The Trading Bible Blog ᑕ❶ᑐ ITM Meaning - In The Money Call Option

What Does ITM Mean in Trading

By Stelian Olar, Updated on: Sep 03 2025.

Options trading often feels like learning a new language, with its own unique lexicon and nuanced concepts. Among the frequently encountered terms, "In The Money" (ITM) stands out as a fundamental descriptor of an option's status.

Understanding the ITM meaning is more than just theory. It also helps in checking risk and planning potential profits. It's important to know that "ITM" in options trading is different. It has no link to an interactive teller machine at a bank. It's also not a management system ITMS. Instead, in trading, ITM relates to asset value. It focuses on the potential found within an option contract.

So, what does ITM mean?

Essentially, an option is in the money when it possesses intrinsic value. This intrinsic value arises because the option strike price is favorably positioned relative to the current market price of the underlying asset. For traders, seeing if an option with a strike is ITM is a key first step. This helps them judge its current worth and future potential. The definition of in the money relies on this positive intrinsic value. This means the option could, in theory, be exercised for an immediate profit. However, this is before considering the cost of the premium paid.

This concept is central to "moneyness," a broader term categorizing options as ITM, At The Money (ATM), or Out of The Money (OTM). Understanding the meaning of in the money is key. The ITM stock meaning, when applied to stock options, directly relates to this favorable positioning against the underlying stock price.

Ultimately, the in the money meaning tells a trader their option has a real, measurable advantage right now. This is the heart of what in the money means. It's not about understanding complex money orders. Instead, it’s all about the direct financial state of your particular option contract.

Example of In The Money Call Option

To truly grasp the ITM meaning, a practical illustration is invaluable. Let's consider an in-the-money call option example. Suppose shares of Company X are currently trading on the open market at a stock price of $110 per share. You, as an investor, hold a call option for Company X with a strike price of $100. This option contract gives you the right, but not the obligation, to buy 100 shares of Company X at $100 per share before its expiration date.

In this scenario, your in-the-money call option is, indeed, "in the money." Why? Because the market price of Company X (110) is higher than your option strike price (110).

The definition of in the money is met. You can calculate the intrinsic value of this in the money call. It's the difference between the current stock price and the strike price. For instance, if the market price is $110 and the strike price is $100, the intrinsic value is $10 per share. A standard option contract usually covers 100 shares. Therefore, the total intrinsic value for your in the money call options would be $10 per share multiplied by 100 shares, which equals $1,000.

This $10 per share is the immediate advantage your option is in the money provides. If you were to exercise exercising the option right now, you could buy shares at $100 and they would be immediately worth $110 on the market. However, it's crucial to remember that being an in the money option doesn't automatically equate to a net profit on the trade. The initial cost of purchasing the option, known as the premium, must be factored in.

For instance, suppose the premium for these ITM calls was $12 per share. Although the option is in the money by $10, you would still have a net loss of 2 per share (10 intrinsic value minus $12 premium) happens if you exercise and sell immediately. It also happens if the option expires at this price level. Conversely, if the premium was $8 per share, your net profit would be $2 per share. The in the money call option example highlights that while intrinsic value is present, the overall profitability depends on the premium paid versus this intrinsic value when the option expires or is sold. Understanding what does in the money mean with options is about recognizing this intrinsic value component.

ITM vs OTM

The concept of "moneyness" in options trading categorizes options based on the relationship between their strike price and the underlying asset's current market price. The three primary states are In The Money (ITM), Out of The Money (OTM), and At The Money (ATM). Understanding the distinction, particularly ITM vs OTM, is fundamental. The in-the-money vs. out-of-the-money comparison reveals core differences in value, risk, and trading strategy.

