The Trading Bible Blog ᑕ❶ᑐ OTM Meaning in Trading - Out of the Money

What Does OTM Mean in Trading

By Stelian Olar, Updated on: Aug 20 2025.

From simple stock investing to more complex derivative instruments like options trading, the world of finance offers numerous ways to participate in the markets. Terms like strike price, expiration date, calls, puts, and especially "moneyness" pepper the landscape. Understanding this jargon is not just academic; it's fundamental to navigating the market and making informed decisions.

One of the most crucial concepts within moneyness is understanding what OTM meaning signifies. OTM, or Out of the Money, describes a specific state of an option contract relative to the market price of its underlying asset.

Unlike its counterparts, In The Money (ITM) and At The Money (ATM), an out of the money option holds no intrinsic value. This might sound disadvantageous, but OTM options play a vital role in various trading strategies, offering both unique opportunities and distinct risks.

This article will delve deep into the OTM meaning in trading, explore examples, contrast in the money out of the money scenarios, and weigh the advantages and disadvantages of incorporating out-of-money options into your approach. Whether you're looking to hedge, speculate, or simply expand your trading toolkit, grasping the nuances of what does OTM mean is essential.

What Is an Example of an OTM?

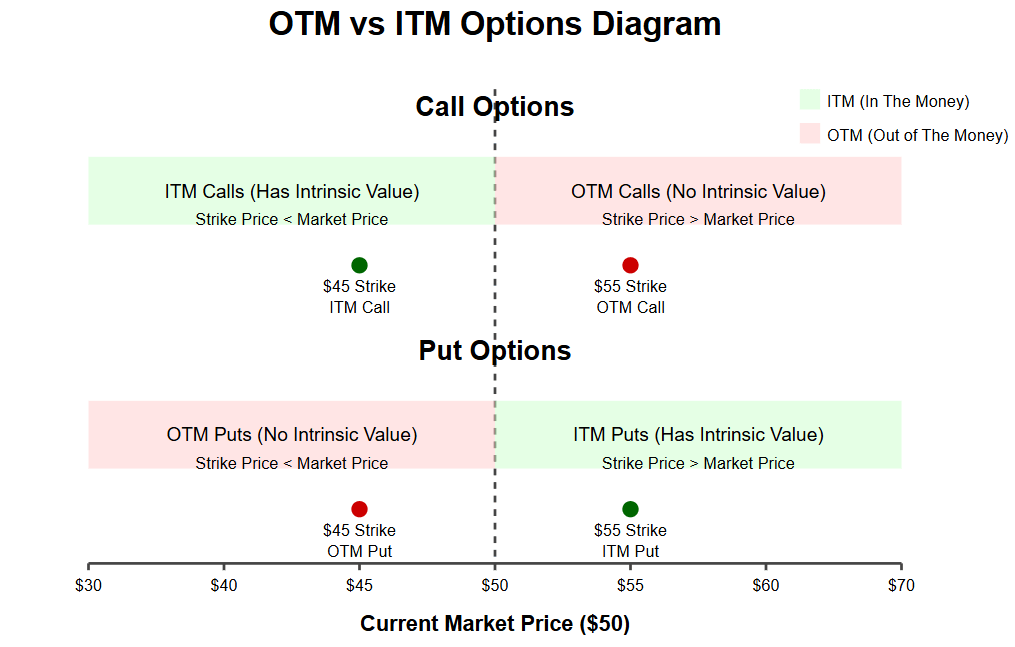

To truly grasp the out-of-the-money definition, let's break it down with practical examples for both primary types of options: calls and puts. The core principle is simple: an option is OTM if exercising it immediately would not result in a profit based solely on the difference between the strike price and the current market price of the underlying asset. It lacks intrinsic value.

Out of the Money Call Option Example:

Imagine stock XYZ is currently trading at $50 per share. An options trader might look at the options chain and consider buying a call option. A call option grants the buyer the right, but not the obligation, to buy the underlying asset at a specified strike price before the option expires.

