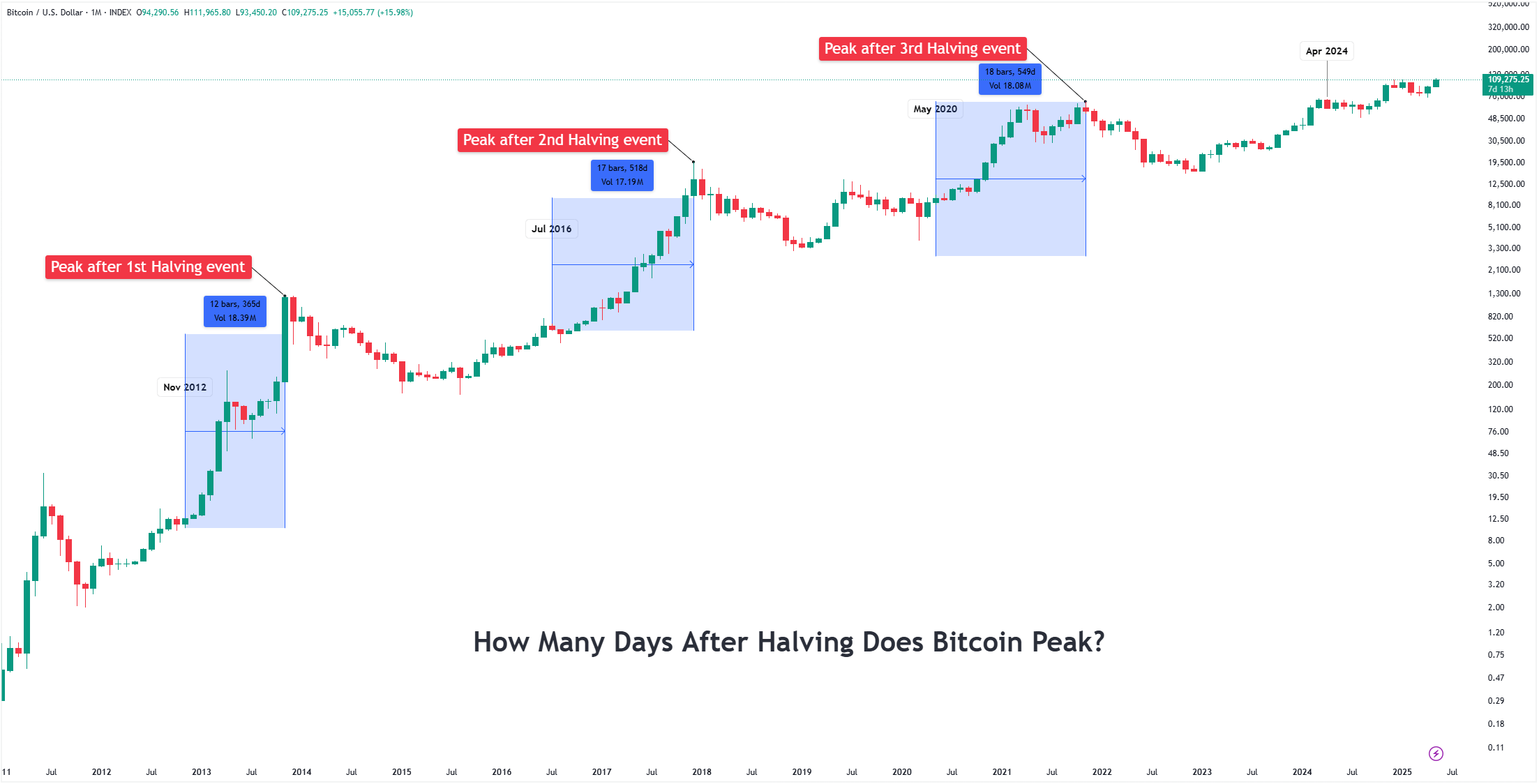

How Many Days After Halving Does Bitcoin Peak?

