The Trading Bible Blog ᑕ❶ᑐ AI Crypto Trading: How To Use AI to Buy and Sell Crypto

AI Crypto Trading Basics

By Stelian Olar, Updated on: Jul 10 2025.

The intersection of artificial intelligence (AI) and cryptocurrency trading is rapidly reshaping how investors approach the volatile crypto markets. Gone are the days when trading was solely based on gut feelings or simple technical indicators.

Today, AI for crypto trading offers sophisticated tools and techniques to analyze vast amounts of data, identify complex patterns, and execute trades with speed and precision previously unimaginable. While the allure of AI crypto trading is undeniable, building high-performing trading strategies using AI isn't just about plugging in a bot; it requires understanding the technology, the data, the risks, and the tools available.

It's not merely about flipping a switch; it's about leveraging artificial intelligence cryptocurrency trading tools strategically. This article aims to demystify how you can use AI to buy and sell crypto, explore the role of specialized bots, weigh the pros and cons, and highlight some of the best AI crypto trading bots available today.

How To Use AI to Buy and Sell Crypto

Using AI to buy and sell crypto isn't about handing over control to a magical black box. Instead, it involves employing sophisticated systems powered by artificial intelligence to analyze the crypto markets and execute trades based on predefined parameters or predictive models. At its core, AI for trading crypto leverages machine learning algorithms to sift through immense datasets far faster and more comprehensively than any human trader could.

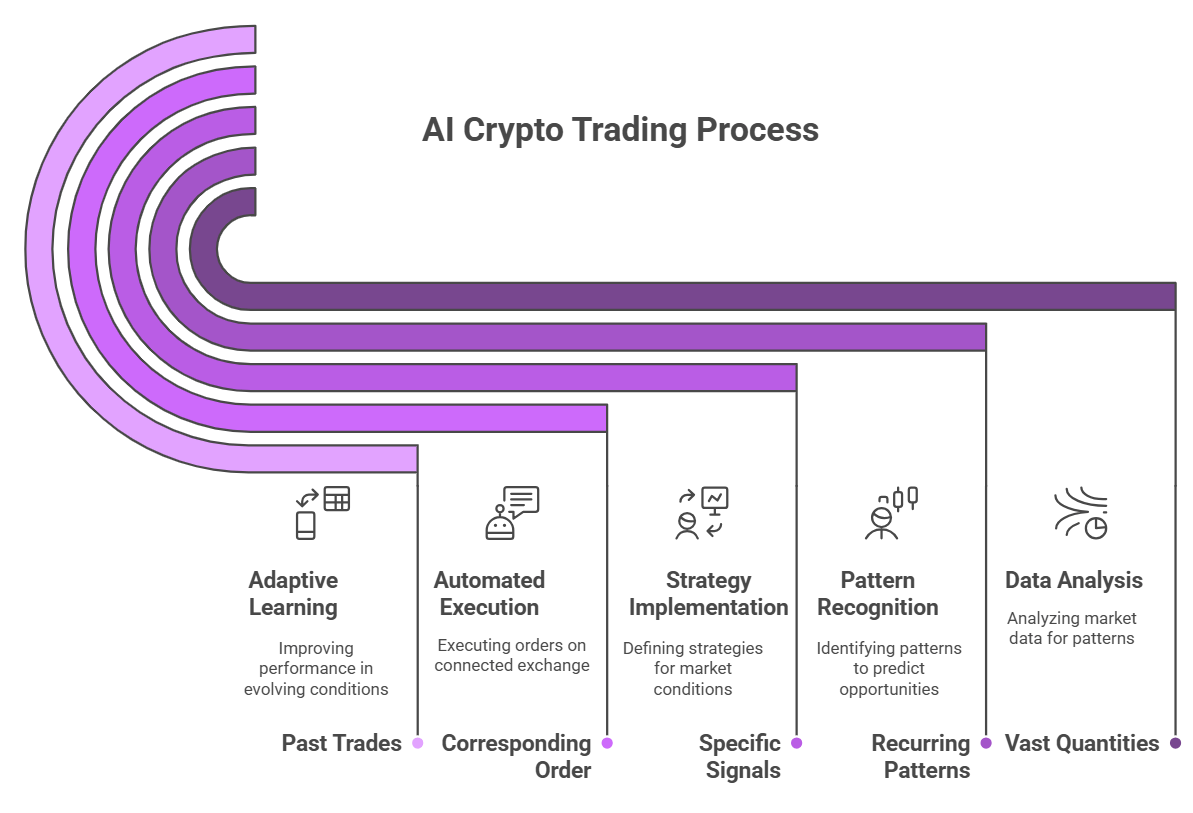

Here’s a breakdown of the process:

- Data Analysis: AI systems consume vast quantities of data. This includes historical data (price movements, trading volumes), real-time market feeds, news articles, social media sentiment (social trading indicators), and even chain data (blockchain activity). The goal is to identify patterns, correlations, and potential signals that might predict future price movements.