Suppose the trader buys an XYZ call option with a strike price of 55. Since the strike price (55), expiring in one month is higher than the current market price ($50), this call option is out of the money (OTM). Why? Because exercising the option would mean buying the stock for $55 when it's readily available in the market for $50. There's no immediate financial benefit; in fact, it would result in an instant loss on the exercise itself (ignoring the premium paid for the option). This specific contract is an out-of-the-money call option. Any out-of-the-money call options will share this characteristic:

Strike Price > Market Price.

This is the fundamental OTM call means.

Out of the Money Put Option Example:

Now, let's consider a put option. A put option gives the buyer the right, but not the obligation, to sell the underlying asset at the specified strike price before expiration. Traders typically buy puts when they anticipate the price moves downwards.

Let's stick with XYZ stock trading at $50. An options trader believes the price might fall and decides to buy or sell – in this case, buy – a put option. They select an XYZ put option with a strike price of 45. Since the strike price (45), expiring in one month is lower than the current market price ($50), this put option is out of the money (OTM). Why? Exercising it would mean selling the stock for $45 when it could be sold in the open market for $50. Again, there's no immediate financial advantage to exercising. This contract is an out-of-the-money put option. For any out-of-the-money put, the relationship is:

Strike Price < Market Price.

This answers what is OTM for puts.

In both scenarios, even though these options have no intrinsic value at this moment, they still have a price (the premium). The possibility exists that the price moves favorably before expiration, potentially turning the OTM option into an ITM option.

Why Do People Buy OTM Puts?

Given that an out of the money put offers no immediate exercise advantage, why would an options trader choose to buy one? There are primarily two compelling reasons: cost-effectiveness for hedging and potential for high returns through speculation.

- Hedging (Portfolio Insurance): They can buy an out of the money put option as a form of insurance. It's a way to lose money less severely in a sharp decline without paying a hefty insurance premium.

- Speculation: Some traders buy out of the money put options not to hedge, but to speculate on a significant drop in the underlying asset's price. This leverage is attractive, but it comes with high risk. If the anticipated large price moves downwards don't materialize before expiration, the out of the money put option will likely expire worthless, and the trader will lose money equivalent to the entire premium paid for the option.

Buying an OTM put is thus a strategic decision, often balancing cost against the desired level of protection or the magnitude of the anticipated price move.

ITM vs OTM - Call Option in the Money / Out of the Money

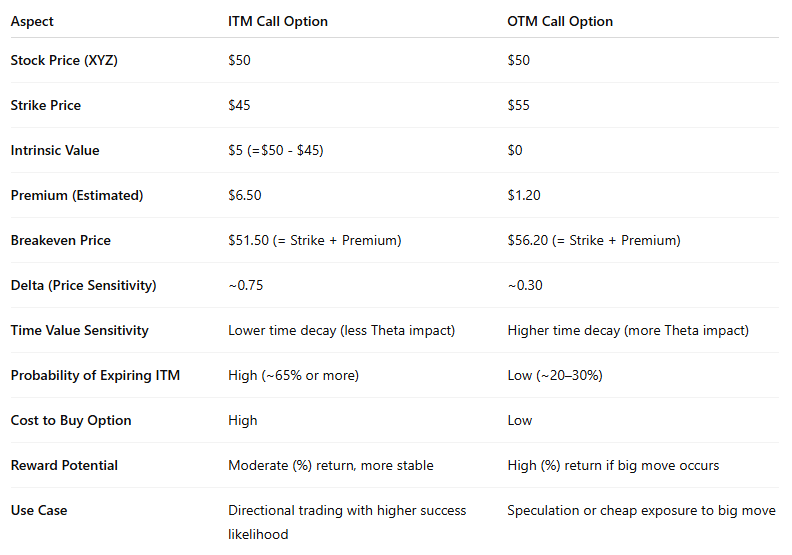

Understanding the distinction between in the money out of the money is fundamental to options trading. Let's focus on the call option in the money out of the money dynamic, though the principles apply symmetrically (in reverse) to put options. The key difference lies in intrinsic value.

