The Trading Bible Blog How Brokers Make Money - The Truth Behind the Business

How Brokers Make Money - The Truth Behind the Business

By Romanon N, Updated on: Aug 09 2023.

Brokers make money through fees and commissions charged to perform every action on their platform such as placing a trade. Other brokers make money by marking up the prices of the assets they allow you to trade or by betting against traders in order to keep their losses.

Normally people don’t have a clue about this and how it works, so if you want to understand whether your broker is fooling you or not, read on.

Here's what we'll talk about during our article:

- What is a Broker?

- What are the main types of brokers?

- Market Maker Brokers

- Straight Through Processing Brokers

- Direct Market Access Brokers

- Electronic Communications Network Brokers

- How do Brokers make money?

- Deposit Fees

- Withdrawal Fees

- Inactivity Fees

- Overnight Fees

- Spread or Marked Up Prices

- In and Out Commissions

- Brokers that profit from trader’s losses

- Conclusion

- Frequently Asked Questions

What is a Broker?

We come with a lot of misconceptions from movies, especially if you never had the opportunity to trade before.

After watching The Wolf of Wall Street everyone believes that brokers are usually men wearing expensive suits that spend their days screaming on the phone selling shares while making thousands of dollars per month.

This craft is nearly gone, back in the old days that was the job description of a broker, but nowadays it’s just private companies that operate using electronic platforms.

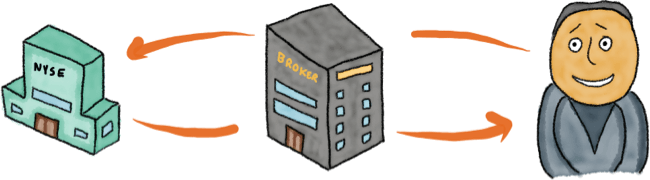

The Broker is just the middleman between traders and the financial markets. A retail trader cannot access directly by himself an exchange such as the New York Stock Exchange for example, he needs a broker as the connector into that pool of liquidity.

Bear in mind that not all brokers are the same. Some brokers do in fact connect you directly into the stock or currency markets, others just offer you to trade on financial derivatives that never leave the house, that’s why it’s very important to understand the type of broker that you trade with, it will give you a clear understanding on how to take advantage of the situation and what to look for.

Featured Brokers for Beginners

| Broker | Top Features |

|---|---|

| |

| |

|

What are the main types of brokers?

The main types of brokers are known as:

- Market Makers (MM)

- Straight Through Processing (STP)

- Direct Market Access (DMA)

- Electronic Communications Network (ECN)

Let’s take a look at each one of them so we can understand the differences:

Market Maker Brokers

They are the ones making the market by quoting the buy and sell prices and providing liquidity (the availability on an asset).

Market maker brokers have a dealing desk model. In case you’re wondering, the dealing desk literally means the desk where the dealer sits, and the dealer is the one trading on behalf of the broker to maximise the benefit of the broker’s exposure.

One very important thing to remember, being a regular market maker is not the same as being a CFD market maker, they are very different.

A regular market maker provides liquidity, quotes prices of the real asset.

A CFD market maker also provides you liquidity and quotes prices but of CFDs, not the real assets, and CFDs are just derivative contracts, so this market maker has a very different angle that we will explore once we get to the part of how they make their money.

There are GOOD CFD market makers and BAD CFD market makers, for that issue read this guide and then continue right here.

Straight Through Processing Brokers

Straight Through processing brokers have a NO-Dealing Desk model. The moment they receive your order it gets sent immediately to another broker that is providing the liquidity.

We know this is going to sound tricky, but be careful with STP brokers. They can also be an undercover market maker broker.

If someone named John purchases two brokers, one of them is a CFD market maker and the other is an STP broker, John could easily do a lot of marketing for the STP broker while he’s sending his orders to the market maker broker.

Direct Market Access Brokers

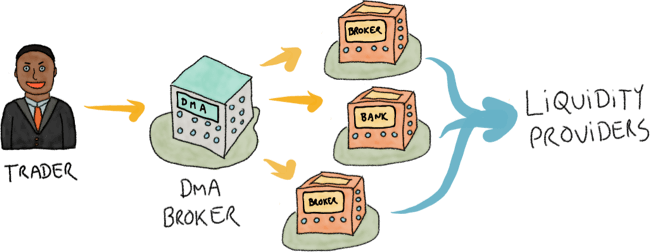

Direct Market Access brokers have also got a NO-Dealing Desk model. The moment they receive an order, they send it immediately to several liquidity providers in their list such as other brokers, banks or exchanges.