- Pattern Recognition & Prediction: Using machine learning, the AI identifies recurring patterns or anomalies that often precede specific market behaviors (e.g., price surges or drops). Based on these patterns, the AI might generate predictive signals about potential buying and selling opportunities. Artificial intelligence crypto bots aim to forecast market direction with a higher degree of probability than traditional methods.

- Strategy Implementation: Traders define trading strategies that dictate how the AI should react to specific signals or market conditions. These strategies can range from simple (e.g., "buy if price drops X% and RSI is below 30") to highly complex, incorporating multiple indicators and data streams.

- Automated Execution: This is where AI crypto trading bots come into play. Once the AI analysis generates a signal that aligns with the user's defined strategy, the bot automatically executes the corresponding buy or sell order on the connected exchange. This automated trading aspect ensures speed and removes emotional decision-making from the execution process.

- Deployment and Execution: This often involves integrating the AI model with a trading platform or exchange via APIs. Many traders use an AI crypto trading bot to automate trading based on the AI's signals, ensuring timely execution 24/7.

- Adaptive Learning: Sophisticated AI systems don't just follow static rules. They employ adaptive learning, meaning they analyze the outcomes of their past trades (future results aren't guaranteed, but past performance is reviewed) and adjust their parameters over time to potentially improve performance in evolving market conditions.

Essentially, using AI for cryptocurrency trading means leveraging its analytical prowess to generate insights and its automation capabilities to act on those insights swiftly and consistently.

The Role of AI Crypto Trading Bots

Central to the practical application of AI in crypto trading are AI crypto trading bots. These software programs act as the bridge between AI-driven analysis and the actual execution of trades on cryptocurrency exchanges. Think of the AI as the brain analyzing the market and formulating a plan, while the crypto AI trading bot is the hand that carries out the action.

AI crypto trading bots are designed to:

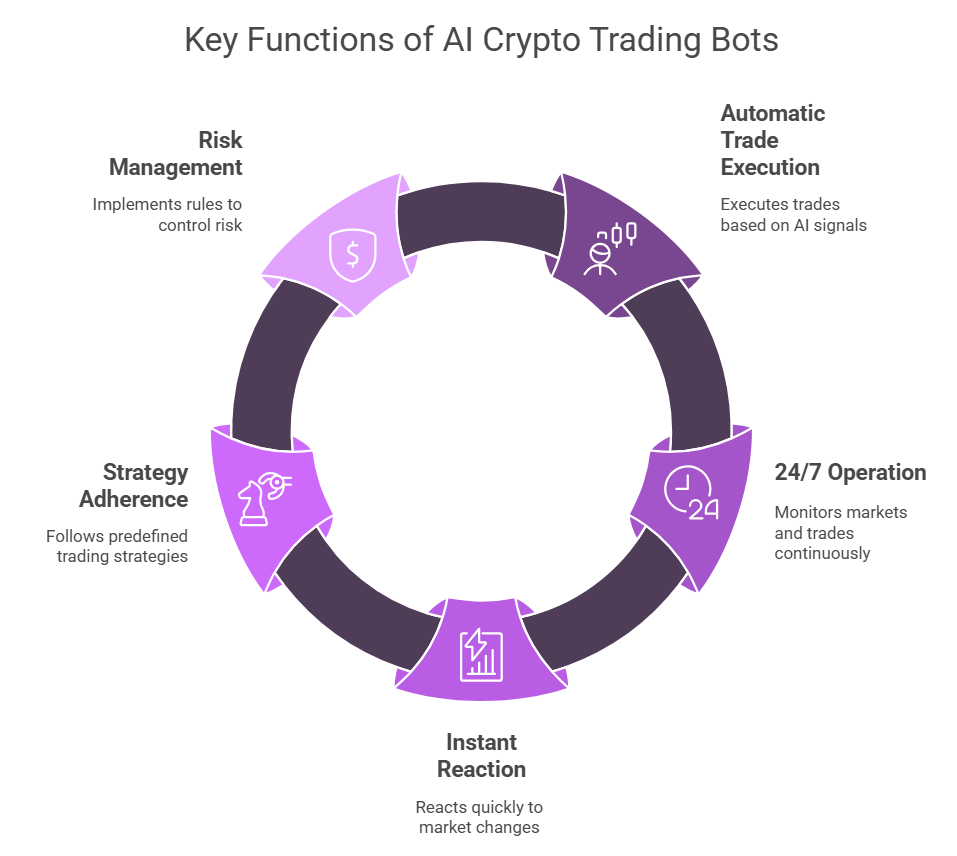

- Execute Trades Automatically: Their primary function is to automate trading, placing buy and sell orders based on the signals generated by the AI algorithms or predefined rules set by the user.