Out of the Money (OTM) Call Option:

As established, an out-of-the-money call option (or OTM calls) has a strike price above the current market price of the underlying asset.

- Example: Stock trades at $50. A $55 strike call option is OTM.

- Intrinsic Value: Zero. Options have no intrinsic value when OTM. Exercising it immediately would lead to buying the asset at a higher price than its market value.

- Value Composition: The option's premium consists entirely of extrinsic value (time value + implied volatility).

- Scenario: You buy an out of money call option hoping the stock price will rise significantly above the strike price before expiration.

In the Money (ITM) Call Option:

Conversely, an in the money (ITM option) call option has a strike price below the current market price of the underlying asset.

- Example: Stock trades at $50. A $45 strike call option is ITM.

- Intrinsic Value: Positive. It's calculated as the Market Price - Strike Price. In our example, $50 - $45 = $5 intrinsic value per share. If you exercise the option, you can immediately buy the stock at $45, and it's worth $50, capturing this $5 difference (before considering the premium paid). This is money ITM.

- Value Composition: The option's premium consists of both intrinsic value and extrinsic value. The deeper the ITM the option is, the larger the intrinsic value component and typically, the smaller the extrinsic value component relative to the total premium.

- Consider buying an ITM call for two main reasons. First, it has a higher probability that the option will keep some value. Second, its price often follows the underlying stock's price movement more closely. This relates to its higher delta.

The ITM vs OTM Spectrum:

It's helpful to think of in the money and out of the money not just as binary states but as part of a spectrum shown on the options chain:

- Deep OTM: Strike price is significantly above the market price (for calls). These are the cheapest OTM call options but have the lowest probability of becoming profitable.

- Near OTM: Strike price is slightly above the market price.

- ATM (At the Money): Strike price is very close to or equal to the market price. ATM options offer a balance between cost and probability.

- Near ITM: Strike price is slightly below the market price.

- Deep ITM: Strike price is significantly below the market price. These are the most expensive calls but have the highest intrinsic value and probability of expiring with some value.

Understanding this out of the money vs in the money relationship is crucial for selecting the right option with a strike. The concepts apply equally to out of the money stock options and options on other assets. The essence of OTM calls meaning or what is an OTM lies in that strike price vs. market price relationship rendering immediate exercise unprofitable. It's money OTM in terms of intrinsic value, which is zero.

Is It Better to Buy ITM or OTM?

This is a common question for aspiring options traders, but there's no single "better" choice. The decision between buying an ITM option versus an OTM option hinges entirely on the trader's specific goals, risk appetite, market forecast, and chosen strategy. It’s a classic ITM vs OTM trade-off analysis.

- Cost: OTM options are always cheaper than corresponding ITM options (same underlying, same expiration date).

- Probability of Profit (PoP): ITM options generally have a higher probability of expiring with at least some value (i.e., expiring ITM) compared to OTM options.

- Potential Return (Leverage): While having a lower PoP, OTM options offer greater leverage and potential for higher percentage returns if the anticipated price move occurs.

- Risk: OTM options carry a higher risk of expiring worthless, meaning the options trader could lose money totaling the entire premium paid.

- Delta shows how sensitive an option's price is to price moves in the underlying asset. ITM options usually have higher deltas. For calls, this is near 1.00; for puts, it's near -1.00. This means their price reacts more strongly to $1 changes in the underlying asset. In contrast, OTM options have lower deltas. They are less sensitive to small price moves. However, big moves or changes in volatility can still make them highly sensitive.

Choose OTM for these reasons:

You want a lower upfront cost.

You seek high leverage and potential percentage returns.

You strongly expect a large price move.

You accept the higher probability of losing the full premium. This often aligns with speculative OTM trading meaning.

Choose ITM if: Your priority is a higher probability of the option retaining some value, you prefer less sensitivity to time decay (theta is often lower for deep ITM), you want the option price to track the underlying more closely, and you are willing to pay a higher premium for these characteristics.

Ultimately, the "better" choice is the one that best fits the specific trade strategy and the individual trader's profile. Many sophisticated strategies even involve simultaneously using in and out of the money options.