Electronic Communications Network Brokers

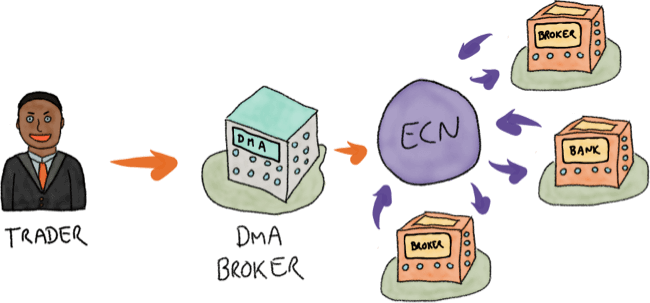

Electronic Communications Network Brokers have a NO-Dealing Desk model. The moment they receive an order it gets sent into a massive network (the ECN) where several market participants are linked and compete for buying and selling.

Basically we could say that the ECN broker is a DMA broker connected to a super huge global network linking all market participants and matching trading orders.

Featured Brokers for Beginners

| Broker | Top Features |

|---|---|

| |

| |

|

How do Brokers make money?

There are some standard methods to make money that pretty much all brokers share, some have a few of them, others not. Let’s talk about these first:

Deposit Fees

Just by the mere fact of adding money to your brokerage account via bank transfer, credit card or whatever method they use, they might charge a fee for this.

Withdrawal Fees

Every time you try to get some of your money out of your brokerage account they may also charge you a fee for this.

Inactivity Fees

In order to motivate customers to be engaged, brokers created this fee. They can call it also maintenance fee or any other pointless name, the whole idea is that they want you to trade as much as possible. Always check how much this fee is and how many trades are you required to execute per month in order to not get charged.

Overnight Fees

When you trade on margin (leveraged trading) which means using borrowed funds to trade bigger than what you can afford, brokers charge you a fee every night that your position remains open. That fee is based on the total amount of borrowed funds that you’re using and it’s usually a small percentage of it.

Spread or Marked Up Prices

The spread is the difference between the buy and sell prices. Usually your broker offers you to buy at a more expensive price than the actual price and to sell at a cheaper price than the actual price. That’s why trades usually open in negative, because your broker already marked up the price at the beginning of your trade with the exception of assets where the spread is zero.

In and Out Commissions

Some Brokers don’t mark up the spread but they choose to charge you on a per-share basis. For example, they can offer a minimum order size such as 10$ and an additional 1 cent per share commission. So buying 10 shares will cost you 10$ and selling them again will cost you 10$.

Few brokers will have some of these fees, others will have them all. The most common variation is watching brokers that charge in-and-out commissions against brokers that don’t charge it but they mark up the spreads.

As a wise person once said, someone has to be getting fooled, there’s no such thing as no commission or free.

Brokers that don’t make any commission usually are marking up prices or selling your trading data such as your orders to large funds that can take advantage of that information. Nothing in this life is free.

Now, going back to broker methods of making money we’re missing the last one:

Brokers that profit from trader’s losses

CFD Market Makers have a business model that is designed to make profits when clients make a loss, here’s how it works:

As CFDs are derivatives that are traded OTC (over the counter) and never reach an exchange, you’re potentially engaging in a closed transaction between you and your broker of whether an asset will go up or down.

The funny part here is that the counterpart in your trade can be your broker.

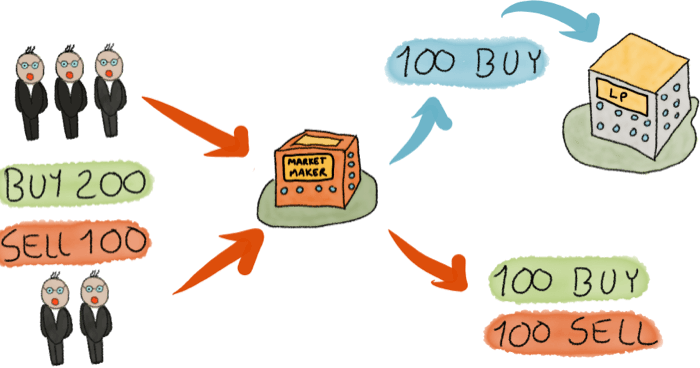

Some brokers will choose to individually take the counterpart on each trader and others will choose to take the counterpart only when they see they can make a profit on the whole company’s exposure. Here’s an example:

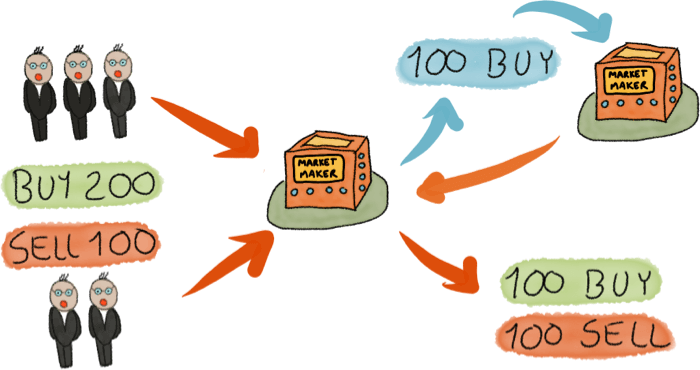

In the example above, you see that there are 200 traders buying and 100 traders selling, so the market maker can match 100 buyers and 100 sellers and send the remaining exposure into a liquidity provider (another broker, the real market, etc) so they can protect themselves in case traders win or lose.

In the example above, you can see that in the exact same scenario, the broker chose to take the other side of the remaining 100 buyers and not send it to the market. Maybe the broker believes the traders will be wrong and can make a profit when those traders lose.

As seen in the image above, the result when brokers chose to not hedge their exposure:

- If a trader makes a loss, the broker profits.

- If a trader makes a profit, the broker loses.

But only if the broker chose to not send the exposure they had into the real market. When brokers do send the exposure (risk) they have into the real market or to another broker, the process is called hedging, it’s how brokers protect themselves.

Brokers can choose to hedge the whole company’s exposure or to hedge individual clients in case that one of them is a huge trader.

Regardless of how weird all of this may seem to you, it’s not bad at all. As long as your broker doesn’t interfere with your trades there are great advantages on trading with a good market maker.

The problem comes if you’re trading with an UNETHICAL market maker that misleads clients into losing. Those ones usually have the business model of individually targeting clients as they’re trying to milk each one of them as much as they can.

Now you know the majority of methods used by brokers to make money. There can be others we didn’t mention but they’re mostly the same repackaged with a different name, in the end they are costs for using borrowed money or assets somehow.

Conclusion

You might be wondering by now, how do I know which type of broker I’m trading with?

Well, here’s the thing:

If the broker is regulated you can ask them, they’re obliged to tell you in detail. Then you can also consult the regulator.

If the broker is not regulated by a reputable financial regulator, then you shouldn’t even be asking but rather running away, they can pretty much do whatever they want with your money and you’re left blank with no one to even ask help from.

Knowing how your broker makes money its important because it will help you behave the best way possible when dealing with them.

If you’re trading with a CFDs Market maker you can take advantage of the fact that they can provide you a better execution at a price you wouldn't find on the market as CFDs give you that ability.

It’s all about knowing how to exploit systems the best way possible.

Good luck!

Frequently Asked Questions

How do Forex Brokers make money?

Depends on the type of broker. Most of the forex brokers that retail traders get access to are CFD market makers, you are not trading real currencies but rather CFDs on those currencies. So the fees are just a small part of the business, the real money is in losses when they choose not to hedge trades.

How do Stock brokers make money?

Depends on the type of broker. Some stock brokers make money by charging in and out commissions on every trade plus a lot of other fees. Others make money by marking up prices and CFD market makers on stock make money from client’s losses when they choose to not hedge.

How do Zero Commission Brokers make money?

By marking up prices which ends up in increasing the spread (difference between buy and sell prices) or by selling your orders to big funds that they have a deal with, which also will end up marking up prices or squeezing micro profits out of your trades.

For example, the moment you buy something there are a few milliseconds from the point you click buy and that order gets executed.

They can sell it to a huge fund that has supercomputers and high speed networks that buy the stock right before you and sell it to you with a very small markup.

Rinse and repeat and you’ve got a multibillion dollar industry.