- Operate 24/7: An AI trading bot crypto can monitor markets and execute trades around the clock, capitalizing on opportunities that might arise while the human trader is asleep or otherwise occupied.

- React Instantly: Speed is crucial in volatile markets. AI bot trading crypto can react to changing market conditions and execute orders in milliseconds, far faster than a human could manually. This is particularly advantageous for strategies like arbitrage or scalping.

- Adhere to Strategy: An AI bot for crypto trading sticks to the plan, removing the emotional biases (like fear or greed) that often plague human traders..

- Manage Risk: Many bots allow users to implement risk management rules, such as setting stop-loss orders (to limit potential losses) or take-profit orders (to secure gains automatically). Some sophisticated crypto trading AI bot platforms offer advanced risk controls.

Different types of bots exist, such as the DCA bot (Dollar-Cost Averaging bot), grid bots, arbitrage bots, and more, each designed for specific trading strategies.

Whether you're looking for an AI crypto trading bot free option or a premium service, these AI agent crypto systems are the primary trading tools for implementing AI cryptocurrency trading strategies. The effectiveness of an AI crypto bot often depends on the quality of its underlying algorithms and the strategy it employs. Popular platforms often integrate multiple crypto AI trading bots under one roof.

Pros and Cons of AI in Crypto Trading

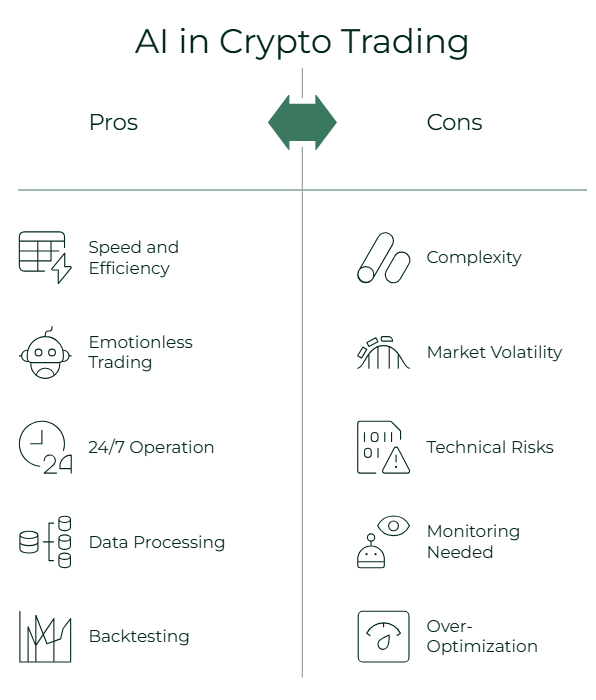

Using artificial intelligence in cryptocurrency trading offers significant advantages, but it's not without drawbacks.

Pros:

- AI trading bot crypto systems can analyze data and execute trades at speeds unattainable by humans.

- AI crypto trading bots are emotionless trading

- A crypto trading AI bot operates 24/7

- Data Processing Power: AI can analyze vast and diverse datasets (historical data, sentiment, news, chain data) simultaneously.

- Backtesting capabilities

- AI crypto bot automation

Cons:

- Complexity

- Market volatility

- Technical risks

- Need for monitoring

- Security concerns

- Crypto AI trading bots carry the risk of over-optimization.

- Scams: The hype around AI crypto trading has attracted scammers promising unrealistic returns. Due diligence is essential.

- Cost: While some AI crypto trading bot free options exist, many advanced platforms and bots require subscription fees, which can add up.

Weighing these pros and cons carefully, alongside robust risk management practices, is vital for anyone considering using AI to buy and sell crypto.

The Best AI Crypto Trading Bots

Choosing the "best AI crypto trading bot" is subjective and depends heavily on individual needs, experience level, preferred trading strategies, and budget. However, several platforms consistently receive positive attention in the crypto AI trading community for their features, reliability, and user experience.