Advantages of Trading OTM Options

Despite the inherent risk of expiring worthless, out of the money options offer several distinct advantages that make them attractive tools for certain strategies and traders:

- Lower Premium Cost: OTM options are considerably cheaper than their ITM or ATM options counterparts with the same expiration date.

- Higher Leverage: Because the premium is lower, OTM options provide greater leverage. If the market makes the anticipated large price moves, this leverage can translate into significantly higher percentage returns compared to ITM options or direct stock positions.

- Potential for High Percentage Gains: Stemming directly from the lower cost and leverage, OTM options offer the potential for explosive percentage gains. Speculators seeking outsized returns often target out of money options for this reason.

- Strategic Flexibility: out of money call options are integral components of many defined-risk options strategies, such as vertical spreads (e.g., bull call spreads, bear put spreads) or credit spreads.

These advantages highlight why, despite their lower probability of success on any single trade, OTM options remain a popular choice for specific objectives within options trading.

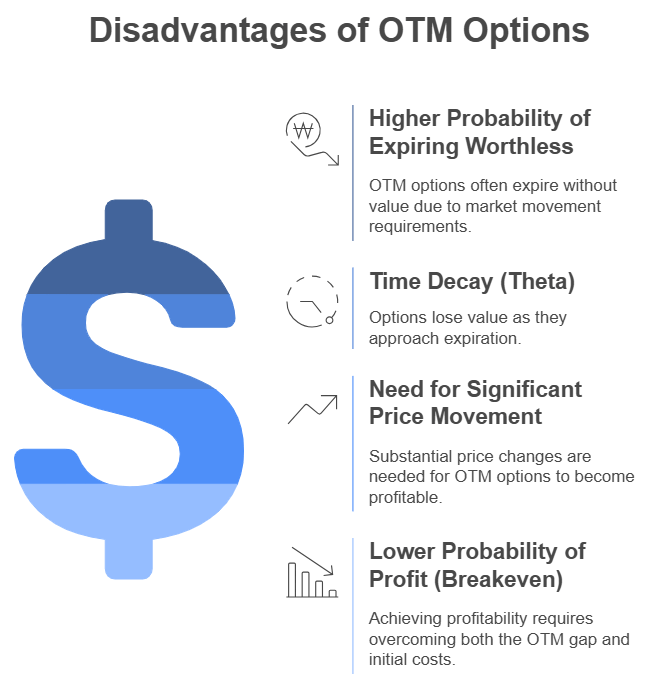

Disadvantages of OTM Options

While the allure of low cost and high leverage is strong, trading OTM options comes with significant drawbacks that every options trader must understand and respect:

- Higher Probability of Expiring Worthless: This is the primary risk. Because the market price needs to move substantially just to reach the strike price (and even further to reach the breakeven point), out of the money options have a statistically lower chance of becoming profitable compared to ITM or ATM options. Many OTM options simply expire worthless, resulting in the buyer losing the entire premium paid for the option. Options have no intrinsic value, and if time runs out before they gain any, they are worth zero.

- Time Decay (Theta): All options lose value as they approach their expiration date due to time decay, represented by the Greek letter Theta.

- Need for Significant Price Movement: OTM options generally have lower Deltas than ITM options. Small or slow moves might not be enough before the option expires.

- Lower Probability of Profit (Breakeven): For an OTM call option, Breakeven = Strike Price + Premium Paid. For an OTM put option, Breakeven = Strike Price - Premium Paid. Many traders lose money because the price didn't reach this extended target. You must overcome both the out of money gap and the initial cost.

Trading OTM options, particularly buying them speculatively, requires a strong directional forecast, an understanding of timing and volatility, and the acceptance of a higher likelihood of losing the invested capital. Careful position sizing and risk management are paramount when dealing with out of the money stock options or any OTM contract.

Consider top-rated options among the best forex brokers: check out Pepperstone, explore FP Markets, or investigate Deriv to find a broker that fits your trading strategy and helps you navigate the markets confidently.