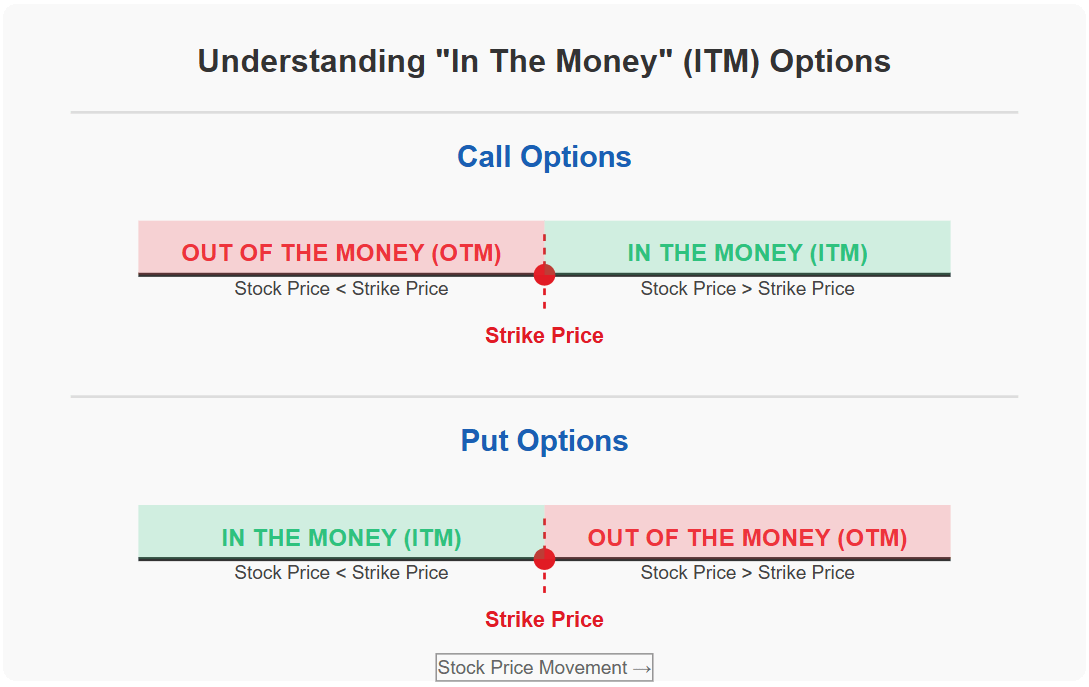

An in the money option (ITM), as we've discussed, possesses intrinsic value.

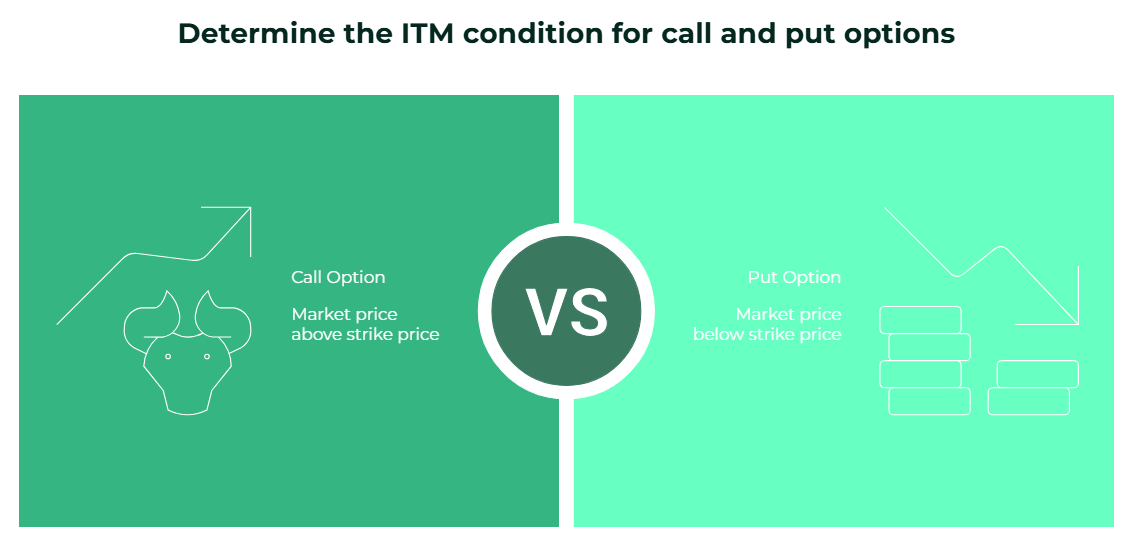

- For a call option to be ITM, the underlying asset's market price must be above the option strike price.

- For a put option (which gives the holder the right to sell the underlying asset), it is ITM when the underlying asset's market price is below the option strike price. This is the crucial condition for an in the money for put option. The put buyer benefits when the stock price falls below the strike.