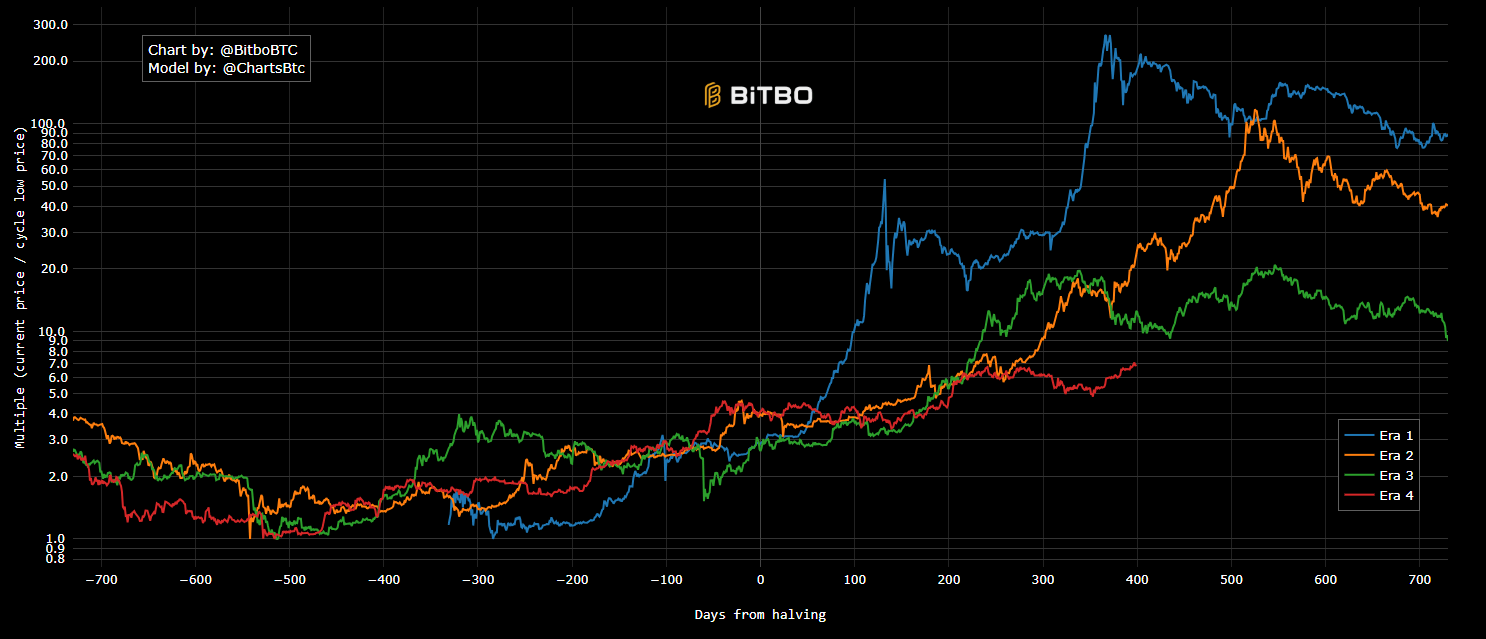

Analyzing how many days after halving does Bitcoin peak involves looking at past Bitcoin halving cycles. There isn't a fixed, predictable number of days. History shows considerable variation:

- After the 2012 halving, Bitcoin peaked approximately 367 days later.

- After the 2016 halving, the peak occurred around 527 days later.

- After the 2020 halving, Bitcoin reached its all-time high roughly 548 days later.

On average, the Bitcoin halving peaks have historically occurred between 12 to 18 months post-halving. This means the full effect of less supply isn't instant. Instead, it builds up over time. A new market peak often happens much later in the next year. Because of this, some might expect the peak from the April 2024 halving to occur around Bitcoin halving 2025.

Is It Better to Buy Bitcoin Before or After Halving?

The question of whether to buy bitcoin before or after halving is a common one for investors trying to time the market. There are arguments for both:

- Buying Before: Some think buying before the halving helps investors get ready for a likely price increase. Historically, there has often been a run-up in price leading into the halving.

- Buying After: Others like to wait until after the halving. They want to see how the market reacts right away. This can help them possibly avoid quick price swings if people "sell the news." This approach might miss the initial surge but could offer a clearer picture of the post-halving trend.

In the end, whether to buy or sell relies on your own comfort with risk, your long-term investment strategy, and how you see the market. One strategy is Dollar-Cost Averaging (DCA). This means investing a set amount of money regularly, no matter the price. DCA can be a less stressful way to handle the price swings during the halving.

When Will Bitcoin Mining End

Bitcoin halving is intrinsically linked to its finite 21 million bitcoins supply, ensuring this cap is approached predictably. New coin issuance from Bitcoin mining effectively ends around 2140 when block rewards diminish.

However, the Bitcoin network will keep going. After block rewards end, Bitcoin miners will mainly earn money from transaction fees. Many believe these fees will be enough to keep them working.

Many more halving events (around 32 in total, addressing how many Bitcoin halvings will there be) will precede this. Each event, like the one on April 20 2024, moves us closer to reliance on transaction fees. So, when will bitcoin mining end for new BTC? It will be around 2140. The question of when will bitcoin halve will stay important for many years to come.

Understanding the dynamics of the Bitcoin Halving is key, but having the right platform to act on these insights is crucial. These recommended Forex brokers provide access to trade Bitcoin (BTC) and a variety of other digital assets: Pepperstone, FP Markets, and Deriv.