Here are some notable examples considered among the top AI agents and platforms:

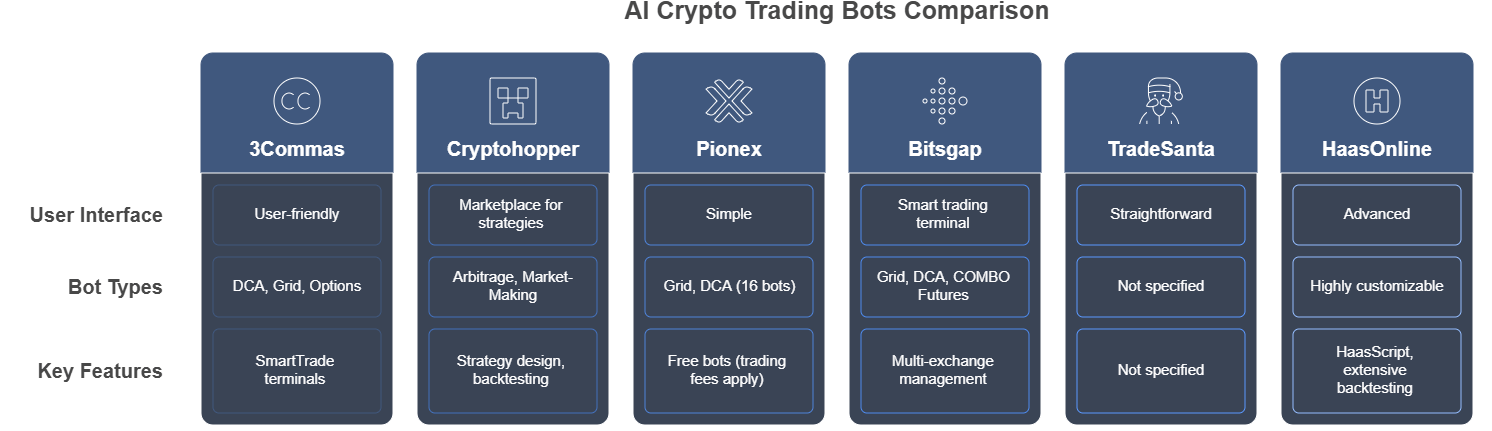

- 3Commas: It’s a popular AI crypto trading app known for its user-friendly interface and wide range of bots (including DCA bot, Grid Bot, Options Bot). It integrates with numerous exchanges and offers SmartTrade terminals for advanced order types.

- Cryptohopper: A cloud-based platform famous for its marketplace where users can buy/sell strategies and signals (social trading). Offers features like arbitrage, market-making, strategy design, backtesting, and offers the best AI crypto trading bot free trials.

- Pionex: Unique in that it's an exchange with built-in crypto trading bot functionality. It offers 16 AI trading bot crypto for free, including Grid Trading and DCA bots. Its simplicity and the fact that it offers an AI crypto trading bot free (aside from trading fees) makes it highly attractive for beginners and those on a budget.

- Bitsgap: Offers a powerful suite of tools, including Grid, DCA, and COMBO Futures bots. Known for its smart trading terminal and ability to manage assets across multiple exchanges from one interface. Considered a strong contender for the best AI trading bot crypto.

- TradeSanta: A good option for those seeking a straightforward AI bot crypto trading experience.

- HaasOnline: One of the older and more advanced platforms, catering primarily to experienced traders and developers. Offers highly customizable bots using HaasScript, extensive backtesting capabilities, and supports numerous strategies like market-making and scalping. It's a powerful AI cryptocurrency trading bot platform for those needing deep customization.

When evaluating AI apps for crypto trading or platforms, consider factors like supported exchanges, available cryptocurrency AI trading bots, security, pricing, user interface, and whether it offers free AI crypto trading bot options.

Remember, even the best crypto AI trading bot requires careful setup, ongoing monitoring, and sound risk management. The rise of the AI crypto trader, augmented by powerful crypto AI bot technology, marks a significant shift in how buy selling decisions are made in the digital asset world. The journey into AI trading crypto is one of continuous learning and adaptation.

Leveraging technology like AI for crypto trading highlights the need for robust and reliable trading platforms – principles crucial in any market.Pepperstone, FP Markets, and Deriv are widely recognized as the best Forex brokers offering powerful platforms like MT4/MT5 (ideal for algorithmic trading/EAs), competitive conditions, and the reliability demanded by serious traders.