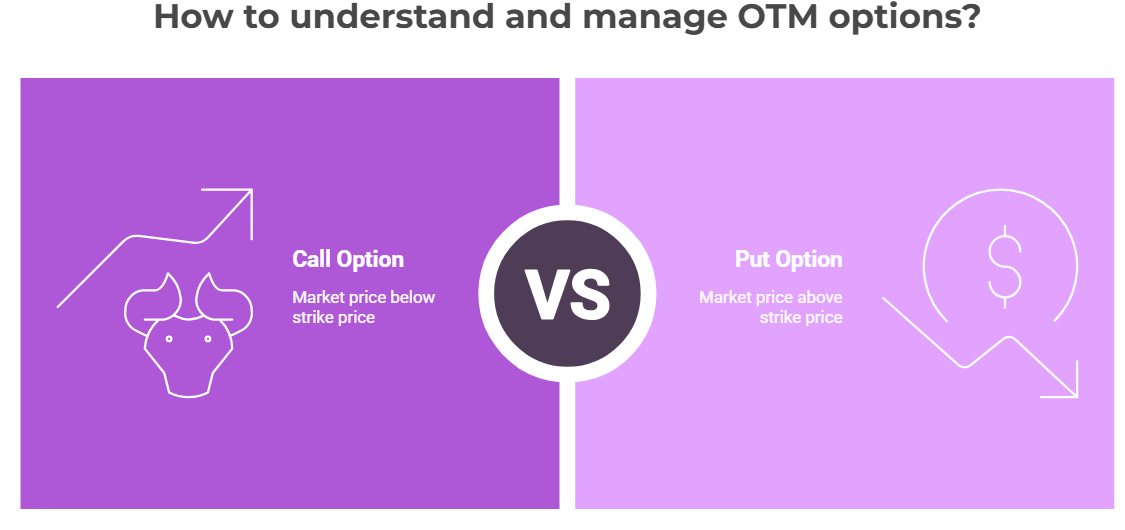

Conversely, an OTM option has no intrinsic value; its entire premium consists of extrinsic value (time value and implied volatility).

- A call option is OTM when the underlying asset's market price is below the strike price.

- A put option is OTM when the underlying asset's market price is above the strike price.

If an option expires OTM, it becomes worthless, and the buyer loses the entire premium paid.

Then there are ATM options (At The Money). An option is considered ATM when its strike price is identical or very close to the current market price of the underlying asset. The state of being in the money at the money or out of the money significantly impacts an option's premium, its sensitivity to price changes in the underlying asset (Delta), and the strategies for which it's best suited.

The key difference when considering ITM vs OTM lies in this intrinsic value. Options in the money have it; OTM options do not. This makes in the money options generally more expensive because their premium includes both intrinsic value and extrinsic value.

OTM options, having only extrinsic value, are cheaper but carry a higher risk of expiring worthless. When traders evaluate an option with a strike, determining if it is money ITM or OTM is a primary consideration. The query, what is in the money option, fundamentally asks about this state of positive intrinsic value.

Advantages of Trading ITM Options

Choosing to trade in the money options comes with several distinct advantages that appeal to various trader profiles and strategic objectives. Understanding these benefits is key to leveraging ITM options effectively within your portfolio.

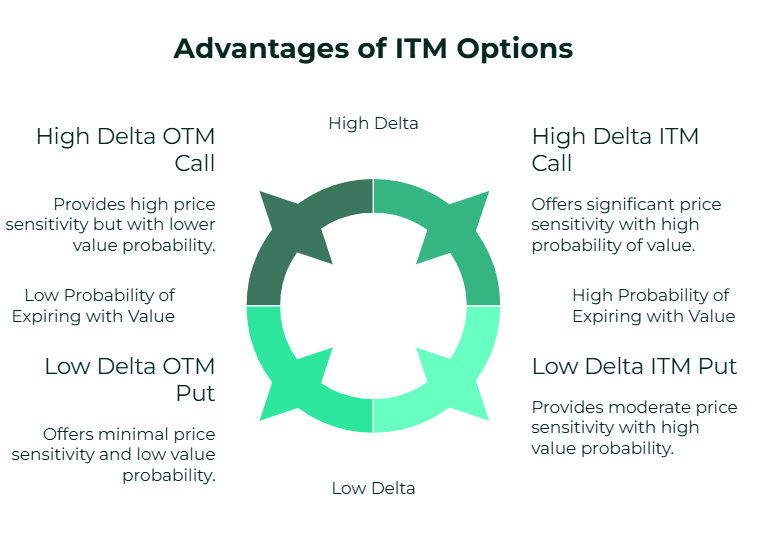

- Higher Probability of Expiring with Value: In the money stock options (and options on other assets) are more likely to stay ITM. This means they have a better chance of expiring with some intrinsic value. This probability is higher compared to ATM or OTM options. While an option expires worthless if not ITM, an in-the-money option already has a head start.

- Higher Delta: ITM options, particularly in the money call options and in the money put option contracts, generally possess a higher Delta. Delta measures an option's price sensitivity to a $1 change in the price of the underlying asset. A call option deep in the money might have a Delta approaching +1.0, meaning its price will move nearly dollar-for-dollar with the underlying stock. Similarly, an in the money put option deep in the money will have a Delta approaching -1.0. This higher Delta means that if the underlying stock price moves favorably, the value of the ITM option will increase more substantially in absolute dollar terms than an OTM option with a lower Delta. This makes ITM calls and puts attractive for directional bets where a trader has strong conviction.

- Intrinsic Value as a "Cushion": The existing intrinsic value in an in the money option acts as a partial buffer against adverse price movements and time decay. This "cushion" can make ITM options feel less risky in certain scenarios compared to OTM options.

- Suitability for Specific Strategies: Some options trading strategies work best with or need in the money options. For example, a "stock replacement strategy" often uses deep in the money call options. This is a way to get similar stock exposure with less capital.

- Exercising the Option: If the trader's intention is to actually acquire (for calls) or sell (for puts) the underlying shares, an ITM option is the one that makes sense for exercising the option.

Understanding these advantages helps traders determine when an in the money option strategy might align with their market outlook and risk tolerance.

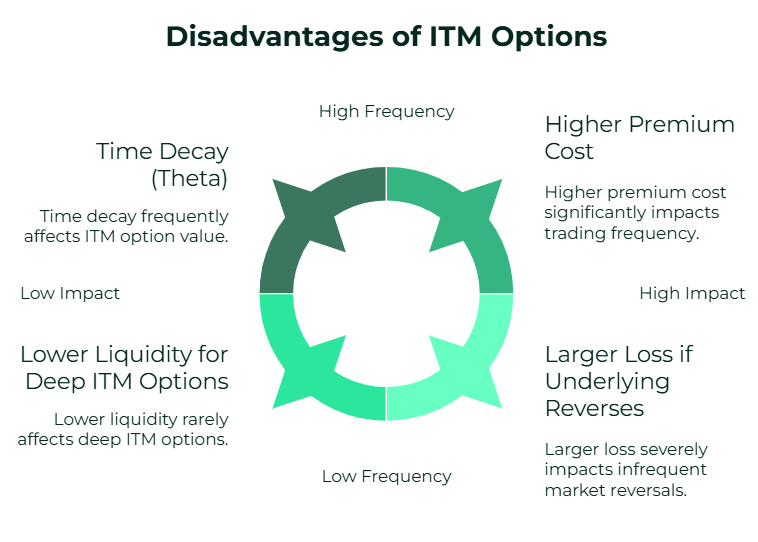

Disadvantages of ITM Options

While in the money options offer compelling advantages, they are not without their drawbacks. Traders must carefully weigh these disadvantages before incorporating ITM options into their strategies, as the ITM meaning in terms of cost and return profile can present challenges.

- Higher Premium Cost: The most apparent disadvantage of in the money options, whether they are in the money call options or an in the money put option, is their higher upfront cost.

- Lower Percentage Return on Capital (for modest moves): For traders seeking leveraged, high-percentage returns, an OTM option might be preferred, despite its lower probability of success. If the option expires only slightly more ITM than when purchased, the profit relative to the high premium might be small.

- Time Decay (Theta) Still a Factor: Although the intrinsic value component of an ITM option is not affected by time decay, the extrinsic value portion is. This means that even options in the money will lose some value as the expiration date approaches, assuming all other factors remain constant. A put buyer of an ITM put, for example, still needs the stock to stay below the strike by enough to cover the initial extrinsic value paid.

- Potentially Lower Liquidity for Deep ITM Options: Very deep in the money options can sometimes suffer from lower liquidity. This can make it slightly more challenging or costly to enter and exit positions at desired prices. While most standard in the money stock options on popular underlyings maintain good liquidity, this can be a consideration for less common or very deep ITM strikes.

- Larger Loss if Underlying Reverses Significantly: If the stock price moves sharply against an ITM position, causing it to become ATM or OTM, the loss incurred can be substantial due to the high initial premium paid.

Understanding what does ITM stands for in terms of these drawbacks is just as important as understanding its benefits. The decision of whether to trade an in the money option versus an OTM option or ATM options always involves a trade-off between probability of success, cost, and potential reward.

Ready to leverage your ITM knowledge? Explore what the best forex brokers like Pepperstone, FP Markets, and Deriv offer. Visit their websites to find the platform best suited for your trading strategies.